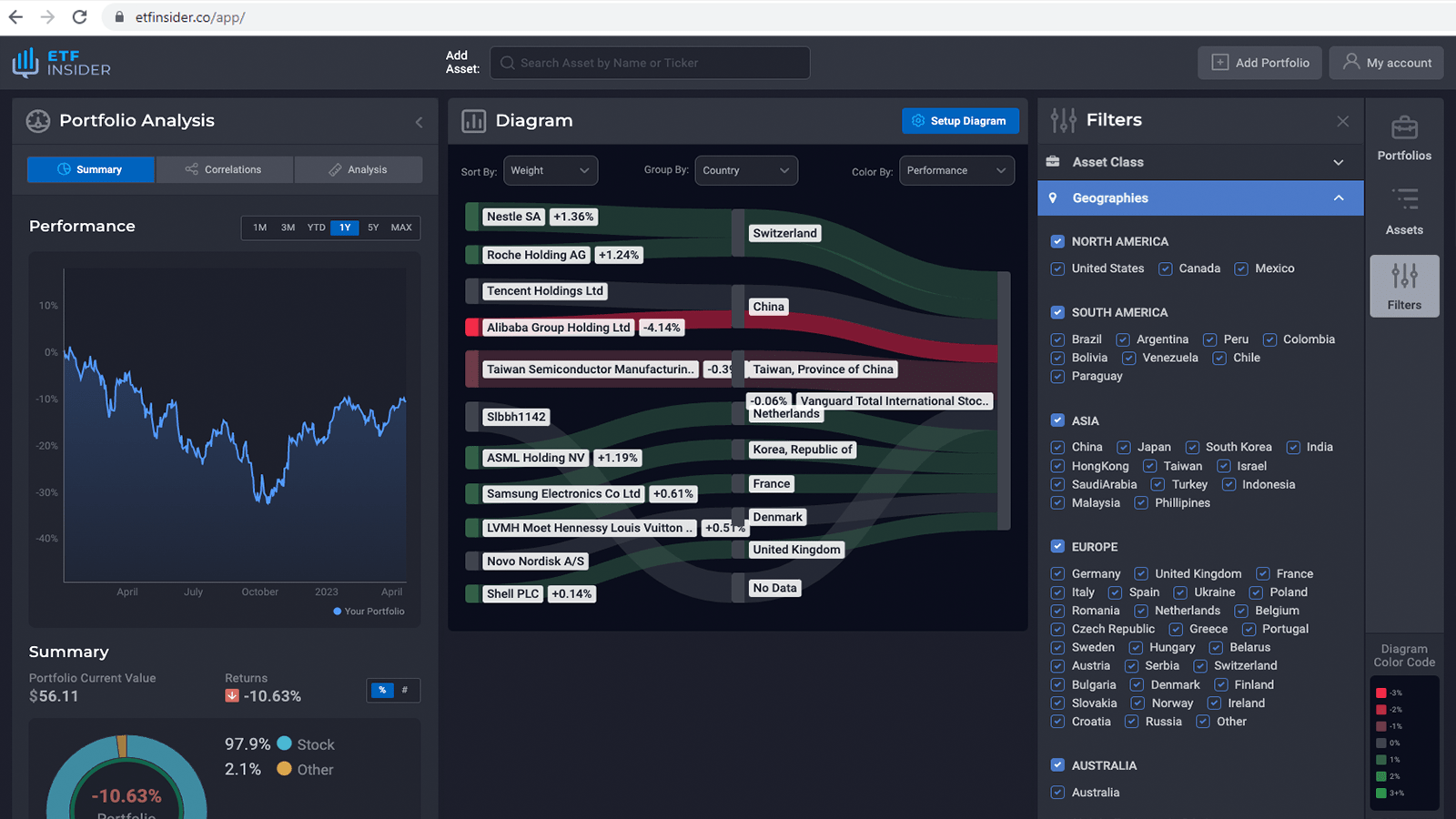

ETF with Apple Inc. exposure

When it comes to investing in ETFs (Exchange-Traded Funds), diversification is key. One popular strategy is to invest in ETFs that provide exposure to well-established companies like Apple Inc. These ETFs allow investors to indirectly invest in Apple Inc. without owning individual Apple stocks. Here's a list of ETFs with Apple Inc. exposure that you should consider: Invesco QQQ Trust (QQQ): This ETF tracks the NASDAQ-100 Index, which includes Apple Inc. and other leading technology companies. It's a great choice for investors seeking broad exposure to the tech sector. iShares Dow Jones U.S. Technology ETF (IYW): This ETF includes Apple Inc. as one of its top holdings. It's designed to track the performance of the U.S. technology sector, making it a suitable option for those interested in tech stocks. Technology Select Sector SPDR Fund (XLK): XLK is another ETF that features Apple Inc. as a major holding. It aims to replicate the performance of the Technology Select Sector Index, providing exposure to various tech companies.

ETFs with Apple Inc. Exposure: Comparisons of QQQ, IYW, and XLK

Now that we've listed some ETFs with Apple Inc. exposure, let's compare three popular options: Invesco QQQ Trust (QQQ), iShares Dow Jones U.S. Technology ETF (IYW), and Technology Select Sector SPDR Fund (XLK). Invesco QQQ Trust (QQQ): Tracks the NASDAQ-100 Index, providing exposure to Apple Inc. and other tech giants. Offers diversification across a wide range of tech stocks. Known for high liquidity and trading volume. iShares Dow Jones U.S. Technology ETF (IYW): Includes Apple Inc. in its top holdings. Seeks to capture the performance of the U.S. technology sector. May be more focused on tech compared to broader market ETFs. Technology Select Sector SPDR Fund (XLK): Features Apple Inc. as a significant component. Designed to mirror the Technology Select Sector Index. Provides a targeted approach to tech sector investing.

CIBR overlap ETF with Apple Inc. exposure

CIBR overlap ETF with Apple Inc. exposure

Apple Inc. Exposure: Benefits of Investing in These ETFs

Investing in ETFs with Apple Inc. exposure offers several advantages over individual stock picking: Diversification: These ETFs provide exposure to not only Apple Inc. but also a basket of other tech stocks, reducing the risk associated with holding a single company's stock. Liquidity: ETFs are traded on stock exchanges, offering high liquidity and ease of buying and selling, even for retail investors. Lower Risk: By spreading your investment across multiple stocks, you reduce the impact of poor performance by one company on your overall portfolio. Professional Management: ETFs are managed by experienced professionals who make decisions based on market trends and research.

Apple Inc. Exposure: Considerations Before Investing

Before investing in ETFs with Apple Inc. exposure, consider the following: Risk Tolerance: Assess your risk tolerance and investment goals to determine the right allocation to these ETFs in your portfolio. Expense Ratios: Compare the expense ratios of different ETFs as lower expenses can enhance your returns over time. Market Research: Stay informed about market trends and the tech sector's performance as it can impact the ETFs' returns. Portfolio Diversification: Ensure that investing in these ETFs aligns with your overall portfolio diversification strategy. In conclusion, ETFs with Apple Inc. exposure offer a convenient way to invest in this tech giant while enjoying the benefits of diversification and professional management. However, like any investment, it's essential to assess your goals and risk tolerance before making a decision. Disclaimer: This article is for informational purposes only and does not provide investment advisory services. Before making any investment decisions, consult with a financial advisor or conduct your research to make informed choices.

Source 1: CIBR ETF issuer

Source 2: CIBR ETF official page

FAQ

What is the CIBR ETF?

The CIBR ETF is an exchange-traded fund that provides investors exposure to specific assets or companies.

What companies does the CIBR ETF have exposure to?

The CIBR ETF has exposure to companies like Apple Inc..

How can I read more about the CIBR ETF?

You can read more about the CIBR ETF in various financial publications, websites, and the official ETF documentation.

Why should I consider investing in the CIBR ETF?

Investing in ETFs can provide diversification, flexibility, and cost-effectiveness. It's important to do your own research or consult with a financial advisor before making investment decisions.

What is the description for the CIBR ETF?

The ETF with Apple Inc. exposure provides investors with an opportunity to diversify their portfolio while gaining insight into the performance and potential of Apple Inc.. This ETF offers a comprehensive view of the company's standing in the market, its historical performance, and future prospects.

How is the CIBR ETF different from other ETFs?

Each ETF has its own unique investment strategy, holdings, and exposure. It's crucial to understand the specifics of each ETF before investing.