ETF with Cisco Systems Inc. and Xilinx Inc. Exposure (Nasdaq)

In a world where technology reigns supreme, investors seek to bolster their portfolios with stalwarts like Cisco Systems Inc. and Xilinx Inc., both integral elements of the technological evolution and significantly represented in Nasdaq. Unpacking the nuances of ETFs housing these titans, we delve into the realms of exposure, comparisons, benefits, and pivotal considerations for investment enthusiasts tethering on the brink of diving into tech-focused funds.

ETF with Cisco Systems Inc. and Xilinx Inc. Exposure (Nasdaq): Exposure

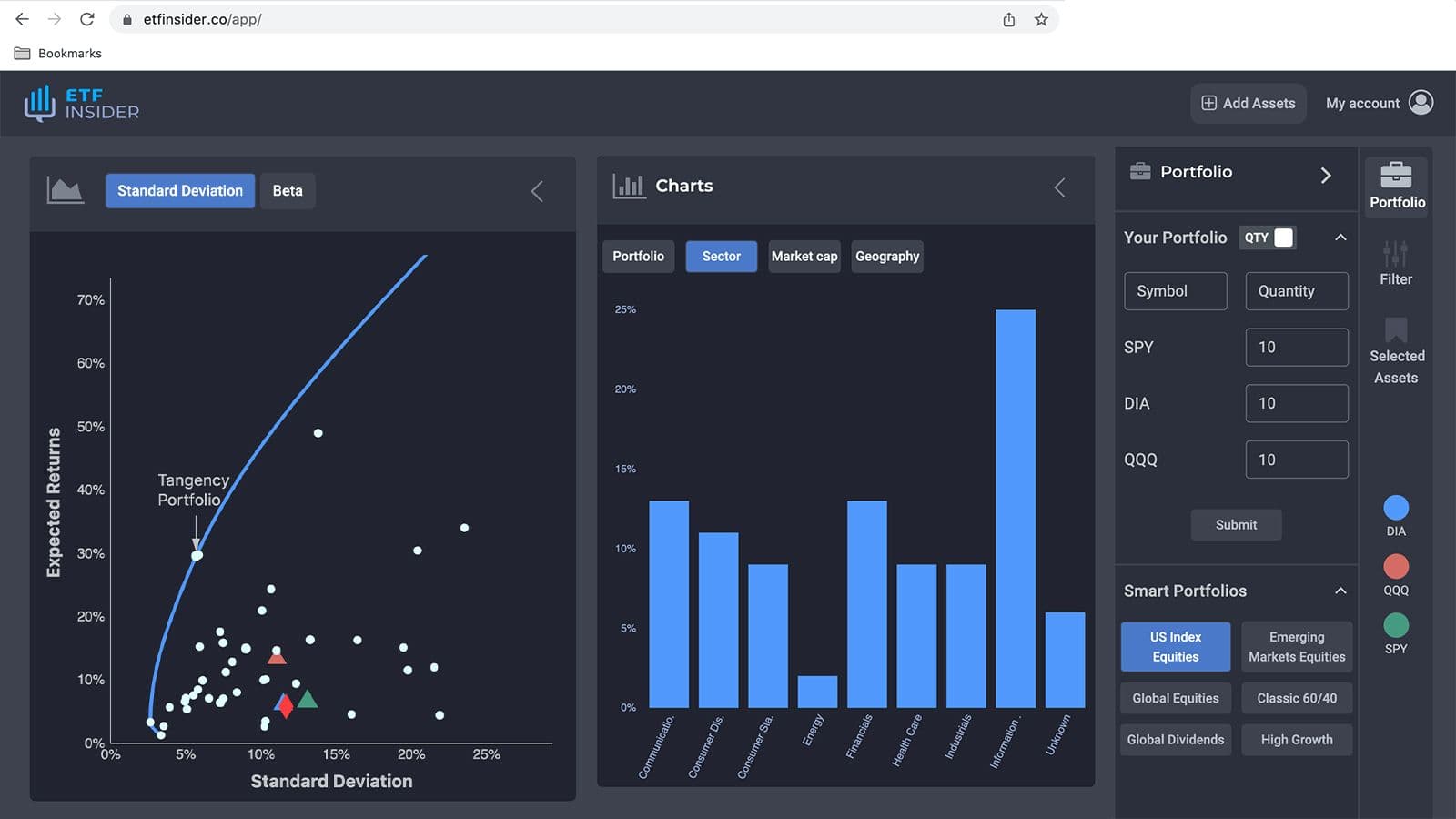

Cisco Systems Inc. and Xilinx Inc., tech behemoths renowned for their sustainable growth, occupy pivotal spots in the portfolios of several ETFs that track the Nasdaq, such as the Invesco QQQ Trust (QQQ) and the Invesco NASDAQ Composite ETF (QQQJ). These ETFs provide substantive exposure to these companies while simultaneously offering a hedge against the inherent volatility of individual stocks. Through these financial instruments, investors are granted the luxury of diversification, as they can glean the rewards of Cisco’s network dominance and Xilinx’s FPGA prowess without being extensively subjected to their individual market risks.

ETF with Cisco Systems Inc. and Xilinx Inc. Exposure (Nasdaq): Comparisons of

When drawing comparisons between ETFs with Cisco and Xilinx exposure and other funds, the defining edge lies in the assimilation of robust tech backbone and stability derived from their seasoned presence in the market. For instance, while the First Trust NASDAQ-100 Technology Sector Index Fund (QTEC) immerses investors deeply into the tech sector, ETFs with Cisco and Xilinx exposure tend to sprawl across multiple tech sub-domains, ensuring that investors are not tethered to the fortunes of a single niche. Furthermore, these companies have demonstrated a resilient stand against market adversities, thereby often safeguarding ETFs from abrupt market shocks common in comparatively nascent tech domains.

QQQ overlap ETF with Cisco Systems Inc. and Xilinx Inc. Exposure (Nasdaq)

QQQ overlap ETF with Cisco Systems Inc. and Xilinx Inc. Exposure (Nasdaq)

ETF with Cisco Systems Inc. and Xilinx Inc. Exposure (Nasdaq): Benefits to invest on those ETFs

Opting for ETFs with Cisco Systems Inc. and Xilinx Inc. exposure as opposed to direct stock picking serves up a platter of benefits, primarily rooted in risk mitigation and diversified exposure. Not only do investors indulge in the robust growth trajectory carved by these companies, but they also circumvent the upheavals that individual stocks are often subjected to, owing to market dynamics and company-specific news. This is crucial in a sector like technology, notorious for its rapid shifts and susceptibility to market sentiment and regulatory changes. Moreover, the historic and projected stability of both companies potentially translates to a lower risk coefficient for the associated ETFs.

ETF with Cisco Systems Inc. and Xilinx Inc. Exposure (Nasdaq): Consideration before investing

Embarking on an investment journey, especially within the vibrant corridors of the technology sector, demands meticulous scrutiny and considerations. For ETFs with Cisco and Xilinx exposure, investors should evaluate their own risk appetite, the fund’s expense ratio, and the inherent risk and return profile of the fund. Moreover, understanding the historical performance, the strategic allocation of assets within the ETF, and assessing how these allocations align with one’s investment goals is paramount. An adept perusal of the fund's underlying assets, technical analysis, and future projections are imperative to align investments with financial aspirations. Conclusion: As technology continues to helm the forefront of investment potentials, ETFs with specific exposure to Cisco Systems Inc. and Xilinx Inc. carve a unique niche for investors, blending stability with the kinetic energy of the tech sector. A thoughtful selection, underlined by strategic considerations, could harness the perennial growth these tech giants continue to showcase. Disclaimer: This article does not provide any investment advisory services.

Source 1: QQQ ETF issuer

Source 2: QQQ ETF official page

FAQ

What is the QQQ ETF?

The QQQ ETF is an exchange-traded fund that provides investors exposure to specific assets or companies.

What companies does the QQQ ETF have exposure to?

The QQQ ETF has exposure to companies like Cisco Systems Inc. and Xilinx Inc. Exposure.

How can I read more about the QQQ ETF?

You can read more about the QQQ ETF in various financial publications, websites, and the official ETF documentation.

Why should I consider investing in the QQQ ETF?

Investing in ETFs can provide diversification, flexibility, and cost-effectiveness. It's important to do your own research or consult with a financial advisor before making investment decisions.

What is the description for the QQQ ETF?

The ETF with Cisco Systems Inc. and Xilinx Inc. Exposure (Nasdaq) exposure provides investors with an opportunity to diversify their portfolio while gaining insight into the performance and potential of Cisco Systems Inc. and Xilinx Inc. Exposure (Nasdaq). This ETF offers a comprehensive view of the company's standing in the market, its historical performance, and future prospects.

How is the QQQ ETF different from other ETFs?

Each ETF has its own unique investment strategy, holdings, and exposure. It's crucial to understand the specifics of each ETF before investing.