IYF VS IAT

Exchange-Traded Funds (ETFs) have become a cornerstone of modern investment portfolios, offering investors a versatile and cost-effective way to gain exposure to a wide range of sectors and asset classes. In this article, we will conduct an in-depth analysis of two popular ETFs: IYF (iShares U.S. Financials ETF) and IAT (iShares U.S. Regional Banks ETF). By examining various critical aspects, including ETF tickers, full names, issuers, sectors, top holdings, capitalization, strategy, tracking, and exposure, we aim to provide a comprehensive comparison that can guide investors in making informed decisions.

IYF Vs IAT: Overview

The IYF and IAT ETFs both operate within the financial sector, but they target different segments of the industry. IYF focuses on large and well-established financial companies, providing investors with exposure to major players in banking, insurance, and investment services. On the other hand, IAT narrows its scope to regional banks, allowing investors to tap into the growth potential of smaller banking institutions that serve specific geographic areas.

IYF Vs IAT: Sectors and Top Holdings

IYF encompasses a broader spectrum of financial services, including diversified financials, insurance, and real estate management. Its top holdings may include giants like JPMorgan Chase, Berkshire Hathaway, and Visa. In contrast, IAT's holdings revolve around regional banks like PNC Financial Services Group, U.S. Bancorp, and KeyCorp. Understanding the sectors and top holdings of these ETFs enables investors to align their choices with their desired exposure to specific segments of the financial industry.

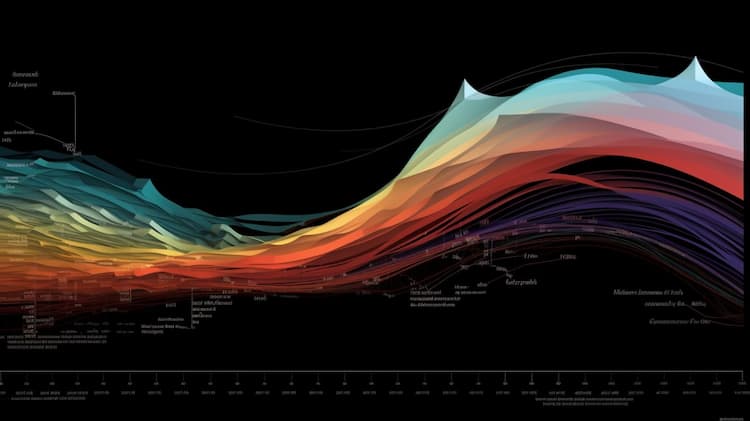

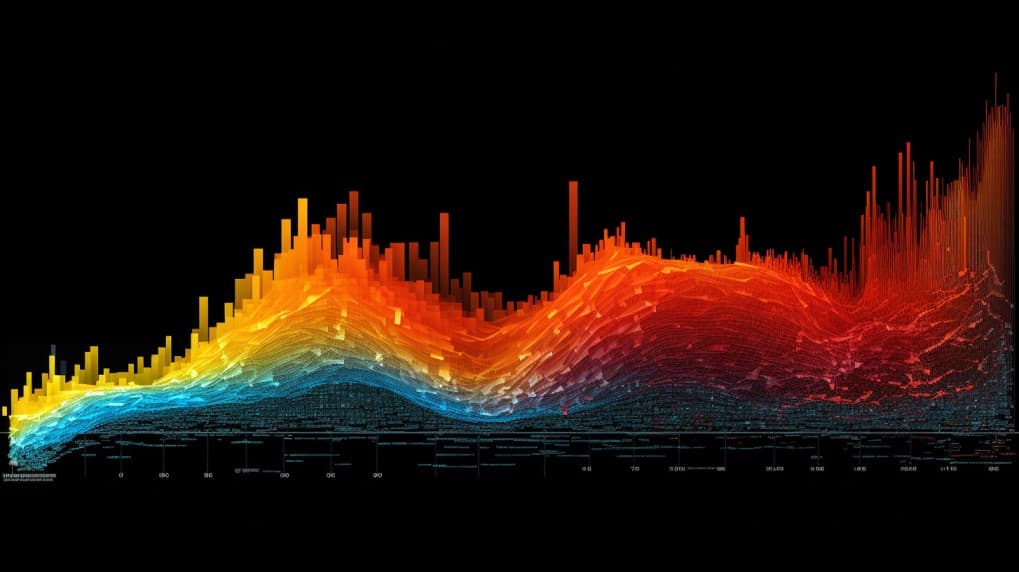

IYF overlap IYF VS IAT

IYF overlap IYF VS IAT

IYF Vs IAT: Capitalization and Strategy

When it comes to capitalization, IYF usually boasts a higher asset under management (AUM) due to its broader focus on larger financial corporations. Its strategy revolves around offering investors a diverse portfolio of established financial institutions, potentially providing stability and growth prospects. IAT, with its focus on regional banks, might exhibit more targeted growth potential and volatility. Analyzing the differences in capitalization and strategy helps investors gauge the potential risk and return profiles of these ETFs.

IYF Vs IAT: Tracking and Exposure

The tracking and exposure strategies of IYF and IAT diverge due to their distinct focuses. IYF aims to replicate the performance of an index composed of U.S. financial companies, providing investors with exposure to various subsectors within the financial industry. IAT, on the other hand, seeks to mirror the performance of an index made up of U.S. regional banks, concentrating its exposure on the dynamics of local banking institutions. Understanding these tracking methods is crucial for investors looking to align their investments with their expectations.

Conclusion

The IYF and IAT ETFs offer unique opportunities for investors seeking exposure to the financial sector. IYF provides a broader and potentially more stable exposure to large financial corporations, while IAT narrows its focus to regional banks, potentially offering more targeted growth potential. As investors consider their options, tools like ETF Insider can provide invaluable insights, offering detailed information about holdings, correlations, overlaps, and more. With its user-friendly app, ETF Insider empowers investors to make well-informed decisions based on data-driven insights.

Disclaimer: This article is intended for informational purposes only and does not offer investment advisory services. It's essential for investors to conduct thorough research and consider their financial goals and risk tolerance before making any investment decisions.

Sources:

iShares by BlackRock (www.ishares.com)

ETF Insider (www.etfinsider.io)

IYF quote and analysis

Discover the top holdings, correlations, and overlaps of ETFs using our visualization tool.

Our app allows you to build and track your portfolio.

To learn more about the IYF iShares U.S. Financials ETF, access our dedicated page now.

FAQ

Why is IYF better than IAT?

IYF may be considered better than IAT for some investors due to its specific focus, offering diversification.

Does IAT beat IYF?

IAT's performance relative to IYF will vary over time, depending on market conditions.

Should I invest in IYF or IAT?

The choice between IYF and IAT should align with your investment goals, risk tolerance, and desired exposure.

Are IYF and IAT good investments?

Both IYF and IAT can be suitable investments depending on individual investment strategies, goals, and risk profiles.

What is the correlation between IYF and IAT?

The correlation between IYF and IAT can vary over time, reflecting differences in performance.