ETF with T-Mobile US Inc. and Check Point Software Technologies Ltd. Exposure (Nasdaq)

Welcome to our comprehensive guide on ETFs with exposure to T-Mobile US Inc. and Check Point Software Technologies Ltd. on the Nasdaq Stock Market. In this article, we will explore the various Exchange-Traded Funds (ETFs) that include these two prominent companies in their portfolios. We'll delve into their exposure, make comparisons to other top holdings, highlight the benefits of investing in these ETFs over individual stock picking, and discuss essential considerations before making an investment. Whether you're a seasoned investor or just starting, this article will provide valuable insights into these ETFs and help you make informed financial decisions.

ETF with T-Mobile US Inc. and Check Point Software Technologies Ltd. Exposure (Nasdaq): Exposure

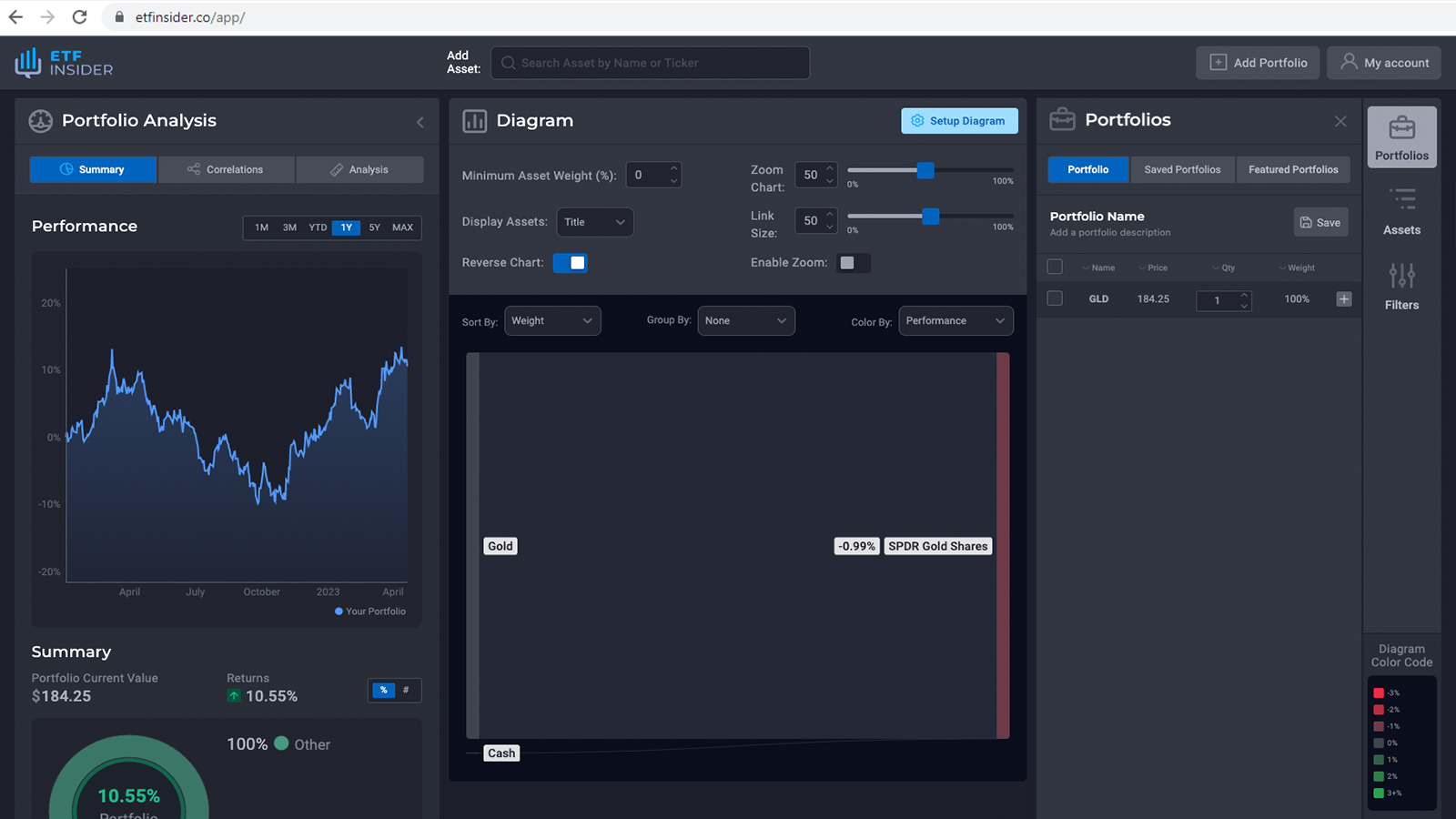

Before diving into the details of specific ETFs, let's first understand the exposure they provide to T-Mobile US Inc. and Check Point Software Technologies Ltd. Both of these companies are listed on the Nasdaq Stock Market, which is known for its focus on technology and innovation. The ETFs we will discuss in this article hold positions in these companies as part of their portfolios. We will explore the extent of exposure, the weight of these stocks within the ETFs, and how they contribute to the overall performance of the funds. Understanding this exposure is crucial for investors looking to align their investments with these specific companies.

ETF with T-Mobile US Inc. and Check Point Software Technologies Ltd. Exposure (Nasdaq): Comparisons of

In this section, we will conduct a brief comparison between the ETFs that include T-Mobile US Inc. and Check Point Software Technologies Ltd. exposure and other top holdings within these funds. It's essential to assess how these ETFs stack up against each other and how their performance may vary based on their diverse portfolios. We will look at factors such as expense ratios, historical performance, dividend yields, and volatility to give you a clear picture of what each ETF offers in terms of risk and return. This information will help you make an informed decision when choosing the right ETF for your investment goals.

QQQ overlap ETF with T-Mobile US Inc. and Check Point Software Technologies Ltd. Exposure (Nasdaq)

QQQ overlap ETF with T-Mobile US Inc. and Check Point Software Technologies Ltd. Exposure (Nasdaq)

ETF with T-Mobile US Inc. and Check Point Software Technologies Ltd. Exposure (Nasdaq): Benefits to Invest in Those ETFs

Investing in ETFs that hold T-Mobile US Inc. and Check Point Software Technologies Ltd. has several advantages, particularly when compared to individual stock picking. In this section, we will highlight the benefits of choosing these ETFs as part of your investment strategy. We will discuss diversification, liquidity, ease of trading, and the potential for reduced risk when investing in ETFs that provide exposure to these tech giants. Understanding these benefits will empower you to make a well-informed decision about incorporating these ETFs into your investment portfolio.

ETF with T-Mobile US Inc. and Check Point Software Technologies Ltd. Exposure (Nasdaq): Considerations Before Investing

Before you invest in any financial instrument, it's essential to consider certain factors that can impact your investment journey. In this section, we will discuss crucial considerations to keep in mind when contemplating investments in ETFs with T-Mobile US Inc. and Check Point Software Technologies Ltd. exposure. We'll cover topics such as your risk tolerance, investment horizon, and overall financial goals. Additionally, we will address tax implications, management fees, and the importance of staying informed about changes in the market and the specific industries these companies operate in. Conclusion: In conclusion, investing in ETFs with exposure to T-Mobile US Inc. and Check Point Software Technologies Ltd. on the Nasdaq Stock Market can be a strategic move for investors seeking diversified exposure to these companies and the broader technology sector. These ETFs offer benefits such as diversification, liquidity, and reduced risk compared to individual stock picking. However, it's crucial to consider your personal financial goals, risk tolerance, and investment horizon before making any investment decisions. Always conduct thorough research and consult with a financial advisor if needed. Remember that this article is for informational purposes only and does not provide investment advisory services. Disclaimer: Please note that this article is for informational purposes only and does not provide investment advisory services. It is essential to conduct thorough research and seek professional financial advice before making any investment decisions.

Source 1: QQQ ETF issuer

Source 2: QQQ ETF official page

FAQ

What is the QQQ ETF?

The QQQ ETF is an exchange-traded fund that provides investors exposure to specific assets or companies.

What companies does the QQQ ETF have exposure to?

The QQQ ETF has exposure to companies like T-Mobile US Inc. and Check Point Software Technologies Ltd. Exposure.

How can I read more about the QQQ ETF?

You can read more about the QQQ ETF in various financial publications, websites, and the official ETF documentation.

Why should I consider investing in the QQQ ETF?

Investing in ETFs can provide diversification, flexibility, and cost-effectiveness. It's important to do your own research or consult with a financial advisor before making investment decisions.

What is the description for the QQQ ETF?

The ETF with T-Mobile US Inc. and Check Point Software Technologies Ltd. Exposure (Nasdaq) exposure provides investors with an opportunity to diversify their portfolio while gaining insight into the performance and potential of T-Mobile US Inc. and Check Point Software Technologies Ltd. Exposure (Nasdaq). This ETF offers a comprehensive view of the company's standing in the market, its historical performance, and future prospects.

How is the QQQ ETF different from other ETFs?

Each ETF has its own unique investment strategy, holdings, and exposure. It's crucial to understand the specifics of each ETF before investing.