ETF with Comcast Corp. and Align Technology Inc. Exposure (Nasdaq)

Comcast Corp. and Align Technology Inc., titans in their respective industries, have attracted substantial attention from investors seeking diversified exposure through exchange-traded funds (ETFs). The companies, listed on Nasdaq, provide unique investment opportunities and can be accessed via specific ETFs.

ETF with Comcast Corp. and Align Technology Inc. Exposure (Nasdaq): Exposure

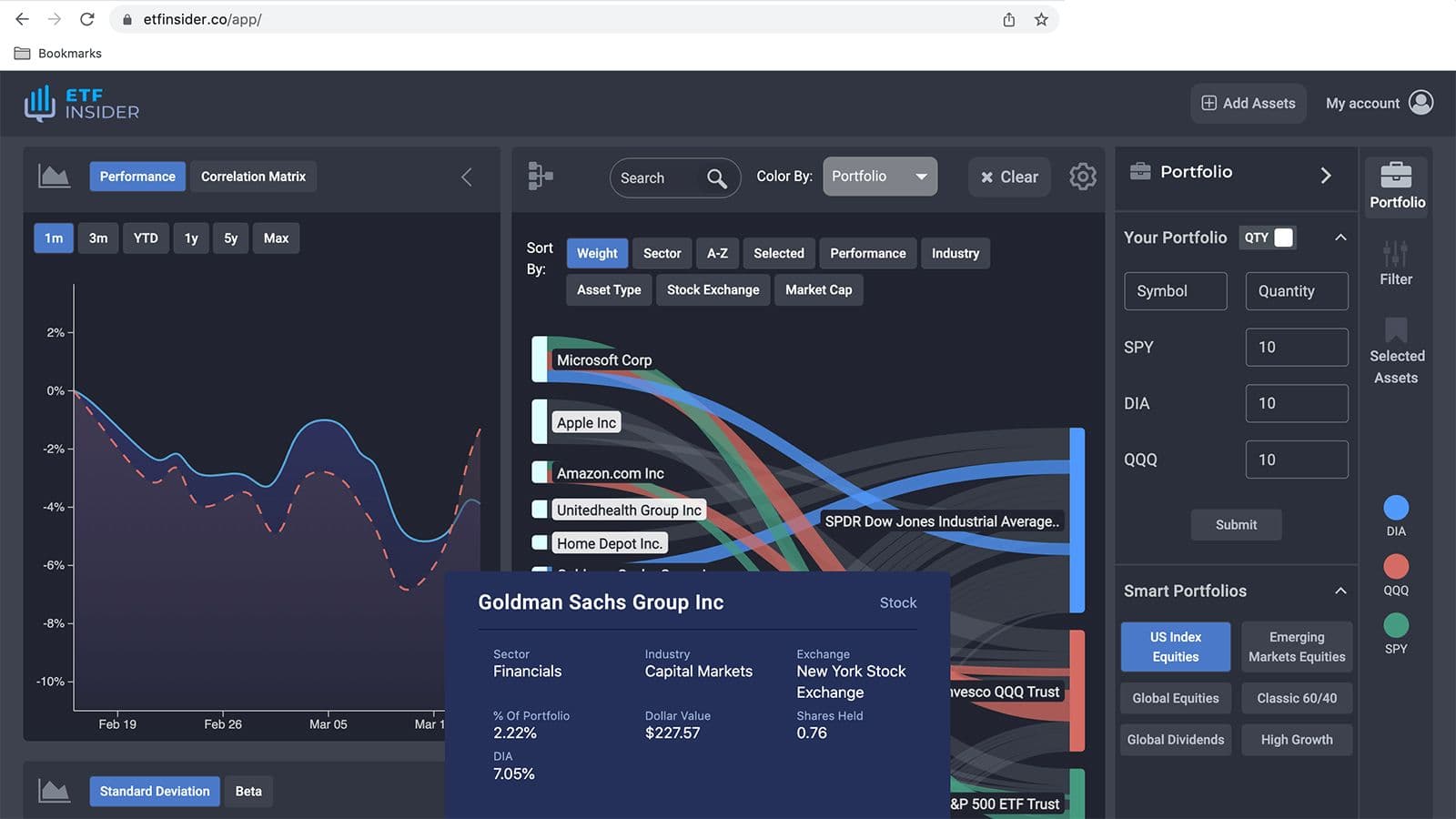

When considering ETFs with notable exposure to Comcast Corp. and Align Technology Inc., investors may look towards funds like the Invesco QQQ Trust (QQQ) and the First Trust NASDAQ-100 Technology Sector Index Fund (QTEC), which lean into the technological and telecommunication sectors, respectively. Comcast, being a significant player in the broadcasting and cable TV sectors, and Align Technology, a renowned developer in medical devices with a focus on dental products, furnish investors with a blend of technological and health care sector exposure. The aforementioned ETFs not only provide a window into these companies but also encapsulate a more comprehensive perspective on the Nasdaq’s tech-dominated environment.

ETF with Comcast Corp. and Align Technology Inc. Exposure (Nasdaq): Comparisons of

Comparing ETFs such as QQQ and QTEC with other prevalent holdings like the Invesco NASDAQ Composite ETF (QQQJ) and the iShares NASDAQ Biotechnology ETF (IBB), certain distinctions emerge regarding sectorial exposure and risk diversity. While QQQ and QTEC offer substantial tech-centric portfolios, which include both Comcast Corp. and Align Technology Inc., QQQJ and IBB may provide broader exposure to the Nasdaq Composite and biotechnology sectors, respectively. Consequently, investors must weigh the tech dominance versus the broader market or sector-specific exposure when opting for an ETF. This decision often hinges on their risk tolerance, investment goals, and the desired industry exposure.

QQQ overlap ETF with Comcast Corp. and Align Technology Inc. Exposure (Nasdaq)

QQQ overlap ETF with Comcast Corp. and Align Technology Inc. Exposure (Nasdaq)

ETF with Comcast Corp. and Align Technology Inc. Exposure (Nasdaq): Benefits to invest on those ETFs

Investing in ETFs like those incorporating Comcast Corp. and Align Technology Inc. holds several advantages over individual stock picking, primarily through diversified exposure, which inherently mitigates risk. These ETFs allow investors to garner the benefits of the prospective growth and stability these companies may offer without being overly exposed to the individual volatility of their stocks. Additionally, considering the long-standing presence and consistent performance of Comcast and Align Technology in the market, incorporating ETFs that include these entities might imbue a portfolio with both innovative and stable components, balancing potential returns with a measure of safety.

ETF with Comcast Corp. and Align Technology Inc. Exposure (Nasdaq): Consideration before investing

However, careful contemplation is paramount before investing. Despite the convenience and diversification that ETFs provide, it's vital to consider factors like the expense ratio, liquidity, and the ETF’s track record. For instance, while the Invesco QQQ Trust (QQQ) is renowned for its high liquidity and robust performance, its tech-heavy stance might not align with the objectives of investors seeking varied sectorial dispersion. Furthermore, recognizing how the ETF has historically responded to market fluctuations and understanding its strategy and holdings are vital to anticipate how it might behave in future market scenarios, thus guiding a well-informed investment decision. In conclusion, while ETFs housing Comcast Corp. and Align Technology Inc. offer lucrative prospects by amalgamating stability with innovation, investors must meticulously evaluate them in the context of their investment goals, risk appetite, and desired market exposure. Only then can one construct a portfolio that is not only reflective of their investment ideology but also resilient in navigating through varied market environments. Disclaimer: This article does not provide investment advisory services and is intended for informational purposes only.

Source 1: QQQ ETF issuer

Source 2: QQQ ETF official page

FAQ

What is the QQQ ETF?

The QQQ ETF is an exchange-traded fund that provides investors exposure to specific assets or companies.

What companies does the QQQ ETF have exposure to?

The QQQ ETF has exposure to companies like Comcast Corp. and Align Technology Inc. Exposure.

How can I read more about the QQQ ETF?

You can read more about the QQQ ETF in various financial publications, websites, and the official ETF documentation.

Why should I consider investing in the QQQ ETF?

Investing in ETFs can provide diversification, flexibility, and cost-effectiveness. It's important to do your own research or consult with a financial advisor before making investment decisions.

What is the description for the QQQ ETF?

The ETF with Comcast Corp. and Align Technology Inc. Exposure (Nasdaq) exposure provides investors with an opportunity to diversify their portfolio while gaining insight into the performance and potential of Comcast Corp. and Align Technology Inc. Exposure (Nasdaq). This ETF offers a comprehensive view of the company's standing in the market, its historical performance, and future prospects.

How is the QQQ ETF different from other ETFs?

Each ETF has its own unique investment strategy, holdings, and exposure. It's crucial to understand the specifics of each ETF before investing.