ETF with QUALCOMM Inc. and Costco Wholesale Corp. Exposure (Nasdaq)

Navigating through the expansive terrain of ETF investing, especially within the Nasdaq, provides an array of opportunities, especially considering stalwarts like QUALCOMM Inc. and Costco Wholesale Corp. Let’s explore the depth, comparing, and considering ETFs housing these two giants.

ETF with QUALCOMM Inc. and Costco Wholesale Corp. Exposure (Nasdaq): Exposure

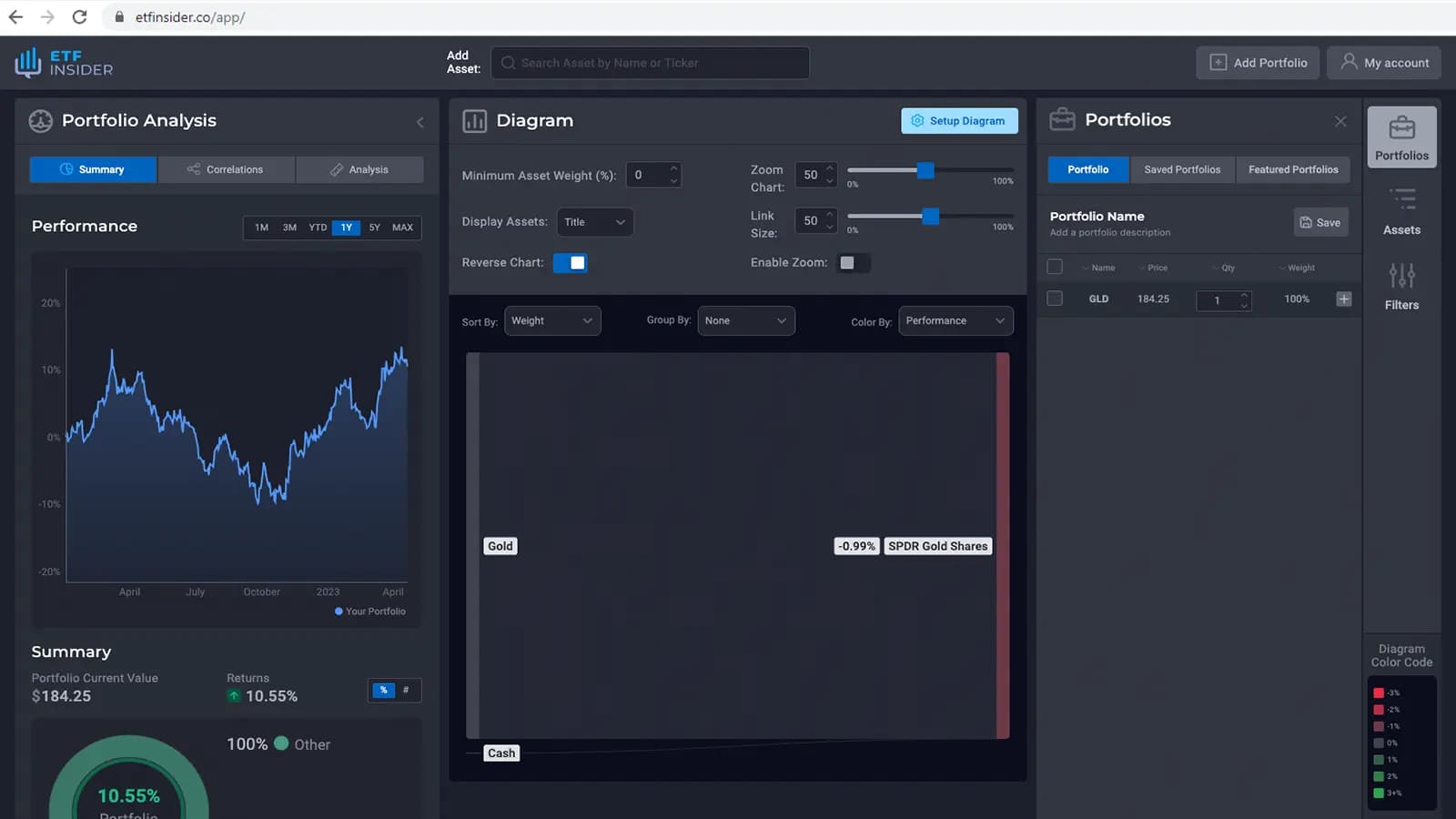

When talking about ETF exposure, it's imperative to discuss Invesco QQQ Trust (QQQ) and Invesco NASDAQ Composite ETF (QQQJ), as these offer broad exposure to the NASDAQ-100 Index and NASDAQ Composite Index respectively, which include giants like QUALCOMM Inc. and Costco Wholesale Corp. QUALCOMM, a leader in semiconductor, wireless technology, and services, alongside Costco, a multinational corporation operating membership-only big-box retail stores, both stand as substantial holdings within several ETFs due to their market cap, stability, and growth potential. The vast exposure to these companies via ETFs offers investors a pathway to participate in their growth and market movements indirectly, providing a buffer against individual stock volatility.

ETF with QUALCOMM Inc. and Costco Wholesale Corp. Exposure (Nasdaq): Comparisons of

Comparatively, ETFs like the Invesco QQQ Trust and Invesco NASDAQ Composite ETF (QQQJ) might have distinct strategic applications when juxtaposed with other top holdings. When investors are in pursuit of direct and broad technology exposure, particularly in giants like QUALCOMM, they might gravitate towards QQQ due to its considerable allocation towards the technology sector. Conversely, an ETF like the iShares NASDAQ Biotechnology ETF (IBB) might cater to investors seeking explicit exposure to the biotechnology sector. Thus, while both ETFs remain within the Nasdaq realm, their sector focus, risk levels, and potential returns can diverge substantially, requiring an astute investment decision based on individual financial goals and risk tolerance.

QQQJ overlap ETF with QUALCOMM Inc. and Costco Wholesale Corp. Exposure (Nasdaq)

QQQJ overlap ETF with QUALCOMM Inc. and Costco Wholesale Corp. Exposure (Nasdaq)

ETF with QUALCOMM Inc. and Costco Wholesale Corp. Exposure (Nasdaq): Benefits to invest on those ETFs

Investing in ETFs that hold QUALCOMM Inc. and Costco Wholesale Corp. present multiple benefits, especially when compared to individual stock picking. Firstly, ETFs inherently offer diversified exposure, mitigating the risks associated with single-stock investments. For instance, while investing directly in QUALCOMM might expose an investor to company-specific risks, having a stake in it through an ETF dilutes such risks, offering a safety net of sorts. Moreover, ETFs offer the added advantage of liquidity, being traded like stocks, and often carrying lower expense ratios than other investment avenues, thereby ensuring that a wider spectrum of investors can access and participate in the capital market dynamics encompassing high-performing companies like QUALCOMM and Costco.

ETF with QUALCOMM Inc. and Costco Wholesale Corp. Exposure (Nasdaq): Consideration before investing

Investors contemplating pouring capital into ETFs should earmark several considerations, especially those tracking robust entities like QUALCOMM and Costco on the Nasdaq. Notably, understanding the overall portfolio, investment strategy, and risk factors of the chosen ETF is paramount. ETFs, while providing a cushion against volatility, are not immune to market risks and their performance can oscillate due to various macroeconomic factors. Moreover, it’s crucial to scrutinize the expense ratio and any applicable fees to discern the cost-effectiveness of the investment. Lastly, alignment with personal investment goals, risk tolerance, and financial health cannot be overstated, ensuring that the selected ETF acts in tandem with the investor’s overarching financial blueprint. Conclusion: As ETFs continue to evolve as a fulcrum in investment strategies, understanding and navigating through the plethora of options, especially within vibrant markets like the Nasdaq, becomes pivotal. Ensuring investments are aligned, not just with market performances, but also personal financial trajectories, ensures a balanced, risk-mitigated, and rewarding investment journey. Disclaimer: This article does not provide any investment advisory services.

Source 1: QQQJ ETF issuer

Source 2: QQQJ ETF official page

FAQ

What is the QQQJ ETF?

The QQQJ ETF is an exchange-traded fund that provides investors exposure to specific assets or companies.

What companies does the QQQJ ETF have exposure to?

The QQQJ ETF has exposure to companies like QUALCOMM Inc. and Costco Wholesale Corp. Exposure.

How can I read more about the QQQJ ETF?

You can read more about the QQQJ ETF in various financial publications, websites, and the official ETF documentation.

Why should I consider investing in the QQQJ ETF?

Investing in ETFs can provide diversification, flexibility, and cost-effectiveness. It's important to do your own research or consult with a financial advisor before making investment decisions.

What is the description for the QQQJ ETF?

The ETF with QUALCOMM Inc. and Costco Wholesale Corp. Exposure (Nasdaq) exposure provides investors with an opportunity to diversify their portfolio while gaining insight into the performance and potential of QUALCOMM Inc. and Costco Wholesale Corp. Exposure (Nasdaq). This ETF offers a comprehensive view of the company's standing in the market, its historical performance, and future prospects.

How is the QQQJ ETF different from other ETFs?

Each ETF has its own unique investment strategy, holdings, and exposure. It's crucial to understand the specifics of each ETF before investing.