ETF with Microsoft Corp. and Ross Stores Inc. Exposure (Nasdaq)

Navigating the financial world of Exchange-Traded Funds (ETFs) can be an intricate task, especially when delving into tech giants like Microsoft Corp. and retail phenomena like Ross Stores Inc. Both these companies, stellar in their respective industries, find notable placements in various ETFs traded in prominent indexes like the S&P 500 and the Nasdaq.

ETF with Microsoft Corp. and Ross Stores Inc. Exposure (Nasdaq): Exposure

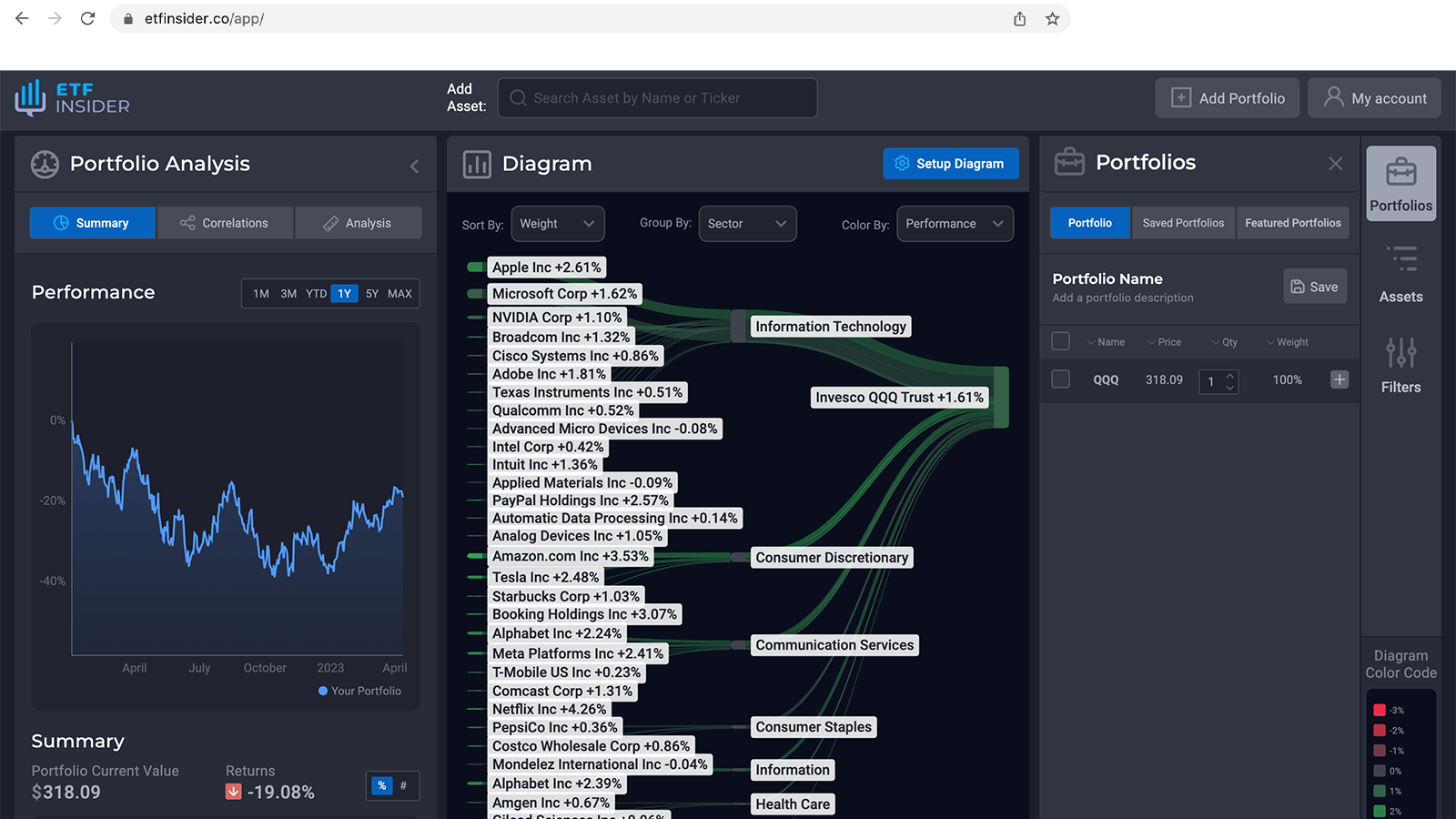

Considering an investment in the technology and retail sectors, ETFs with exposure to Microsoft Corp. and Ross Stores Inc. are worth exploring. Notably, the Invesco QQQ Trust (QQQ) is a fundamental ETF that tracks the NASDAQ-100 Index, giving investors a substantial exposure to Microsoft, due to its significant position in the tech industry. On the flip side, considering Ross Stores, a retail titan, offers a diversification into the consumer discretionary sector, balancing a technology-heavy portfolio with consumer-related stocks, and thus, providing a potential hedge against tech-specific market movements.

ETF with Microsoft Corp. and Ross Stores Inc. Exposure (Nasdaq): Comparisons of

When it comes to comparing ETFs that expose investors to Microsoft and Ross Stores Inc., we might inspect the asset allocation and overall sector diversification. QQQ, as previously noted, largely engages with the technology sector, significantly highlighting Microsoft as one of its predominant holdings. Comparatively, more generalized ETFs, such as the Invesco NASDAQ Composite ETF (QQQJ), may include a broader range of companies like Ross Stores Inc., facilitating an investment strategy that permeates various sectors and not just technology, allowing investors to potentially mitigate risks associated with market volatility in a specific sector.

QQQ overlap ETF with Microsoft Corp. and Ross Stores Inc. Exposure (Nasdaq)

QQQ overlap ETF with Microsoft Corp. and Ross Stores Inc. Exposure (Nasdaq)

ETF with Microsoft Corp. and Ross Stores Inc. Exposure (Nasdaq): Benefits to invest on those ETFs

Investing in ETFs like those holding Microsoft Corp. and Ross Stores Inc. offers a diversified strategy as compared to individual stock picking. An investment in such ETFs inherently provides a less volatile experience given the diversified nature of these financial instruments. While individual stock investment in entities like Microsoft may provide robust returns given the right market conditions, the balanced exposure to multiple sectors through ETFs may protect against sector-specific downturns and spread risk, making it a potentially prudent option for investors seeking both, growth and stability in their portfolio.

ETF with Microsoft Corp. and Ross Stores Inc. Exposure (Nasdaq): Consideration before investing

Investing in any financial instrument, including ETFs, demands thorough research and a deep understanding of your risk tolerance and investment goals. Specifically, for ETFs with holdings in Microsoft Corp. and Ross Stores Inc., consider factors such as the ETF’s expense ratio, historical performance, and its strategy toward managing market volatility. Additionally, investors should appraise their own investment thesis, ensuring alignment with their long-term objectives and risk appetite, given that the markets for technology and retail sectors can exhibit varying levels of volatility based on economic, geopolitical, and sector-specific events. Conclusion: A strategic allocation towards ETFs that expose investors to both, Microsoft Corp. and Ross Stores Inc., potentially offers a balanced blend of the technological and retail sectors. Remember, aligning your investment with your financial goals and risk tolerance remains paramount in navigating through the multifaceted world of investments. Disclaimer: This article does not provide investment advisory services, and is not intended to provide specific financial advice.

Source 1: QQQ ETF issuer

Source 2: QQQ ETF official page

FAQ

What is the QQQ ETF?

The QQQ ETF is an exchange-traded fund that provides investors exposure to specific assets or companies.

What companies does the QQQ ETF have exposure to?

The QQQ ETF has exposure to companies like Microsoft Corp. and Ross Stores Inc. Exposure.

How can I read more about the QQQ ETF?

You can read more about the QQQ ETF in various financial publications, websites, and the official ETF documentation.

Why should I consider investing in the QQQ ETF?

Investing in ETFs can provide diversification, flexibility, and cost-effectiveness. It's important to do your own research or consult with a financial advisor before making investment decisions.

What is the description for the QQQ ETF?

The ETF with Microsoft Corp. and Ross Stores Inc. Exposure (Nasdaq) exposure provides investors with an opportunity to diversify their portfolio while gaining insight into the performance and potential of Microsoft Corp. and Ross Stores Inc. Exposure (Nasdaq). This ETF offers a comprehensive view of the company's standing in the market, its historical performance, and future prospects.

How is the QQQ ETF different from other ETFs?

Each ETF has its own unique investment strategy, holdings, and exposure. It's crucial to understand the specifics of each ETF before investing.