ETF with QUALCOMM Inc. and Incyte Corp. Exposure (Nasdaq)

Investing in the technology and biopharmaceutical sectors offers a slew of opportunities, particularly through entities like QUALCOMM Inc. and Incyte Corp., prominent players on the Nasdaq. Ensuring optimal exposure and diversification in these sectors can be achieved through thoughtfully selected ETFs.

ETF with QUALCOMM Inc. and Incyte Corp. Exposure (Nasdaq): Exposure

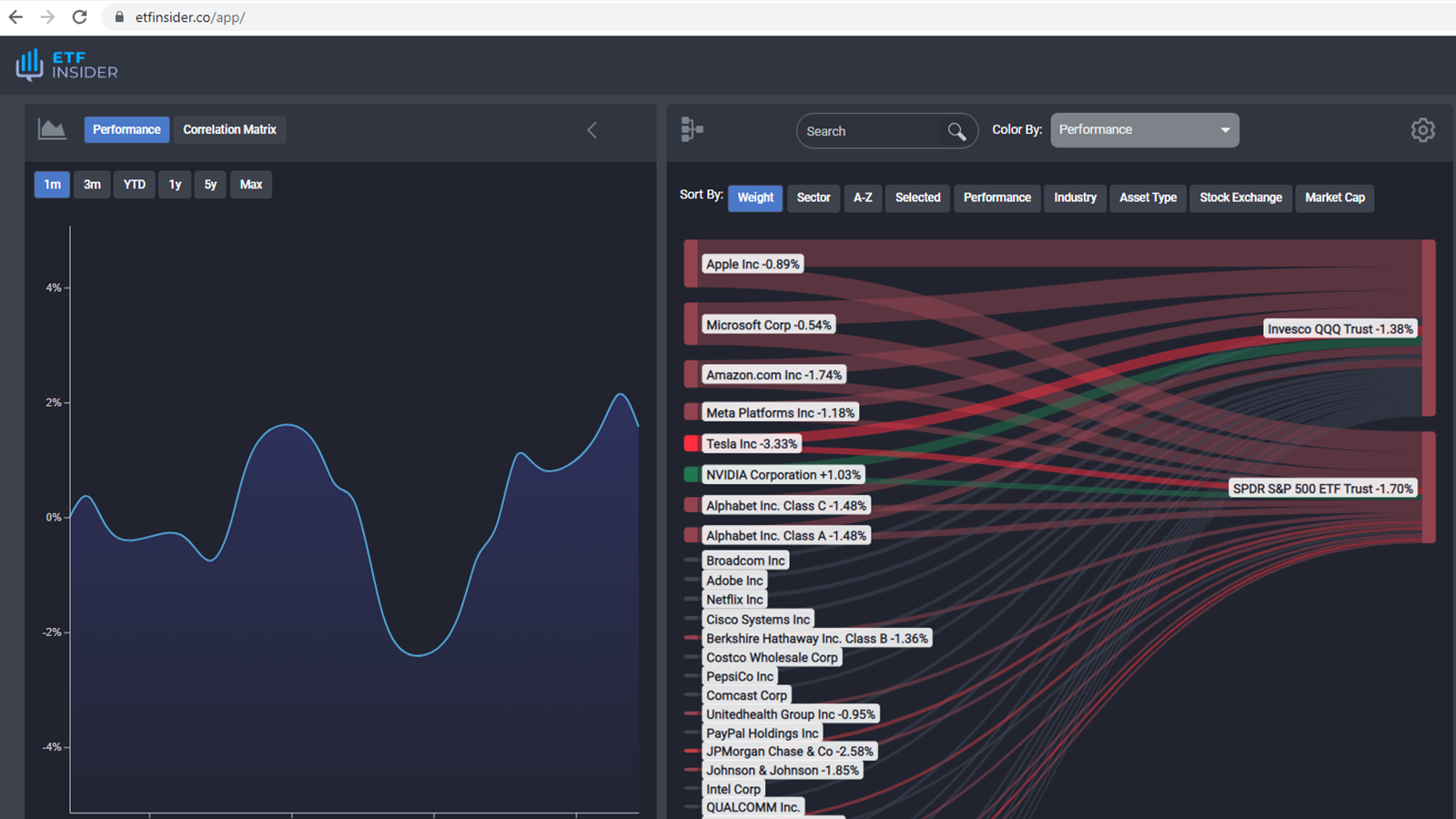

To amplify one's investment in the tech and biopharmaceutical sectors, particularly focusing on QUALCOMM and Incyte, Invesco QQQ Trust (QQQ) and iShares NASDAQ Biotechnology ETF (IBB) emerge as instrumental choices. The former, QQQ, encapsulates a broad spectrum of non-financial firms on the NASDAQ, ensuring a substantial exposure to the technology sector where QUALCOMM prominently thrives. On the other hand, IBB specifically channels investments into the biotechnology sector, where Incyte has established its prowess, offering investors a focused avenue to capitalize on advancements and growth in biopharma.

ETF with QUALCOMM Inc. and Incyte Corp. Exposure (Nasdaq): Comparisons

While QQQ and IBB offer substantial exposure to QUALCOMM and Incyte respectively, it's crucial to benchmark them against alternatives. When juxtaposing QQQ with Invesco NASDAQ Composite ETF (QQQJ), we observe a more generalized exposure in the latter, as it covers a broader range of companies across diverse sectors on the NASDAQ. Meanwhile, considering alternatives to IBB, the First Trust NASDAQ-100 Technology Sector Index Fund (QTEC) also surfaces as a noteworthy mention for those looking to delve deeper into tech-specific investments, though it may dilute the specific exposure to biopharmaceuticals and, consequently, to entities like Incyte.

QQQ overlap ETF with QUALCOMM Inc. and Incyte Corp. Exposure (Nasdaq)

QQQ overlap ETF with QUALCOMM Inc. and Incyte Corp. Exposure (Nasdaq)

ETF with QUALCOMM Inc. and Incyte Corp. Exposure (Nasdaq): Benefits to invest on those ETFs

Investing in ETFs, such as QQQ and IBB, which offer targeted exposure to QUALCOMM and Incyte, respectively, provides an array of benefits over individual stock picking. Firstly, ETFs furnish investors with immediate diversification, mitigating risks associated with single stock volatility. Secondly, they curtail the requisite for rigorous individual stock analysis and the ensuing management. Furthermore, given the robust trajectory and innovations in tech and biopharma domains, these ETFs serve as a conduit to partake in the overarching growth of these sectors, without being tethered to the fortunes of a singular entity.

ETF with QUALCOMM Inc. and Incyte Corp. Exposure (Nasdaq): Consideration before investing

While ETFs like QQQ and IBB offer a compelling narrative, especially for those eying the technology and biopharmaceutical sectors via stalwarts like QUALCOMM and Incyte, caution and diligence remain paramount. Prospective investors ought to consider aspects such as the ETF’s expense ratio, its tracking error, and liquidity. Moreover, it is pivotal to assess one’s risk tolerance and investment horizon and to be mindful of the macroeconomic and sector-specific nuances that could potentially derail short-term projections. Conclusion: Strategically opting for ETFs that accord substantial exposure to dynamic and progressive sectors, like technology and biopharmaceuticals, can be a prudent venture. Through QQQ and IBB, investors can adeptly navigate the realms where QUALCOMM and Incyte hold substantial sway, leveraging the growth while safeguarding against the perils of individual stock investments. Disclaimer: This article does not provide investment advisory services and is not intended to offer any specific advice.

Source 1: QQQ ETF issuer

Source 2: QQQ ETF official page

FAQ

What is the QQQ ETF?

The QQQ ETF is an exchange-traded fund that provides investors exposure to specific assets or companies.

What companies does the QQQ ETF have exposure to?

The QQQ ETF has exposure to companies like QUALCOMM Inc. and Incyte Corp. Exposure.

How can I read more about the QQQ ETF?

You can read more about the QQQ ETF in various financial publications, websites, and the official ETF documentation.

Why should I consider investing in the QQQ ETF?

Investing in ETFs can provide diversification, flexibility, and cost-effectiveness. It's important to do your own research or consult with a financial advisor before making investment decisions.

What is the description for the QQQ ETF?

The ETF with QUALCOMM Inc. and Incyte Corp. Exposure (Nasdaq) exposure provides investors with an opportunity to diversify their portfolio while gaining insight into the performance and potential of QUALCOMM Inc. and Incyte Corp. Exposure (Nasdaq). This ETF offers a comprehensive view of the company's standing in the market, its historical performance, and future prospects.

How is the QQQ ETF different from other ETFs?

Each ETF has its own unique investment strategy, holdings, and exposure. It's crucial to understand the specifics of each ETF before investing.