ETF with Texas Instruments Inc. and Applied Materials Inc. Exposure (Nasdaq)

Engaging with financial markets necessitates a well-considered strategy, especially when contemplating investing in companies like Texas Instruments Inc. and Applied Materials Inc., which hold significant positions in the tech industry and are listed on Nasdaq. ETFs offer an alternative route for investors to gain exposure to such companies, furnishing an opportunity to diversify and potentially mitigate risks.

ETF with Texas Instruments Inc. and Applied Materials Inc. Exposure (Nasdaq): Exposure

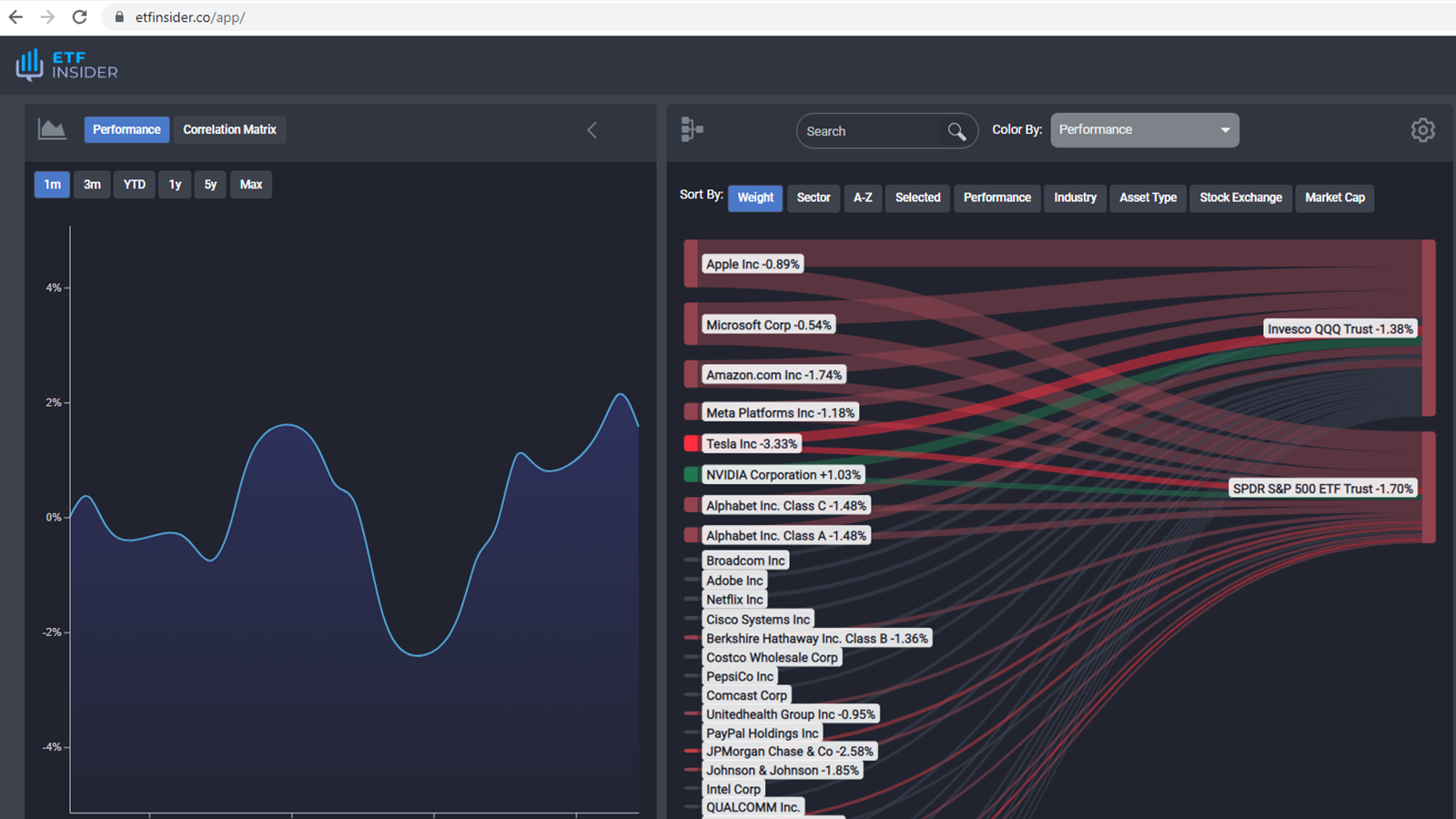

Investing in ETFs that have exposure to high-performing companies like Texas Instruments Inc. and Applied Materials Inc. enables investors to harness the growth potential of these tech giants without directly purchasing their stocks. Notably, these companies are not only traded on Nasdaq but also find their presence in several ETFs. For instance, the Invesco QQQ Trust (QQQ) and Invesco NASDAQ Composite ETF (QQQJ) track the NASDAQ-100 and NASDAQ Composite Index, respectively, providing broad exposure to technology and growth companies, which includes the aforementioned entities.

ETF with Texas Instruments Inc. and Applied Materials Inc. Exposure (Nasdaq): Comparisons of

Comparing ETFs like Invesco QQQ Trust (QQQ) and Invesco NASDAQ Composite ETF (QQQJ), we see varied exposure to technology and growth sectors. Whereas QQQ emphasizes the largest non-financial companies on Nasdaq, including Texas Instruments and Applied Materials, QQQJ provides a broader representation of the NASDAQ Composite Index. In relation to other popular ETFs on Nasdaq such as First Trust NASDAQ-100 Technology Sector Index Fund (QTEC) and iShares NASDAQ Biotechnology ETF (IBB), the former concentrates on the tech sector and the latter on biotechnology within the Nasdaq, offering different sectoral exposures and risk-return profiles to investors.

QQQ overlap ETF with Texas Instruments Inc. and Applied Materials Inc. Exposure (Nasdaq)

QQQ overlap ETF with Texas Instruments Inc. and Applied Materials Inc. Exposure (Nasdaq)

ETF with Texas Instruments Inc. and Applied Materials Inc. Exposure (Nasdaq): Benefits to Invest in Those ETFs

Opting to invest in ETFs with exposure to Texas Instruments Inc. and Applied Materials Inc. as opposed to direct stock picking bears a multitude of benefits, including diversification, risk mitigation, and potentially steadier returns. Given their reputable standing and influential weight on the Nasdaq, incorporating such assets into one’s portfolio via ETFs like Invesco QQQ or QQQJ can harness the growth of these tech stalwarts while concurrently affording exposure to other potent entities in the index, thus spreading risk and potential reward.

ETF with Texas Instruments Inc. and Applied Materials Inc. Exposure (Nasdaq): Consideration Before Investing

Prior to diving into investment, certain considerations must be evaluated, particularly regarding the ETFs offering exposure to Texas Instruments Inc. and Applied Materials Inc. An investor must appraise factors such as the ETF’s expense ratio, historical performance, dividend yield, and sectoral exposure. Additionally, comprehending the inherent risks of investing in the tech sector, such as market volatility and regulatory shifts, is pivotal. Understanding one’s own risk tolerance, investment goals, and ensuring alignment with the chosen ETF’s strategy is imperative to navigate through the complex financial waters. In conclusion, while ETFs such as those tracking companies like Texas Instruments Inc. and Applied Materials Inc. on Nasdaq provide a compelling investment avenue, the endeavor necessitates an intricate understanding and meticulous assessment of various elements involved in ETF investing. It is not merely about exposure, but judiciously choosing a financial instrument that resonates with one’s investment ethos and risk appetite. Disclaimer: This article is for informational purposes only and does not provide any investment advisory services.

Source 1: QQQ ETF issuer

Source 2: QQQ ETF official page

FAQ

What is the QQQ ETF?

The QQQ ETF is an exchange-traded fund that provides investors exposure to specific assets or companies.

What companies does the QQQ ETF have exposure to?

The QQQ ETF has exposure to companies like Texas Instruments Inc. and Applied Materials Inc. Exposure.

How can I read more about the QQQ ETF?

You can read more about the QQQ ETF in various financial publications, websites, and the official ETF documentation.

Why should I consider investing in the QQQ ETF?

Investing in ETFs can provide diversification, flexibility, and cost-effectiveness. It's important to do your own research or consult with a financial advisor before making investment decisions.

What is the description for the QQQ ETF?

The ETF with Texas Instruments Inc. and Applied Materials Inc. Exposure (Nasdaq) exposure provides investors with an opportunity to diversify their portfolio while gaining insight into the performance and potential of Texas Instruments Inc. and Applied Materials Inc. Exposure (Nasdaq). This ETF offers a comprehensive view of the company's standing in the market, its historical performance, and future prospects.

How is the QQQ ETF different from other ETFs?

Each ETF has its own unique investment strategy, holdings, and exposure. It's crucial to understand the specifics of each ETF before investing.