ETF with QUALCOMM Inc. and O'Reilly Automotive Inc. Exposure (Nasdaq)

Exploring the intricate world of Exchange Traded Funds (ETFs), particularly those with exposure to renowned companies like QUALCOMM Inc. and O'Reilly Automotive Inc., unravels a myriad of investment opportunities and considerations. Here, we delve into the specifics, comparing, and contrasting different ETFs which encompass these corporations, listed on the Nasdaq, and explore the unique advantages and potential considerations before funneling capital into them.

ETF with QUALCOMM Inc. and O'Reilly Automotive Inc. Exposure (Nasdaq): Exposure

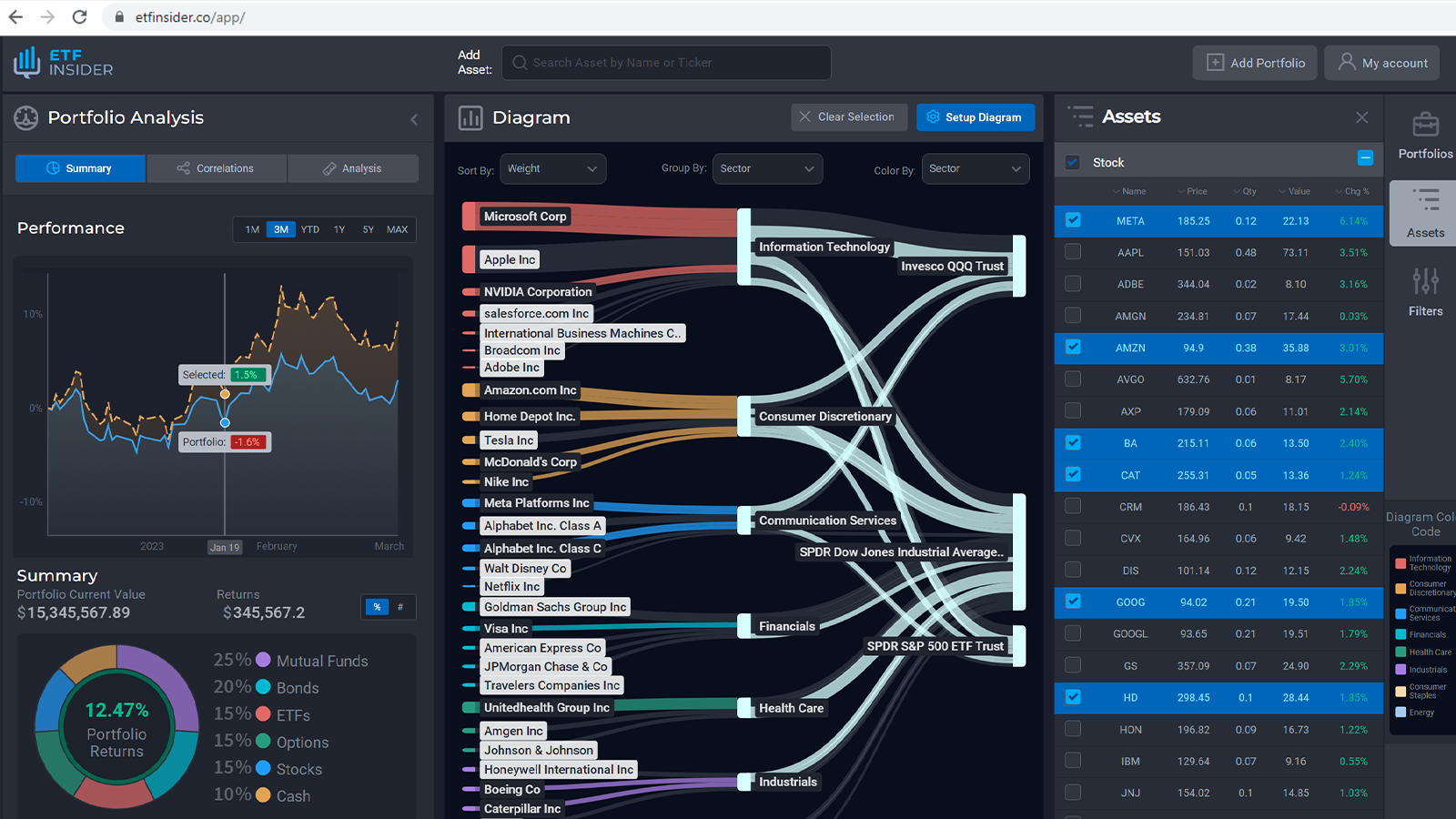

When it comes to ETFs with exposure to QUALCOMM Inc. and O'Reilly Automotive Inc., investors are primarily tapping into the technology and consumer services sectors, respectively. QUALCOMM, a leader in the semiconductor and telecommunications equipment industry, and O'Reilly Automotive, a titan in the automotive aftermarket parts industry, both play pivotal roles within their sectors on the Nasdaq. The Invesco QQQ Trust (QQQ) is notably attractive for investors seeking exposure to QUALCOMM, given its focus on the largest non-financial companies listed on the Nasdaq. On the other hand, distinct ETFs like the First Trust NASDAQ-100 Technology Sector Index Fund (QTEC) and iShares NASDAQ Biotechnology ETF (IBB) also provide varying degrees of exposure to these corporations and their respective sectors, thus facilitating a diversified investment landscape.

ETF with QUALCOMM Inc. and O'Reilly Automotive Inc. Exposure (Nasdaq): Comparisons of

Comparing ETFs that incorporate QUALCOMM Inc. and O'Reilly Automotive Inc. to those with other top holdings like Apple or Microsoft, it's paramount to recognize different sector exposures and risk profiles. While QQQ presents a broader technology and growth-company exposure, including QUALCOMM, QTEC specifically hones in on the technology sector, potentially offering a more concentrated technology investment. Simultaneously, ETFs focusing on specific sectors or industries where O'Reilly Automotive might be a top holding could offer targeted exposure to the retail and consumer services sector, contrasting with broader market ETFs. The key is to juxtapose not just the holdings but also the sectors, strategies, and risk levels each ETF presents.

QQQ overlap ETF with QUALCOMM Inc. and O'Reilly Automotive Inc. Exposure (Nasdaq)

QQQ overlap ETF with QUALCOMM Inc. and O'Reilly Automotive Inc. Exposure (Nasdaq)

ETF with QUALCOMM Inc. and O'Reilly Automotive Inc. Exposure (Nasdaq): Benefits to invest on those ETFs

Investing in ETFs that hold QUALCOMM Inc. and O'Reilly Automotive Inc., compared to direct stock picking, confers the advantage of diversification, potentially mitigating risks associated with the volatilities of individual stocks. The ETFs not only amalgamate various stocks within a sector but also, depending on the ETF, might provide exposure to different sectors simultaneously. This structured exposure helps to potentially balance the portfolio, as underperformance in one sector might be offset by positive returns in another, thereby possibly ensuring a steadier investment trajectory and lowering the investment risk when juxtaposed with individual stock picking.

ETF with QUALCOMM Inc. and O'Reilly Automotive Inc. Exposure (Nasdaq): Consideration before investing

Investing in ETFs, including those with exposure to QUALCOMM Inc. and O'Reilly Automotive Inc., requires a thorough understanding of the underlying strategies and risk factors of each fund. Consideration should be given to the expense ratio, tracking error, and the overall strategy of the ETF (e.g., sector-specific, growth-oriented, or value-driven). Additionally, understanding the weightage of these companies within the ETF, the sector dynamics, and how they align with one’s investment objectives and risk tolerance is crucial before investment decisions are made. Conclusion: Navigating through the labyrinth of ETFs, especially those enveloping giants like QUALCOMM Inc. and O'Reilly Automotive Inc., warrants a meticulous approach, weighing exposures against risk and aligning them with individual investment goals. Therefore, a well-informed decision, factoring in the varied facets expounded upon here, serves as the keystone in underpinning a resilient and fruitful investment journey. Disclaimer: This article does not provide investment advisory services and should not be construed as an offer, solicitation, or recommendation to engage in any particular investment strategy.

Source 1: QQQ ETF issuer

Source 2: QQQ ETF official page

FAQ

What is the QQQ ETF?

The QQQ ETF is an exchange-traded fund that provides investors exposure to specific assets or companies.

What companies does the QQQ ETF have exposure to?

The QQQ ETF has exposure to companies like QUALCOMM Inc. and O'Reilly Automotive Inc. Exposure.

How can I read more about the QQQ ETF?

You can read more about the QQQ ETF in various financial publications, websites, and the official ETF documentation.

Why should I consider investing in the QQQ ETF?

Investing in ETFs can provide diversification, flexibility, and cost-effectiveness. It's important to do your own research or consult with a financial advisor before making investment decisions.

What is the description for the QQQ ETF?

The ETF with QUALCOMM Inc. and O'Reilly Automotive Inc. Exposure (Nasdaq) exposure provides investors with an opportunity to diversify their portfolio while gaining insight into the performance and potential of QUALCOMM Inc. and O'Reilly Automotive Inc. Exposure (Nasdaq). This ETF offers a comprehensive view of the company's standing in the market, its historical performance, and future prospects.

How is the QQQ ETF different from other ETFs?

Each ETF has its own unique investment strategy, holdings, and exposure. It's crucial to understand the specifics of each ETF before investing.