BOTZ Vs CIBR: Capitalization and Strategy

Exchange-Traded Funds (ETFs) have transformed the investment landscape, offering investors a convenient way to gain diversified exposure across a wide range of sectors and asset classes. In this article, we will conduct an in-depth analysis of two prominent ETFs: BOTZ (Global X Robotics & Artificial Intelligence ETF) and CIBR (First Trust NASDAQ Cybersecurity ETF). By exploring key aspects such as ETF tickers, full names, issuers, sectors, top holdings, capitalization, strategy, tracking, and exposure, we aim to provide you with valuable insights to make informed investment decisions.

BOTZ Vs CIBR: Overview

BOTZ and CIBR are distinct ETFs that cater to different corners of the technology industry. While BOTZ focuses on companies involved in robotics and artificial intelligence, CIBR hones in on the cybersecurity sector. This divergence in investment themes has a significant impact on the underlying holdings and potential risks associated with these ETFs, a topic we will delve into in the following sections.

BOTZ Vs CIBR: Sectors and Top Holdings

BOTZ, as the name suggests, is heavily invested in companies driving advancements in robotics and artificial intelligence. Its top holdings include well-known names like NVIDIA, Intuitive Surgical, and ABB Ltd. On the other hand, CIBR's portfolio consists of cybersecurity industry leaders such as Cisco Systems, Palo Alto Networks, and Fortinet. Understanding the sectors and top holdings can guide investors in choosing the ETF that aligns with their investment goals and risk preferences.

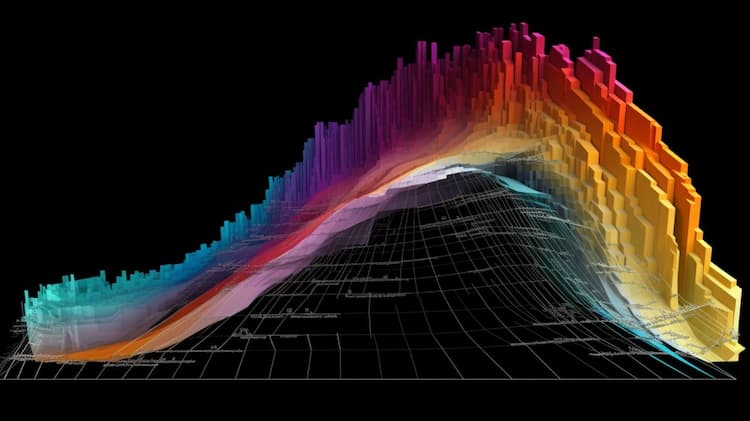

BOTZ overlap BOTZ VS CIBR

BOTZ overlap BOTZ VS CIBR

BOTZ Vs CIBR: Capitalization and Strategy

BOTZ boasts a substantial Asset Under Management (AUM), highlighting its popularity among investors who seek exposure to cutting-edge technological trends. CIBR's strategy revolves around capitalizing on the growing importance of cybersecurity in an increasingly digital world. The differing capitalization and investment strategies of these ETFs translate into varying potential returns and associated risks, necessitating careful consideration from investors.

BOTZ Vs CIBR: Tracking and Exposure

BOTZ aims to track an index that captures the performance of companies driving advancements in robotics and AI. Its performance is influenced by technological innovations and market sentiment towards these industries. CIBR, in contrast, provides exposure to the cybersecurity sector, which thrives on the rising need for safeguarding digital assets and privacy. Understanding the tracking methodologies and exposure strategies aids investors in selecting the ETF that aligns with their investment objectives.

Conclusion

BOTZ and CIBR are two unique ETFs that offer investors targeted exposure to distinct corners of the technology sector. To gain comprehensive insights into the holdings, correlations, overlaps, and other critical aspects of these ETFs, investors can turn to ETF Insider—an intuitive and user-friendly app designed to provide a wealth of information on various financial instruments. ETF Insider empowers investors with the tools they need to make well-informed decisions.

Disclaimer: This article is intended for informational purposes only and does not provide investment advisory services. Investors should conduct thorough research and seek professional guidance before making investment decisions.

Sources:

ETF issuers' official websites and prospectuses.

ETF databases and market data platforms.

Financial news and analysis from reputable sources.

CIBR quote and analysis

Discover the top holdings, correlations, and overlaps of ETFs using our visualization tool.

Our app allows you to build and track your portfolio.

To learn more about the CIBR First Trust NASDAQ Cybersecurity ETF, access our dedicated page now.

FAQ

Why is BOTZ better than CIBR?

BOTZ may be considered better than CIBR for some investors due to its specific focus, offering diversification.

Does CIBR beat BOTZ?

CIBR's performance relative to BOTZ will vary over time, depending on market conditions.

Should I invest in BOTZ or CIBR?

The choice between BOTZ and CIBR should align with your investment goals, risk tolerance, and desired exposure.

Are BOTZ and CIBR good investments?

Both BOTZ and CIBR can be suitable investments depending on individual investment strategies, goals, and risk profiles.

What is the correlation between BOTZ and CIBR?

The correlation between BOTZ and CIBR can vary over time, reflecting differences in performance.