ETF with Intel Corp. and Ross Stores Inc. Exposure (Nasdaq)

Navigating through the complex avenues of financial instruments like Exchange Traded Funds (ETFs) can be daunting, especially when keen on investing in particular companies, such as Intel Corp. and Ross Stores Inc., stalwarts traded on the Nasdaq. Unraveling the role of such specific investments within the sphere of various ETFs can unveil pathways to strategic investment, aligning with individual financial objectives and risk tolerance.

ETF with Intel Corp. and Ross Stores Inc. Exposure (Nasdaq): Exposure

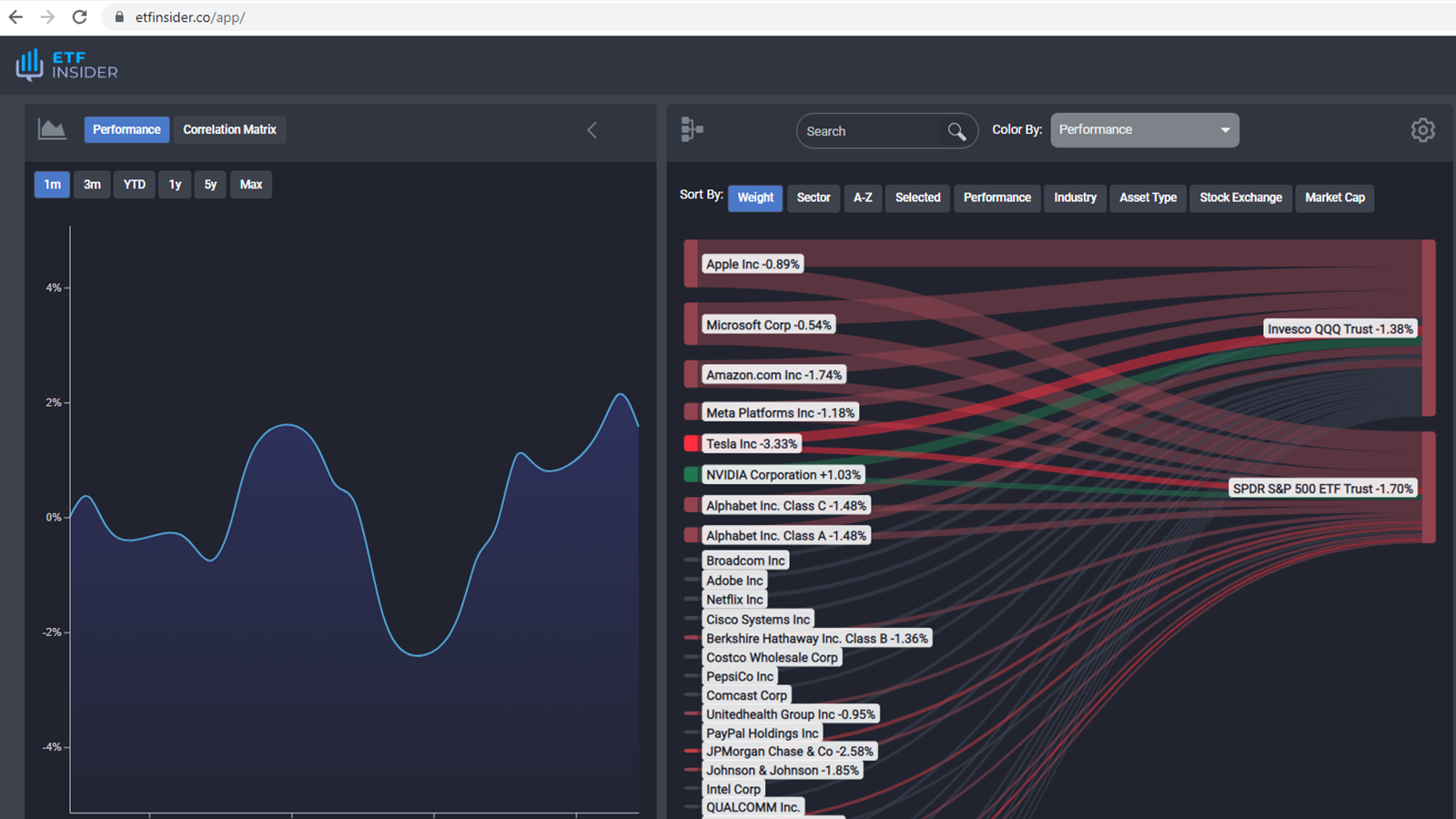

Intel Corp. and Ross Stores Inc., both integral parts of the Nasdaq, carry significant weight in a variety of ETFs, facilitating diversified investment in technology and retail sectors respectively. Investors looking to capitalize on the performance of these entities without direct stock purchasing often pivot towards ETFs like Invesco QQQ Trust (QQQ) or iShares NASDAQ Biotechnology ETF (IBB), which not only grant exposure to these companies but also provide a balanced investment by spreading the risk across numerous entities in related sectors. Thus, investing in such ETFs allows one to indirectly benefit from the market movements influenced by these notable corporations.

ETF with Intel Corp. and Ross Stores Inc. Exposure (Nasdaq): Comparisons of

While Intel Corp. majorly resonates within technology-oriented ETFs like Invesco QQQ Trust (QQQ) and First Trust NASDAQ-100 Technology Sector Index Fund (QTEC), Ross Stores Inc. might be encapsulated within broader ETFs due to its retail orientation. The underlying difference between ETFs such as QQQ and QTEC might surface in sector-specific risk and return profiles, considering QTEC offers a more concentrated exposure to the technology sector. Thus, when an investor is inclining towards a more sector-specific investment, identifying and understanding the underlying holdings and their proportional representations in these ETFs become imperative for making informed decisions.

QQQ overlap ETF with Intel Corp. and Ross Stores Inc. Exposure (Nasdaq)

QQQ overlap ETF with Intel Corp. and Ross Stores Inc. Exposure (Nasdaq)

ETF with Intel Corp. and Ross Stores Inc. Exposure (Nasdaq): Benefits to invest on those ETFs

Investing in ETFs with exposure to companies like Intel Corp. and Ross Stores Inc. offers a plethora of benefits over direct stock picking, including but not limited to, risk mitigation through diversification, transparency, and flexibility in trading. Moreover, with ETFs, investors acquire a slice of numerous pies, ensuring that the underperformance of a particular entity (be it Intel or Ross) can potentially be buffered by the steadier or superior performance of other entities within the ETF. Also, the ease of trading ETFs, much like individual stocks, on stock exchanges provides investors with a convenient avenue to capitalize on the potential upward trajectory of these corporations without directly engaging in their stock trading.

ETF with Intel Corp. and Ross Stores Inc. Exposure (Nasdaq): Consideration before investing

Before parking one's capital in ETFs with significant exposure to Intel Corp. and Ross Stores Inc., investors must weigh multiple considerations such as their risk tolerance, investment horizon, and the ETF’s expense ratio. Furthermore, understanding the implications of macroeconomic factors, sector-specific challenges, and any regulatory changes on these companies becomes crucial. It’s also pivotal to observe the historical performance, portfolio diversification, and the management strategy of the chosen ETF to ensure alignment with one’s investment goals and risk appetite. In conclusion, although investing in ETFs provides a relatively safer haven for capital allocation by providing diversified exposure, comprehending the underlying holdings and their respective impact on ETF performance is pivotal. By doing so, investors can strategically place themselves to possibly harness the market winds in their favor while ensuring their risks are meticulously hedged. Disclaimer: This content does not provide any investment advisory services.

Source 1: QQQ ETF issuer

Source 2: QQQ ETF official page

FAQ

What is the QQQ ETF?

The QQQ ETF is an exchange-traded fund that provides investors exposure to specific assets or companies.

What companies does the QQQ ETF have exposure to?

The QQQ ETF has exposure to companies like Intel Corp. and Ross Stores Inc. Exposure.

How can I read more about the QQQ ETF?

You can read more about the QQQ ETF in various financial publications, websites, and the official ETF documentation.

Why should I consider investing in the QQQ ETF?

Investing in ETFs can provide diversification, flexibility, and cost-effectiveness. It's important to do your own research or consult with a financial advisor before making investment decisions.

What is the description for the QQQ ETF?

The ETF with Intel Corp. and Ross Stores Inc. Exposure (Nasdaq) exposure provides investors with an opportunity to diversify their portfolio while gaining insight into the performance and potential of Intel Corp. and Ross Stores Inc. Exposure (Nasdaq). This ETF offers a comprehensive view of the company's standing in the market, its historical performance, and future prospects.

How is the QQQ ETF different from other ETFs?

Each ETF has its own unique investment strategy, holdings, and exposure. It's crucial to understand the specifics of each ETF before investing.