ETF with Intuit Inc. and Incyte Corp. Exposure (Nasdaq)

If you're considering investing in Exchange-Traded Funds (ETFs) with exposure to Intuit Inc. and Incyte Corp. on the Nasdaq, you've come to the right place. ETFs have gained immense popularity among investors for their diversification benefits and ease of trading. In this article, we will delve into the world of ETFs with a focus on Intuit Inc. and Incyte Corp. exposure, exploring their advantages, comparisons to other top holdings, benefits over stock picking, and crucial considerations before making your investment decision.

ETF with Intuit Inc. and Incyte Corp. Exposure (Nasdaq): Exposure

Before diving into the specifics of these ETFs, let's understand the exposure they offer. Intuit Inc. and Incyte Corp. are prominent companies listed on the Nasdaq Stock Market. Investors seeking exposure to these companies often turn to ETFs to gain a diversified stake. These ETFs aim to replicate the performance of Nasdaq-listed companies, including Intuit Inc. and Incyte Corp., allowing you to participate in their growth and profitability.

ETF with Intuit Inc. and Incyte Corp. Exposure (Nasdaq): Comparisons of

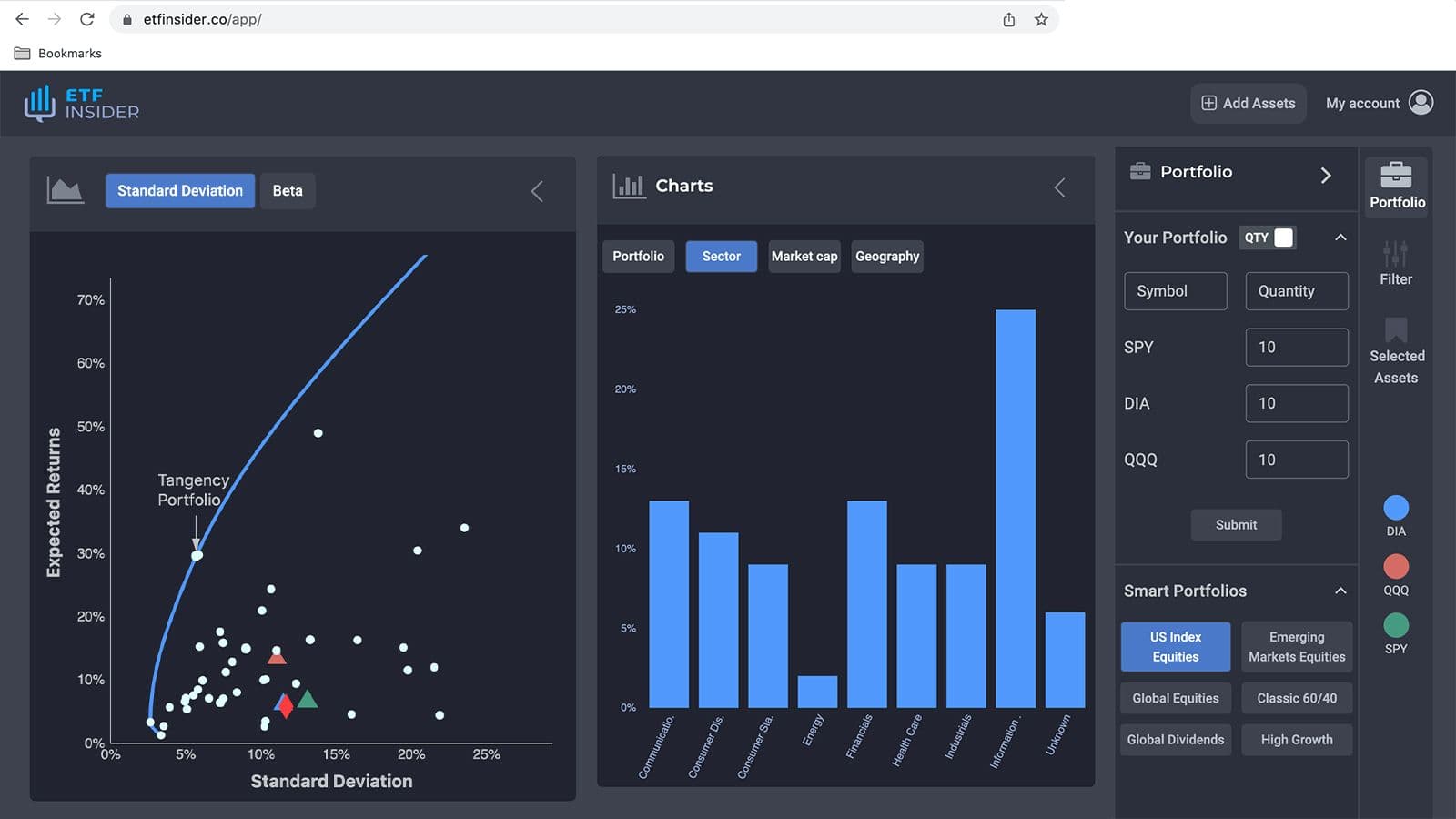

Now, let's compare these ETFs to other top holdings within the Nasdaq. It's essential to understand how these funds stack up against their competitors and what sets them apart. We will analyze factors such as expense ratios, historical performance, and sector exposure to help you make an informed decision about which ETF aligns best with your investment goals.

QQQ overlap ETF with Intuit Inc. and Incyte Corp. Exposure (Nasdaq)

QQQ overlap ETF with Intuit Inc. and Incyte Corp. Exposure (Nasdaq)

ETF with Intuit Inc. and Incyte Corp. Exposure (Nasdaq): Benefits to Invest In These ETFs

Investing in ETFs with exposure to Intuit Inc. and Incyte Corp. on the Nasdaq offers several advantages over individual stock picking. We'll explore these benefits, such as diversification, reduced risk, and ease of trading. Discover how these ETFs can provide a well-rounded portfolio, especially if you're interested in the technology and biotech sectors, where these companies operate.

ETF with Intuit Inc. and Incyte Corp. Exposure (Nasdaq): Considerations Before Investing

While ETFs can be an excellent investment choice, it's crucial to consider various factors before making your investment. We'll discuss considerations such as liquidity, tracking error, and tax efficiency, which can impact your overall returns. Additionally, understanding the specific strategies and objectives of these ETFs is vital to ensure they align with your financial goals. Conclusion: In conclusion, investing in ETFs with exposure to Intuit Inc. and Incyte Corp. on the Nasdaq can be a smart move for diversifying your portfolio and reducing individual stock risk. These funds offer a convenient way to access a broad range of Nasdaq-listed companies, including these two notable players. However, as with any investment, it's essential to conduct thorough research and consider your individual financial circumstances before making a decision. Disclaimer: This article is for informational purposes only and does not provide any investment advisory services. Make sure to consult with a qualified financial advisor before making any investment decisions.

Source 1: QQQ ETF issuer

Source 2: QQQ ETF official page

FAQ

What is the QQQ ETF?

The QQQ ETF is an exchange-traded fund that provides investors exposure to specific assets or companies.

What companies does the QQQ ETF have exposure to?

The QQQ ETF has exposure to companies like Intuit Inc. and Incyte Corp. Exposure.

How can I read more about the QQQ ETF?

You can read more about the QQQ ETF in various financial publications, websites, and the official ETF documentation.

Why should I consider investing in the QQQ ETF?

Investing in ETFs can provide diversification, flexibility, and cost-effectiveness. It's important to do your own research or consult with a financial advisor before making investment decisions.

What is the description for the QQQ ETF?

The ETF with Intuit Inc. and Incyte Corp. Exposure (Nasdaq) exposure provides investors with an opportunity to diversify their portfolio while gaining insight into the performance and potential of Intuit Inc. and Incyte Corp. Exposure (Nasdaq). This ETF offers a comprehensive view of the company's standing in the market, its historical performance, and future prospects.

How is the QQQ ETF different from other ETFs?

Each ETF has its own unique investment strategy, holdings, and exposure. It's crucial to understand the specifics of each ETF before investing.