ETF with Cisco Systems Inc. and Broadcom Inc. Exposure (Nasdaq)

With an intriguing dynamic in the technology sector, Exchange Traded Funds (ETFs) holding shares of titans like Cisco Systems Inc. and Broadcom Inc. have become a focal point for many investors. These companies, listed on the Nasdaq, present a wealth of investment opportunities through various ETFs, bridging the gap between individual stock investments and diversified portfolio exposure.

ETF with Cisco Systems Inc. and Broadcom Inc. Exposure (Nasdaq): Exposure

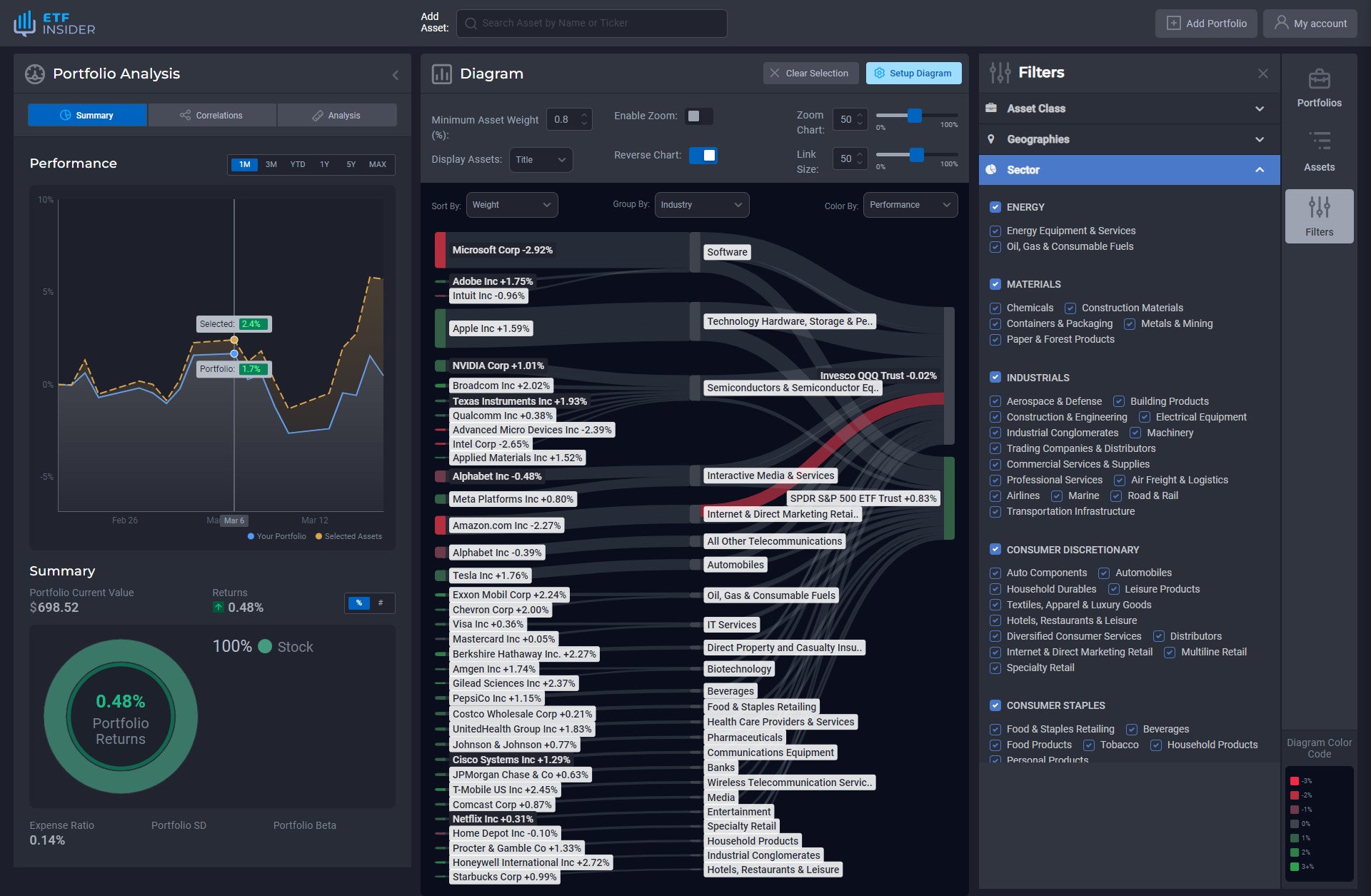

Cisco Systems Inc. and Broadcom Inc., two technological giants, have significantly impacted the networking hardware space and semiconductor industry respectively. ETFs encapsulating these entities, such as the Invesco QQQ Trust (QQQ) and Invesco NASDAQ Composite ETF (QQQJ), enable investors to gain robust exposure to these companies while maintaining the diversification essential to mitigate potential risks. The presence of these firms in ETFs provides an advantageous investment strategy by allowing stock market participation without relying on the performance of a single entity.

ETF with Cisco Systems Inc. and Broadcom Inc. Exposure (Nasdaq): Comparisons of

While Cisco and Broadcom command significant weight in several ETFs, comparisons with other behemoths like Apple Inc. or Microsoft Corp. reveal distinctive allocation strategies among various funds. For instance, the Invesco QQQ Trust, which keenly tracks the NASDAQ-100 Index, leans heavily towards the tech sector, offering a pronounced exposure to these companies. Alternatively, broader funds like the Invesco NASDAQ Composite ETF (QQQJ) might provide extensive coverage of the Nasdaq, encapsulating a more varied spectrum of companies, ensuring that investment risks are meticulously dispersed.

QQQ overlap ETF with Cisco Systems Inc. and Broadcom Inc. Exposure (Nasdaq)

QQQ overlap ETF with Cisco Systems Inc. and Broadcom Inc. Exposure (Nasdaq)

ETF with Cisco Systems Inc. and Broadcom Inc. Exposure (Nasdaq): Benefits to invest on those ETFs

Opting to invest in ETFs encapsulating firms like Cisco and Broadcom extends numerous advantages over traditional stock picking. Firstly, investors benefit from the inherent diversification of ETFs, which usually amalgamate various assets to curate a balanced investment vehicle, mitigating potential financial pitfalls of single stock investment. Secondly, ETFs often imbue a cost-effective investment strategy, evading the usually higher fees encountered in active fund management, and simultaneously, offering the ability to trade during market hours similar to individual stocks, thus providing flexibility and liquidity.

ETF with Cisco Systems Inc. and Broadcom Inc. Exposure (Nasdaq): Consideration before investing

Investing in ETFs, particularly those focused on technology giants like Cisco and Broadcom, necessitates a thorough evaluation of certain aspects. The technology sector is notably volatile, prompting a need for investors to ascertain their risk tolerance levels. Additionally, it’s imperative to scrutinize the expense ratios, ensuring that the costs of the chosen ETF don’t markedly diminish potential returns. Moreover, understanding the ETF’s approach, be it growth-oriented or value-focused, is crucial to aligning investment choices with individual financial objectives and market perspectives. In conclusion, while the allure of investing in potent entities like Cisco Systems Inc. and Broadcom Inc. is palpable, electing to invest through meticulously chosen ETFs can manifest as a balanced and judicious investment strategy. The myriad of available ETFs, each with its strategic allocation and focus, offers a versatile platform for diverse investment approaches, thereby accommodating various financial objectives and risk appetites. Disclaimer: This article does not provide investment advisory services. Always consult a financial advisor before making investment decisions.

Source 1: QQQ ETF issuer

Source 2: QQQ ETF official page

FAQ

What is the QQQ ETF?

The QQQ ETF is an exchange-traded fund that provides investors exposure to specific assets or companies.

What companies does the QQQ ETF have exposure to?

The QQQ ETF has exposure to companies like Cisco Systems Inc. and Broadcom Inc. Exposure.

How can I read more about the QQQ ETF?

You can read more about the QQQ ETF in various financial publications, websites, and the official ETF documentation.

Why should I consider investing in the QQQ ETF?

Investing in ETFs can provide diversification, flexibility, and cost-effectiveness. It's important to do your own research or consult with a financial advisor before making investment decisions.

What is the description for the QQQ ETF?

The ETF with Cisco Systems Inc. and Broadcom Inc. Exposure (Nasdaq) exposure provides investors with an opportunity to diversify their portfolio while gaining insight into the performance and potential of Cisco Systems Inc. and Broadcom Inc. Exposure (Nasdaq). This ETF offers a comprehensive view of the company's standing in the market, its historical performance, and future prospects.

How is the QQQ ETF different from other ETFs?

Each ETF has its own unique investment strategy, holdings, and exposure. It's crucial to understand the specifics of each ETF before investing.