ETF with QUALCOMM Inc. and Ross Stores Inc. Exposure (Nasdaq)

The advent of Exchange-Traded Funds (ETFs) has brought about a unique means for investors to gain exposure to various segments of the market, including specific companies like QUALCOMM Inc. and Ross Stores Inc., which are listed on the Nasdaq and are part of different ETFs.

ETF with QUALCOMM Inc. and Ross Stores Inc. Exposure (Nasdaq): Exposure

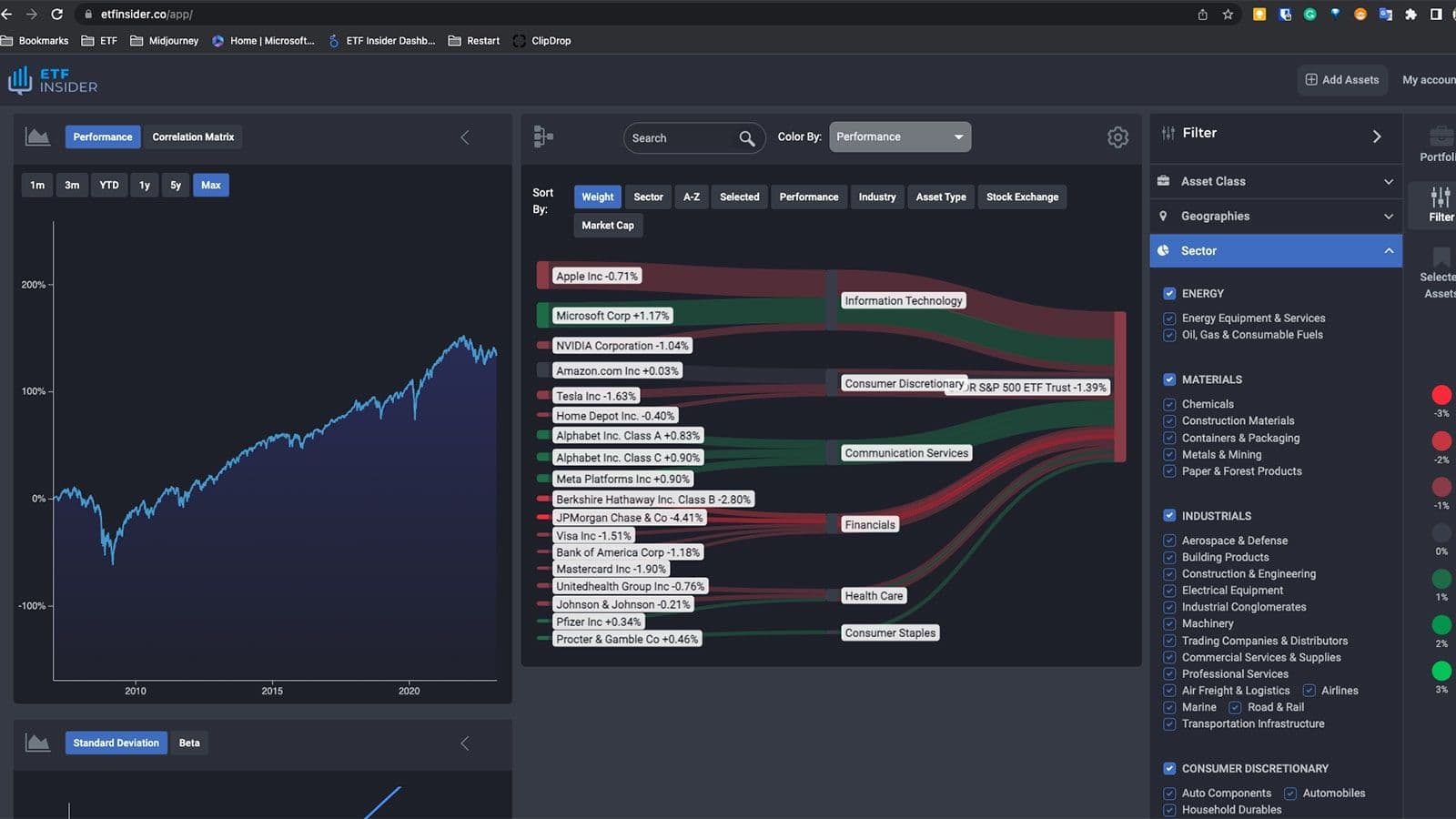

Investing in ETFs like the Invesco QQQ Trust (QQQ) or the Invesco NASDAQ Composite ETF (QQQJ) can provide investors with exposure to QUALCOMM Inc., a leader in the technology sector, and Ross Stores Inc., a giant in the retail arena. QUALCOMM's performance often correlates with the technology-driven Nasdaq, benefiting from trends and shifts in the tech industry. On the other hand, Ross Stores Inc., renowned for its off-price retail model, provides a robust and resilient investment avenue, even during economic downturns, by offering discounted quality products that continue to attract consumers. Together, these companies offer a blend of growth and stability within the ETF structures that house them.

ETF with QUALCOMM Inc. and Ross Stores Inc. Exposure (Nasdaq): Comparisons

Comparing ETFs that hold positions in QUALCOMM and Ross Stores Inc., such as the Invesco QQQ Trust (QQQ), to other ETFs with major holdings in different sectors, it is discernible that the inclusion of tech and retail segments can provide a balanced investment approach. While the QQQ is heavy on technology and includes QUALCOMM, it may exhibit more volatility than, for instance, the iShares S&P 500 Value ETF (IVE) which may potentially offer a broader diversification across various sectors and companies, therefore possibly providing a different risk-reward profile. Likewise, diversification within one ETF allows for mitigated risk, providing a cushion against sector-specific downturns and ensuring that the investor has a hand in various market pies.

IVE overlap ETF with QUALCOMM Inc. and Ross Stores Inc. Exposure (Nasdaq)

IVE overlap ETF with QUALCOMM Inc. and Ross Stores Inc. Exposure (Nasdaq)

ETF with QUALCOMM Inc. and Ross Stores Inc. Exposure (Nasdaq): Benefits to invest in those ETFs

Investing in ETFs containing QUALCOMM and Ross Stores provides investors with the benefits of diversification and reduced risk compared to individual stock picking. With a single investment, they gain access to the performance of these notable companies along with other industry leaders, which can be particularly advantageous for those who seek exposure to these sectors without the need to heavily research and invest in individual stocks. Furthermore, the ETF structure allows for easy trading, similar to stocks, providing liquidity and flexibility in managing investment portfolios, while also usually incurring lower expense ratios than other investment vehicles such as mutual funds.

ETF with QUALCOMM Inc. and Ross Stores Inc. Exposure (Nasdaq): Consideration before investing

It’s crucial for investors to consider several factors before investing in ETFs that include QUALCOMM Inc. and Ross Stores Inc. among their holdings. Understanding the weighted allocation of these companies within the ETF, the expense ratio, and the overall investment strategy of the ETF is imperative. Additionally, considering one’s own investment goals, risk tolerance, and investment horizon is paramount. Aligning these with the ETF’s objectives, while also keeping an eye on the economic factors that may affect the tech and retail sectors, ensures a more informed and strategic investment decision.

Conclusion

The strategic incorporation of ETFs that provide exposure to influential companies like QUALCOMM Inc. and Ross Stores Inc. in an investment portfolio affords both diversification and a measured exposure to the tech and retail sectors respectively. Astute considerations regarding investment strategies and a thorough understanding of the involved variables are indispensable in optimizing the benefits drawn from such investments. Disclaimer: This article does not provide investment advisory services.

Source 1: IVE ETF issuer

Source 2: IVE ETF official page

FAQ

What is the IVE ETF?

The IVE ETF is an exchange-traded fund that provides investors exposure to specific assets or companies.

What companies does the IVE ETF have exposure to?

The IVE ETF has exposure to companies like QUALCOMM Inc. and Ross Stores Inc. Exposure.

How can I read more about the IVE ETF?

You can read more about the IVE ETF in various financial publications, websites, and the official ETF documentation.

Why should I consider investing in the IVE ETF?

Investing in ETFs can provide diversification, flexibility, and cost-effectiveness. It's important to do your own research or consult with a financial advisor before making investment decisions.

What is the description for the IVE ETF?

The ETF with QUALCOMM Inc. and Ross Stores Inc. Exposure (Nasdaq) exposure provides investors with an opportunity to diversify their portfolio while gaining insight into the performance and potential of QUALCOMM Inc. and Ross Stores Inc. Exposure (Nasdaq). This ETF offers a comprehensive view of the company's standing in the market, its historical performance, and future prospects.

How is the IVE ETF different from other ETFs?

Each ETF has its own unique investment strategy, holdings, and exposure. It's crucial to understand the specifics of each ETF before investing.