ETF with Comcast Corp. and Verisk Analytics Inc. Exposure (Nasdaq)

When it comes to investing in the Nasdaq and gaining exposure to companies like Comcast Corp. and Verisk Analytics Inc., exchange-traded funds (ETFs) offer a convenient and diversified approach. Here's a list of ETFs that can help you tap into the potential of these companies and the broader Nasdaq market. Invesco QQQ Trust (QQQ): The Invesco QQQ Trust is one of the most popular ETFs that track the Nasdaq-100 Index. It includes companies like Comcast Corp. and Verisk Analytics Inc., along with other tech giants, making it a comprehensive choice for Nasdaq exposure. Invesco NASDAQ Composite ETF (QQQJ): For a more direct exposure to the Nasdaq Composite Index, consider this ETF. It encompasses a broader range of companies, offering a different perspective compared to the Nasdaq-100. First Trust NASDAQ-100 Technology Sector Index Fund (QTEC): If you're particularly interested in the technology sector within the Nasdaq, QTEC focuses on technology-related companies from the Nasdaq-100 Index. Direxion NASDAQ-100 Equal Weighted Index Shares (QQQE): QQE provides equal-weighted exposure to the Nasdaq-100 Index, ensuring that smaller companies have an equal say in your investment.

ETFs with Comcast Corp. and Verisk Analytics Inc.: Comparisons of QQQ, QQQJ, QTEC, and QQQE

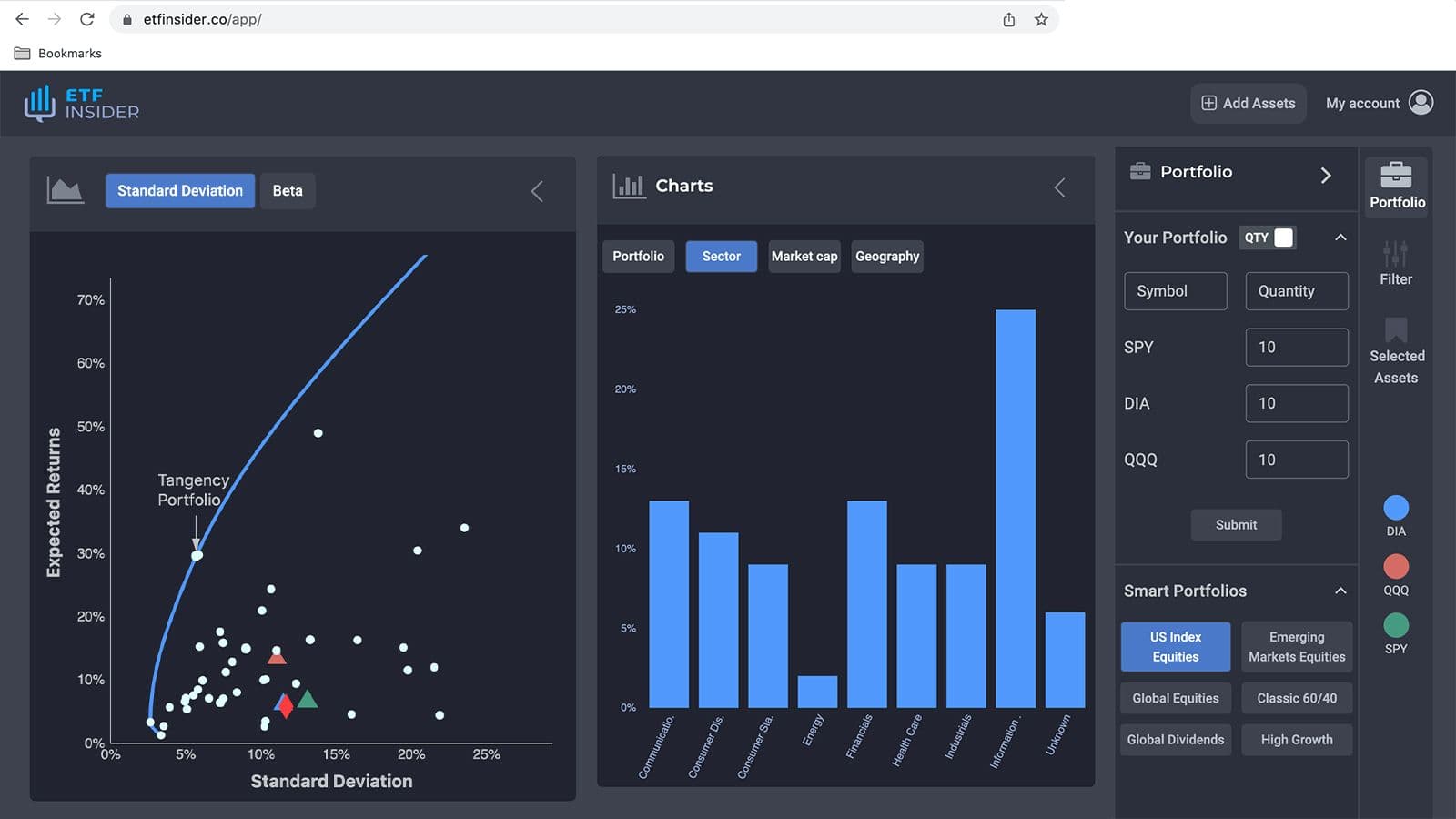

Now, let's dive into a short comparison between these ETFs, highlighting their unique features and what sets them apart from one another. Invesco QQQ Trust (QQQ): QQQ is the go-to choice for investors seeking broad exposure to the Nasdaq-100 Index. It's heavily weighted towards tech giants like Apple, Amazon, and Microsoft, in addition to Comcast Corp. and Verisk Analytics Inc. QQQ is known for its liquidity and strong performance tracking the index. Invesco NASDAQ Composite ETF (QQQJ): If you want a broader Nasdaq experience, QQQJ tracks the Nasdaq Composite Index, which includes a more diverse range of companies compared to the Nasdaq-100. This ETF can provide exposure to smaller and mid-cap firms alongside larger ones. First Trust NASDAQ-100 Technology Sector Index Fund (QTEC): QTEC hones in on the technology sector within the Nasdaq-100. It's a concentrated choice for those who believe in the tech industry's growth potential, and it includes Comcast Corp. and Verisk Analytics Inc. Direxion NASDAQ-100 Equal Weighted Index Shares (QQQE): QQE offers an equal-weighted approach to the Nasdaq-100, ensuring that smaller companies in the index are not overshadowed by the giants. It's a unique way to gain exposure to the Nasdaq's full spectrum.

QQQ overlap ETF with Comcast Corp. and Verisk Analytics Inc. Exposure (Nasdaq)

QQQ overlap ETF with Comcast Corp. and Verisk Analytics Inc. Exposure (Nasdaq)

Comcast Corp. and Verisk Analytics Inc.: Benefits of Investing in These ETFs

Investing in ETFs like QQQ, QQQJ, QTEC, and QQQE that hold positions in Comcast Corp. and Verisk Analytics Inc. has several advantages compared to individual stock picking: Diversification: These ETFs provide instant diversification by holding multiple stocks, reducing the risk associated with individual company performance. Liquidity: ETFs are traded on stock exchanges, offering high liquidity, making it easy to buy and sell shares at market prices. Lower Costs: ETFs typically have lower expense ratios compared to actively managed funds, allowing investors to keep more of their returns. Professional Management: ETFs are managed by experienced professionals who aim to track the performance of their respective indexes accurately.

Comcast Corp. and Verisk Analytics Inc.: Considerations Before Investing

Before investing in any ETF, including those with exposure to Comcast Corp. and Verisk Analytics Inc., consider the following factors: Risk Tolerance: Understand your risk tolerance and investment goals. Some ETFs may be more volatile than others, so choose accordingly. Expense Ratios: Compare expense ratios among ETFs to ensure you're getting good value for your investment. Market Research: Stay informed about the overall market and specific sectors or industries that these companies operate in. Diversification: While ETFs offer diversification, consider how these ETFs fit into your overall investment portfolio for optimal diversification.

Conclusion

In summary, investing in ETFs with exposure to Comcast Corp. and Verisk Analytics Inc. via options like QQQ, QQQJ, QTEC, and QQQE can be a smart move for investors looking to tap into the Nasdaq market. These ETFs provide diversification, liquidity, and professional management, making them a compelling choice for Nasdaq-focused investments. However, it's essential to assess your risk tolerance and do your due diligence before investing in any financial instrument. Disclaimer: This article does not provide any investment advisory services. It is for informational purposes only, and you should consult with a financial advisor before making any investment decisions.

Source 1: QQQ ETF issuer

Source 2: QQQ ETF official page

FAQ

What is the QQQ ETF?

The QQQ ETF is an exchange-traded fund that provides investors exposure to specific assets or companies.

What companies does the QQQ ETF have exposure to?

The QQQ ETF has exposure to companies like Comcast Corp. and Verisk Analytics Inc. Exposure.

How can I read more about the QQQ ETF?

You can read more about the QQQ ETF in various financial publications, websites, and the official ETF documentation.

Why should I consider investing in the QQQ ETF?

Investing in ETFs can provide diversification, flexibility, and cost-effectiveness. It's important to do your own research or consult with a financial advisor before making investment decisions.

What is the description for the QQQ ETF?

The ETF with Comcast Corp. and Verisk Analytics Inc. Exposure (Nasdaq) exposure provides investors with an opportunity to diversify their portfolio while gaining insight into the performance and potential of Comcast Corp. and Verisk Analytics Inc. Exposure (Nasdaq). This ETF offers a comprehensive view of the company's standing in the market, its historical performance, and future prospects.

How is the QQQ ETF different from other ETFs?

Each ETF has its own unique investment strategy, holdings, and exposure. It's crucial to understand the specifics of each ETF before investing.