ETF with Texas Instruments Inc. and Intuitive Surgical Inc. Exposure (Nasdaq)

Navigating the world of ETFs, particularly those that harbor shares of companies like Texas Instruments Inc. and Intuitive Surgical Inc., can be a crucial step in a robust investment strategy. Engaging with such companies via ETFs offers a window into the often volatile world of the Nasdaq, while potentially mitigating certain risks.

ETF with Texas Instruments Inc. and Intuitive Surgical Inc. Exposure (Nasdaq): Exposure

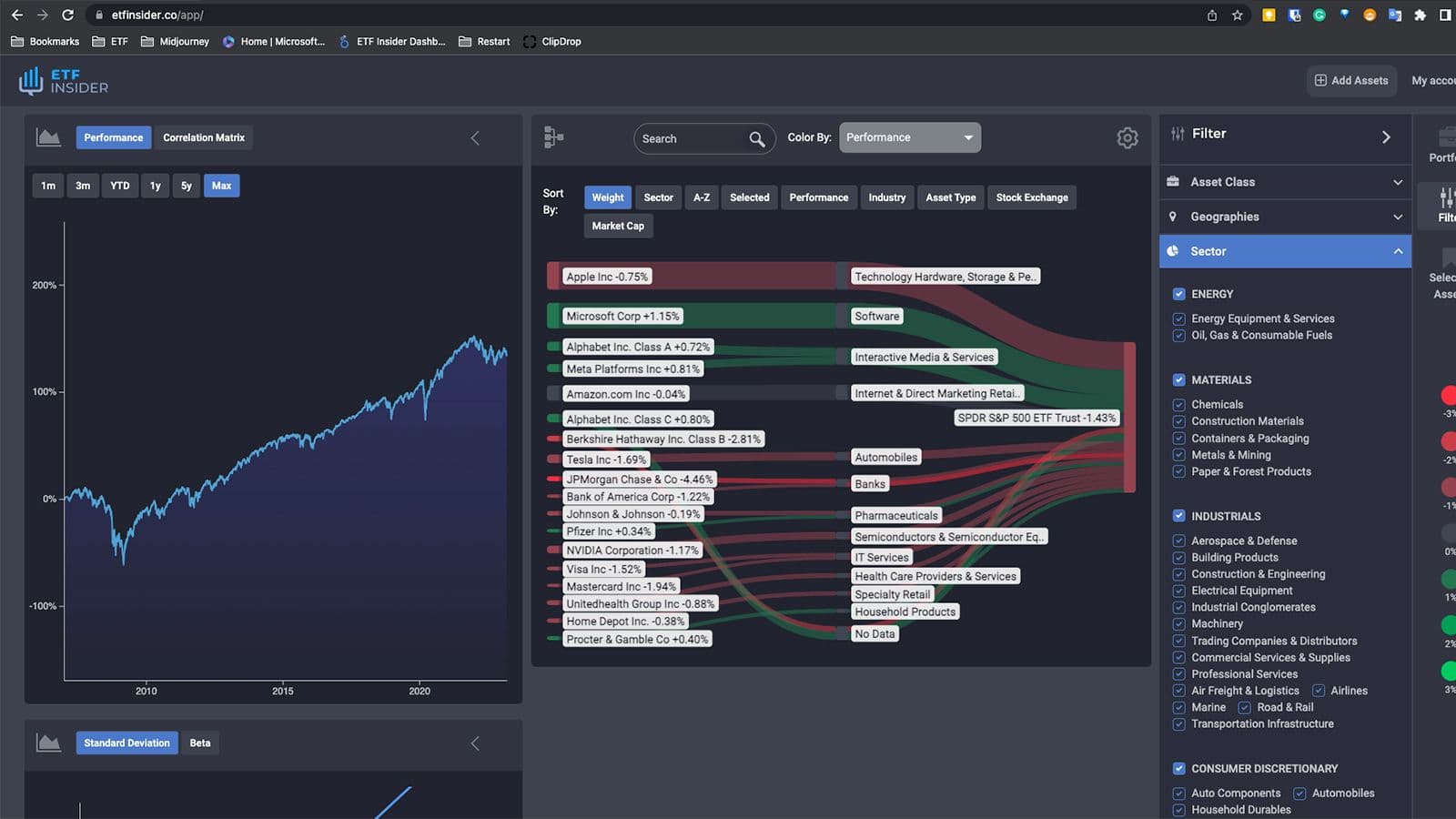

Examining ETFs that encompass companies like Texas Instruments and Intuitive Surgical provides insight into their intrinsic and extrinsic value within the broader financial markets. Texas Instruments Inc., a major player in the semiconductor industry, and Intuitive Surgical Inc., a leader in robotic-assisted, minimally invasive surgery, are prominent entities traded on the Nasdaq. ETFs encapsulating these companies often deliver a bifocal view into the tech and healthcare sectors. Instruments such as Invesco QQQ Trust (QQQ) and Invesco NASDAQ Composite ETF (QQQJ) offer exposure to these industries by reflecting the performance of the NASDAQ-100 and NASDAQ Composite Index respectively, thereby enabling investors to indirectly engage with these sectors.

ETF with Texas Instruments Inc. and Intuitive Surgical Inc. Exposure (Nasdaq): Comparisons

When sifting through ETFs, the comparisons of funds that hold Texas Instruments and Intuitive Surgical with others that have divergent top holdings are imperative. ETFs like the Invesco QQQ Trust (QQQ) emphasize non-financial companies on the Nasdaq, hence being tech-dominant, while First Trust NASDAQ-100 Technology Sector Index Fund (QTEC) specifically targets the technological arena. Comparatively, if an investor desires a broader, comprehensive exposure to various sectors, alternatives like the Invesco NASDAQ Composite ETF (QQQJ) might be more apt, as it covers a wider array of companies listed on the Nasdaq, potentially offering a more diversified investment.

QQQ overlap ETF with Texas Instruments Inc. and Intuitive Surgical Inc. Exposure (Nasdaq)

QQQ overlap ETF with Texas Instruments Inc. and Intuitive Surgical Inc. Exposure (Nasdaq)

ETF with Texas Instruments Inc. and Intuitive Surgical Inc. Exposure (Nasdaq): Benefits to Invest

Investing in ETFs, especially those involving companies like Texas Instruments and Intuitive Surgical, harbors an array of advantages over individual stock picking. First, it offers a level of diversification, as the performance is tied to a basket of companies, mitigating the risks associated with individual stock fluctuations. Secondly, the intricacies of these specific businesses and their respective industries may require a nuanced understanding that ETFs, managed by professional financial analysts, can offer. Hence, it inherently provides a lower-cost, simpler, and generally safer vehicle, especially for retail investors who might not have the same level of expertise or information access as financial professionals.

ETF with Texas Instruments Inc. and Intuitive Surgical Inc. Exposure (Nasdaq): Consideration Before Investing

While the allure of ETFs holding Texas Instruments and Intuitive Surgical shares can be palpable, conscientious considerations are paramount before investing. Understanding the risk factors, including market volatility, economic impacts on the tech and healthcare sectors, and the overall performance history of the chosen ETF, are vital. Moreover, considerations like expense ratios, the liquidity of the ETF, and any applicable management fees should also be accounted for, ensuring the investment aligns with one’s financial objectives and risk tolerance. In conclusion, engaging in the ETF realm, especially those enmeshing companies like Texas Instruments and Intuitive Surgical, necessitates a balanced approach, amalgamating adequate knowledge with strategic planning. The intersection of technology and healthcare through such ETFs offers a potentially rewarding, yet complex, investment landscape that mandates thorough exploration and prudence. Disclaimer: This article does not provide any investment advisory services.

Source 1: QQQ ETF issuer

Source 2: QQQ ETF official page

FAQ

What is the QQQ ETF?

The QQQ ETF is an exchange-traded fund that provides investors exposure to specific assets or companies.

What companies does the QQQ ETF have exposure to?

The QQQ ETF has exposure to companies like Texas Instruments Inc. and Intuitive Surgical Inc. Exposure.

How can I read more about the QQQ ETF?

You can read more about the QQQ ETF in various financial publications, websites, and the official ETF documentation.

Why should I consider investing in the QQQ ETF?

Investing in ETFs can provide diversification, flexibility, and cost-effectiveness. It's important to do your own research or consult with a financial advisor before making investment decisions.

What is the description for the QQQ ETF?

The ETF with Texas Instruments Inc. and Intuitive Surgical Inc. Exposure (Nasdaq) exposure provides investors with an opportunity to diversify their portfolio while gaining insight into the performance and potential of Texas Instruments Inc. and Intuitive Surgical Inc. Exposure (Nasdaq). This ETF offers a comprehensive view of the company's standing in the market, its historical performance, and future prospects.

How is the QQQ ETF different from other ETFs?

Each ETF has its own unique investment strategy, holdings, and exposure. It's crucial to understand the specifics of each ETF before investing.