ETF with Texas Instruments Inc. and Regeneron Pharmaceuticals Inc. Exposure (Nasdaq)

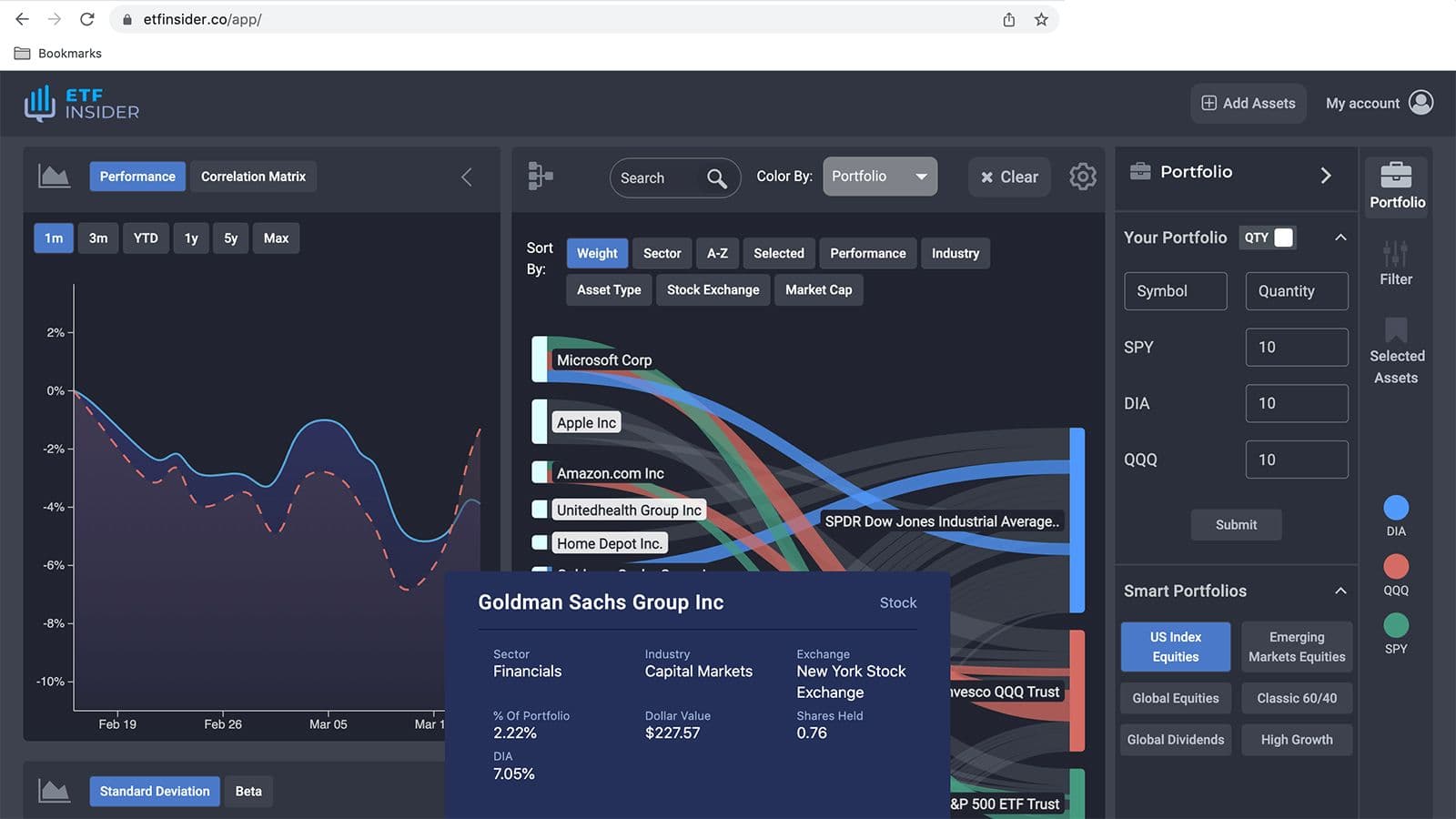

Investing in ETFs which encapsulate assets such as Texas Instruments Inc. and Regeneron Pharmaceuticals Inc. means diving into an investment vehicle that essentially provides a comprehensive, and often, a diversified portfolio. Texas Instruments Inc., known for its semiconductors and Regeneron Pharmaceuticals Inc., acclaimed for its biomedical innovations, are both encapsulated in various ETFs, including some that track the renowned Nasdaq and S&P 500 indices. For instance, Invesco QQQ Trust (QQQ) and iShares Core S&P 500 ETF (IVV) can offer investors an entry point into the technological and biomedical sectors through a single, consolidated investment path.

ETF with Texas Instruments Inc. and Regeneron Pharmaceuticals Inc. Exposure (Nasdaq) : Comparisons of

Investing in ETFs that hold Texas Instruments and Regeneron Pharmaceuticals may offer certain advantages over ETFs focusing on other top holdings within the same indices. Both companies have demonstrated consistent growth, innovative technology advancements, and substantial market capitalization, rendering them as vital constituents within their respective sectors in ETFs such as the Invesco QQQ Trust and iShares NASDAQ Biotechnology ETF (IBB). It is fundamental, however, for investors to analyze the underlying holdings, performance metrics, and cost factors of each ETF to comprehend the unique elements and comparative stance against ETFs with different prime holdings.

IVV overlap ETF with Texas Instruments Inc. and Regeneron Pharmaceuticals Inc. Exposure (Nasdaq)

IVV overlap ETF with Texas Instruments Inc. and Regeneron Pharmaceuticals Inc. Exposure (Nasdaq)

ETF with Texas Instruments Inc. and Regeneron Pharmaceuticals Inc. Exposure (Nasdaq): Benefits to Invest on Those ETFs

Investing in ETFs, particularly those with exposure to high-performing companies like Texas Instruments and Regeneron Pharmaceuticals, can offer several benefits in contrast to selecting individual stocks. Firstly, ETFs inherently provide diversification by spreading the investment across various companies, thereby mitigating the risk associated with stock picking in individual enterprises. Secondly, the presence of these companies in ETFs like iShares Core S&P 500 ETF and Invesco QQQ Trust offers a seamless means to tap into the inherent growth trajectories within the technological and biomedical sectors, respectively, without necessitating a deep dive into each company’s detailed financial analytics and future predictions.

ETF with Texas Instruments Inc. and Regeneron Pharmaceuticals Inc. Exposure (Nasdaq): Consideration Before Investing

While ETFs, especially those tracking reputed indices like Nasdaq and S&P 500, are often hailed for their diversification and relative stability, due diligence before investment cannot be overstated. Potential investors must thoroughly scrutinize the ETF's expense ratio, historic performance, dividend yields, and the holistic balance of the sectors represented. Moreover, understanding the nuanced demands and trends within the technological and biomedical sectors, along with economic indicators and global events that may impact these industries, is pivotal to anticipate the future performance and safeguard against any potential risks enveloped in these investment avenues. In conclusion, effectively harnessing the growth potential presented by ETFs with exposure to Texas Instruments Inc. and Regeneron Pharmaceuticals Inc. demands a thorough understanding of the intrinsic and extrinsic factors that could influence the respective sectors and the broader market. Ensuring that the selected ETF aligns with the investor’s financial goals, risk tolerance, and investment horizon is quintessential to navigating the multifaceted world of ETF investments proficiently. Disclaimer: This article does not provide investment advisory services, and it is not intended to recommend any investment policy to potential investors.

Source 1: IVV ETF issuer

Source 2: IVV ETF official page

FAQ

What is the IVV ETF?

The IVV ETF is an exchange-traded fund that provides investors exposure to specific assets or companies.

What companies does the IVV ETF have exposure to?

The IVV ETF has exposure to companies like Texas Instruments Inc. and Regeneron Pharmaceuticals Inc. Exposure.

How can I read more about the IVV ETF?

You can read more about the IVV ETF in various financial publications, websites, and the official ETF documentation.

Why should I consider investing in the IVV ETF?

Investing in ETFs can provide diversification, flexibility, and cost-effectiveness. It's important to do your own research or consult with a financial advisor before making investment decisions.

What is the description for the IVV ETF?

The ETF with Texas Instruments Inc. and Regeneron Pharmaceuticals Inc. Exposure (Nasdaq) exposure provides investors with an opportunity to diversify their portfolio while gaining insight into the performance and potential of Texas Instruments Inc. and Regeneron Pharmaceuticals Inc. Exposure (Nasdaq). This ETF offers a comprehensive view of the company's standing in the market, its historical performance, and future prospects.

How is the IVV ETF different from other ETFs?

Each ETF has its own unique investment strategy, holdings, and exposure. It's crucial to understand the specifics of each ETF before investing.