ETF with Costco Wholesale Corp. and Verisk Analytics Inc. Exposure (Nasdaq)

Navigating the investment pathways through the Nasdaq, particularly with giants like Costco Wholesale Corp. and Verisk Analytics Inc., enables investors to explore a myriad of ETF opportunities. But, how do these opportunities measure up in terms of exposure, comparison, benefits, and critical considerations?

ETF with Costco Wholesale Corp. and Verisk Analytics Inc. Exposure (Nasdaq): Exposure

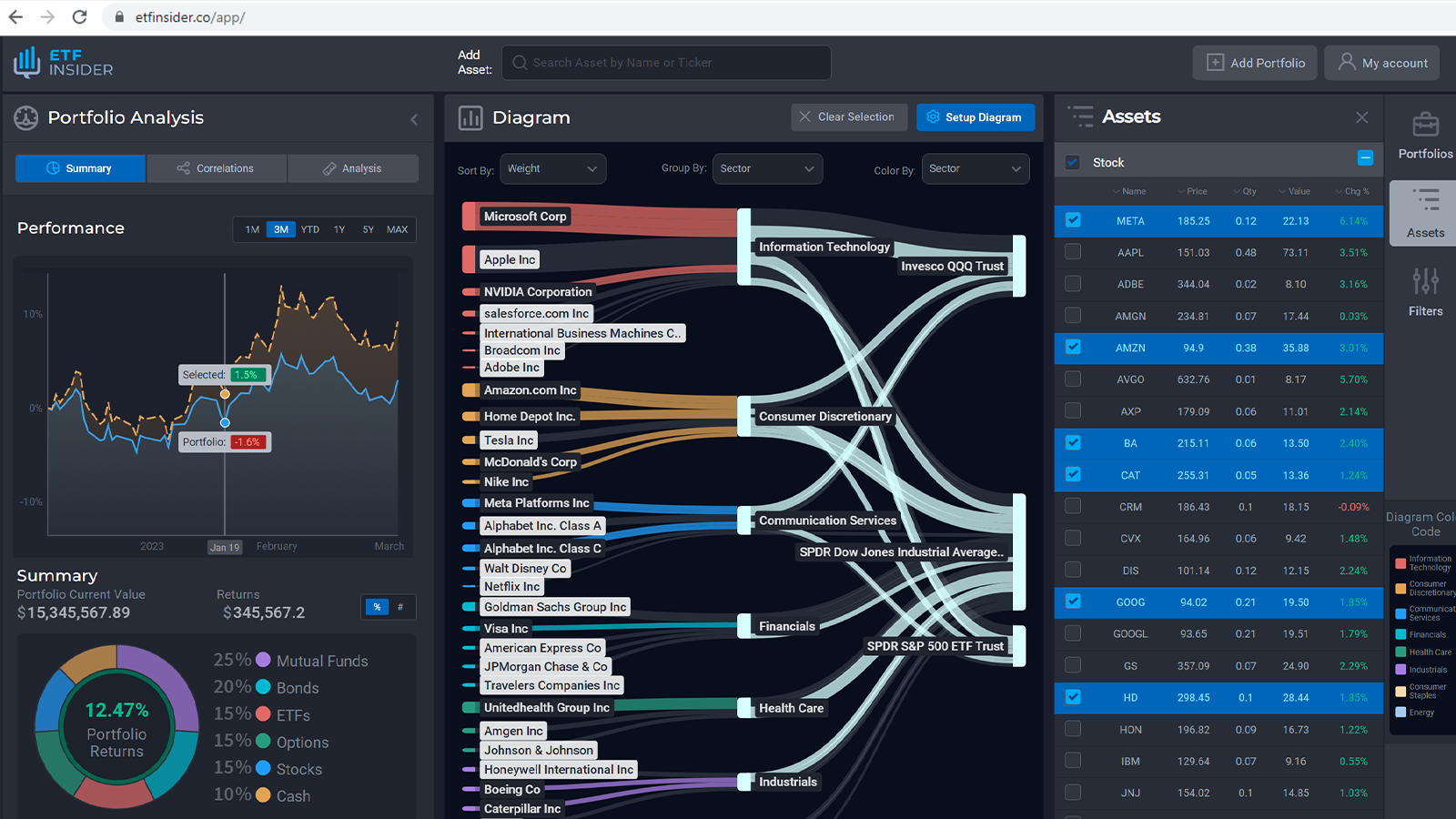

Costco Wholesale Corp. and Verisk Analytics Inc. are renowned for their robust market presence and performance in the Nasdaq. Investors seeking ETFs with substantial exposure to these firms might lean towards options like Invesco QQQ Trust (QQQ) or Invesco NASDAQ Composite ETF (QQQJ). QQQ is notable for tracking the NASDAQ-100, providing a solid foundation in non-financial companies, whereas QQQJ offers a broader spectrum, aligning more closely with the NASDAQ Composite Index and thereby indirectly encompassing a diverse range of companies including Costco and Verisk.

ETF with Costco Wholesale Corp. and Verisk Analytics Inc. Exposure (Nasdaq): Comparisons of

When paralleling ETFs like QQQ and QQQJ to other ETFs with top holdings in, for instance, the technology sector, distinctions become perceptible. The First Trust NASDAQ-100 Technology Sector Index Fund (QTEC) focuses exclusively on technology-related entities within the NASDAQ-100, providing a technologically dense investment space. In contrast, ETFs with exposure to Costco and Verisk offer a diversified investment pathway by encapsulating the broader retail and data analytics sectors respectively, thereby providing a varied investment landscape.

QQQ overlap ETF with Costco Wholesale Corp. and Verisk Analytics Inc. Exposure (Nasdaq)

QQQ overlap ETF with Costco Wholesale Corp. and Verisk Analytics Inc. Exposure (Nasdaq)

ETF with Costco Wholesale Corp. and Verisk Analytics Inc. Exposure (Nasdaq): Benefits to invest on those ETFs

Investing in ETFs with exposure to Costco and Verisk, compared to stock picking, hinges on diversification and risk management. Instead of betting on the individual stock performance of these companies, an ETF like QQQJ provides a safety net, offering not just a stake in these companies, but an investment that spans across various organizations listed on the Nasdaq. This approach inherently diversifies an investor's portfolio, potentially mitigating risks and providing a stable yet progressive investment trajectory.

ETF with Costco Wholesale Corp. and Verisk Analytics Inc. Exposure (Nasdaq): Consideration before investing

Prior to embarking on an investment journey with these ETFs, several considerations merit attention. Firstly, the investor must align the ETF’s overarching investment strategy with their personal financial goals and risk tolerance. Furthermore, examining the ETF's expense ratio, historical performance, and potential for future growth is paramount. Analyzing the overall health and strategies of Costco and Verisk, along with keeping a pulse on market trends, economic health, and global factors influencing the retail and analytics sectors, can underpin a well-informed investment decision. Conclusion: Strategic investment in ETFs, especially those with exposure to market leaders in the Nasdaq like Costco and Verisk, beckons not just a financial investment but an investment in meticulous research and thoughtful strategy. Remember, the pulse of wise investing beats in the heart of well-informed, strategic, and purpose-driven decision-making. Disclaimer: This article does not provide any investment advisory services. Note: Ensure that the usage of HTML tags is appropriate on the platform where the content will be published to maintain the structured hierarchy and SEO-optimization.

Source 1: QQQ ETF issuer

Source 2: QQQ ETF official page

FAQ

What is the QQQ ETF?

The QQQ ETF is an exchange-traded fund that provides investors exposure to specific assets or companies.

What companies does the QQQ ETF have exposure to?

The QQQ ETF has exposure to companies like Costco Wholesale Corp. and Verisk Analytics Inc. Exposure.

How can I read more about the QQQ ETF?

You can read more about the QQQ ETF in various financial publications, websites, and the official ETF documentation.

Why should I consider investing in the QQQ ETF?

Investing in ETFs can provide diversification, flexibility, and cost-effectiveness. It's important to do your own research or consult with a financial advisor before making investment decisions.

What is the description for the QQQ ETF?

The ETF with Costco Wholesale Corp. and Verisk Analytics Inc. Exposure (Nasdaq) exposure provides investors with an opportunity to diversify their portfolio while gaining insight into the performance and potential of Costco Wholesale Corp. and Verisk Analytics Inc. Exposure (Nasdaq). This ETF offers a comprehensive view of the company's standing in the market, its historical performance, and future prospects.

How is the QQQ ETF different from other ETFs?

Each ETF has its own unique investment strategy, holdings, and exposure. It's crucial to understand the specifics of each ETF before investing.