ETF with QUALCOMM Inc. and Applied Materials Inc. Exposure (Nasdaq)

Investing in Exchange Traded Funds (ETFs) provides a robust and diversified vehicle to access specific market segments while mitigating risks. Particularly, ETFs that expose investors to potent tech stocks like QUALCOMM Inc. and Applied Materials Inc., which are traded on Nasdaq, become instrumental in crafting a growth-oriented investment portfolio.

ETF with QUALCOMM Inc. and Applied Materials Inc. Exposure (Nasdaq): Exposure

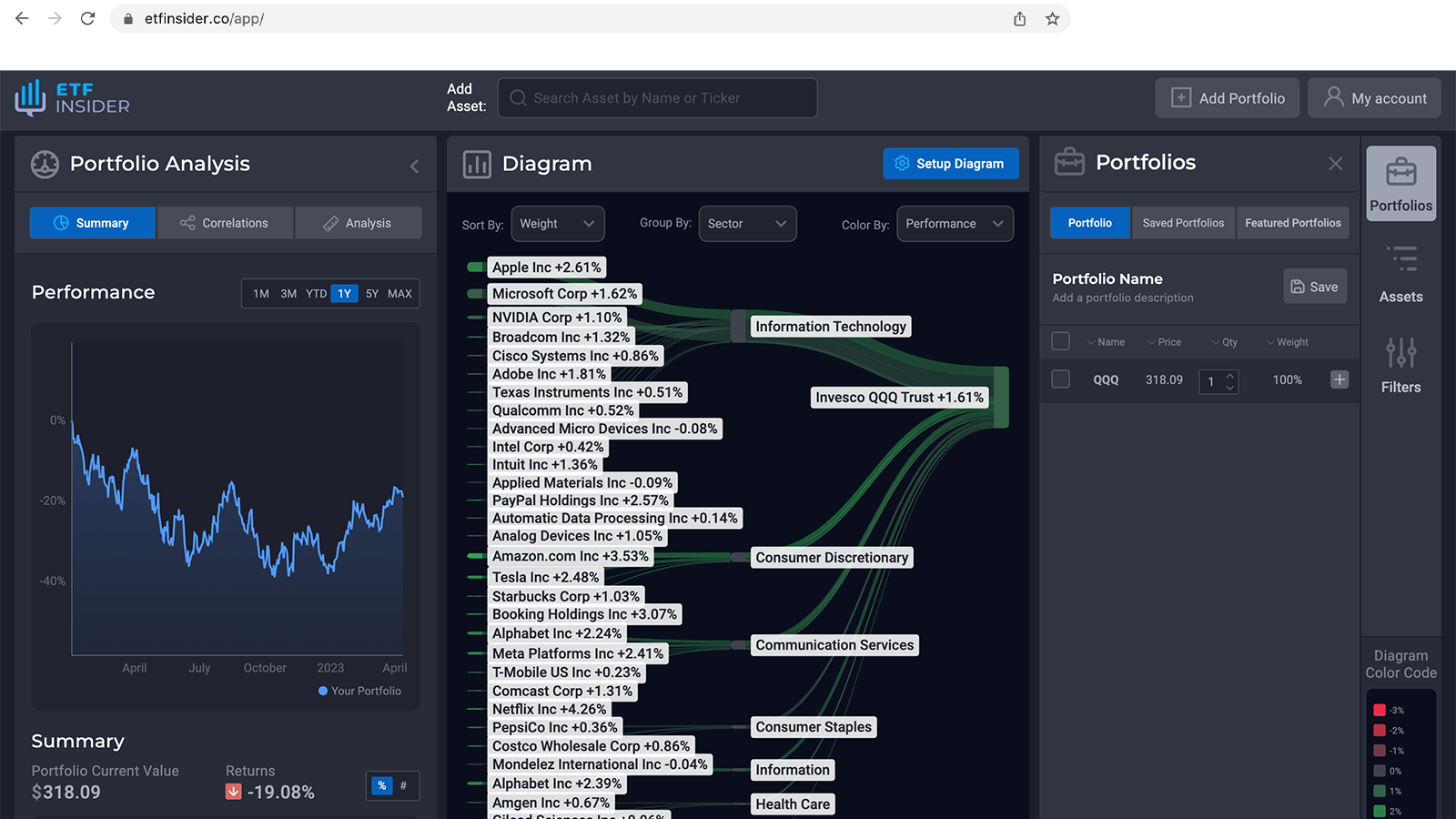

QUALCOMM Inc. and Applied Materials Inc. have etched their dominance in the technological industry, with the former being a leader in semiconductor, wireless technologies, and the latter standing out in materials engineering solutions used to produce new chip and advanced display. The Invesco QQQ Trust (QQQ) is notable for enabling investors to tap into the pulsating heart of tech companies like QUALCOMM and Applied Materials Inc. by tracking the NASDAQ-100 Index, which comprises non-financial entities. Conversely, the Invesco NASDAQ Composite ETF (QQQJ) offers a broader insight into the Nasdaq Composite Index, encapsulating a wider range of companies and, consequently, somewhat diversifying risk.

ETF with QUALCOMM Inc. and Applied Materials Inc. Exposure (Nasdaq): Comparisons

Comparatively, ETFs such as the iShares NASDAQ Biotechnology ETF (IBB), which leans heavily into the biotechnological sector, and the First Trust NASDAQ Cybersecurity ETF (CIBR), focusing on cybersecurity, represent distinct sector-specific investment pathways contrary to the more encompassing tech exposure provided by QQQ. Investing in ETFs like QQQ, which encase QUALCOMM Inc. and Applied Materials Inc., might offer a juxtaposed risk-reward metric as opposed to other more niche-oriented ETFs within the Nasdaq umbrella.

QQQ overlap ETF with QUALCOMM Inc. and Applied Materials Inc. Exposure (Nasdaq)

QQQ overlap ETF with QUALCOMM Inc. and Applied Materials Inc. Exposure (Nasdaq)

ETF with QUALCOMM Inc. and Applied Materials Inc. Exposure (Nasdaq): Benefits to invest on those ETFs

Opting for ETFs enveloping QUALCOMM Inc. and Applied Materials Inc. as opposed to individual stock picking steers investors towards a balanced and less tumultuous investment journey, especially considering the intrinsic volatility of tech stocks. The advantage spirals into aspects like minimized risk through diversification, as these ETFs provide exposure to a broader spectrum of companies within the Nasdaq, not just the focal two. Moreover, it offers ease of trading and potentially lower transaction costs as opposed to meticulously cherry-picking stocks, which often requires deeper analysis and may impose a heftier transactional cost.

ETF with QUALCOMM Inc. and Applied Materials Inc. Exposure (Nasdaq): Consideration before investing

While ETFs, like those encapsulating QUALCOMM Inc. and Applied Materials Inc., may present a seemingly glittering investment avenue, considerations concerning market volatility, especially in the tech industry, and the overarching economic climate cannot be overlooked. Furthermore, due diligence in scrutinizing the ETF’s expense ratio, historical performance, and its alignment with your investment goals and risk tolerance must be adeptly navigated to sculpt a prudent investment decision. Conclusion: Engaging with ETFs that offer exposure to dynamic tech entities like QUALCOMM Inc. and Applied Materials Inc. serves not only as a gateway to potentially lucrative returns but also as a mechanism to traverse through the tech investment landscape with a cushion of diversification. Such a journey, whilst promising, mandates a thorough understanding and assessment of the involved risks and contextual market variables. Disclaimer: This content does not provide any investment advisory services.

Source 1: QQQ ETF issuer

Source 2: QQQ ETF official page

FAQ

What is the QQQ ETF?

The QQQ ETF is an exchange-traded fund that provides investors exposure to specific assets or companies.

What companies does the QQQ ETF have exposure to?

The QQQ ETF has exposure to companies like QUALCOMM Inc. and Applied Materials Inc. Exposure.

How can I read more about the QQQ ETF?

You can read more about the QQQ ETF in various financial publications, websites, and the official ETF documentation.

Why should I consider investing in the QQQ ETF?

Investing in ETFs can provide diversification, flexibility, and cost-effectiveness. It's important to do your own research or consult with a financial advisor before making investment decisions.

What is the description for the QQQ ETF?

The ETF with QUALCOMM Inc. and Applied Materials Inc. Exposure (Nasdaq) exposure provides investors with an opportunity to diversify their portfolio while gaining insight into the performance and potential of QUALCOMM Inc. and Applied Materials Inc. Exposure (Nasdaq). This ETF offers a comprehensive view of the company's standing in the market, its historical performance, and future prospects.

How is the QQQ ETF different from other ETFs?

Each ETF has its own unique investment strategy, holdings, and exposure. It's crucial to understand the specifics of each ETF before investing.