ETF with Texas Instruments Inc. and Workday Inc. Exposure (Nasdaq)

Navigating through the financial sea of the S&P 500 and Nasdaq, ETFs with particular company exposures, like Texas Instruments Inc. and Workday Inc., may offer a distinct, viable path for investors. Both indices reveal a plethora of opportunities, especially when focusing on specific technological and software companies.

ETF with Texas Instruments Inc. and Workday Inc. Exposure (Nasdaq): Exposure

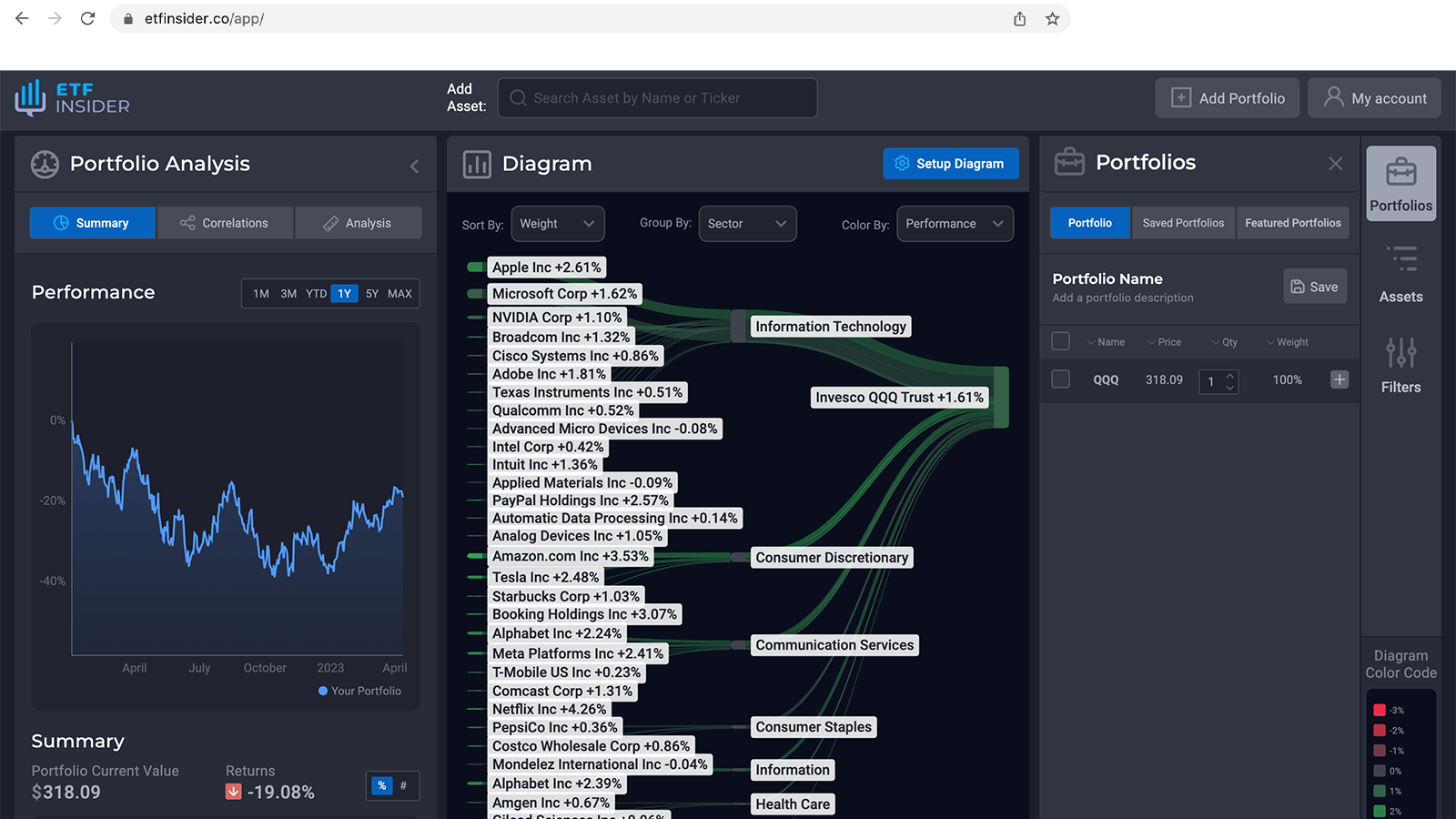

Texas Instruments Inc. and Workday Inc. are prominent entities within the Nasdaq, establishing their significance in numerous ETFs. For instance, Invesco QQQ Trust (QQQ) and Invesco NASDAQ Composite ETF (QQQJ) might provide reasonable exposure to these corporations due to their meticulous tracking of the NASDAQ-100 Index and the NASDAQ Composite Index, respectively. These indices house various technology and growth companies, with Texas Instruments and Workday being notable components, impacting the ETFs’ overall performance and providing investors with an efficient gateway to indirectly invest in these firms.

ETF with Texas Instruments Inc. and Workday Inc. Exposure (Nasdaq): Comparisons of

While ETFs like QQQ and QQQJ encapsulate broad exposure to the Nasdaq, they diversify risks across numerous holdings, including Texas Instruments and Workday. Comparatively, alternatives like the First Trust NASDAQ-100 Technology Sector Index Fund (QTEC) may grant more concentrated exposure to the technological sector, whereas Invesco NASDAQ Internet ETF (PNQI) zeroes in on internet-related businesses, still intertwining with our focal companies. The choice between these ETFs and direct stock investments into Texas Instruments or Workday depends on the investor’s risk tolerance and investment strategy, with ETFs typically providing a broader safety net through diversification.

QQQ overlap ETF with Texas Instruments Inc. and Workday Inc. Exposure (Nasdaq)

QQQ overlap ETF with Texas Instruments Inc. and Workday Inc. Exposure (Nasdaq)

ETF with Texas Instruments Inc. and Workday Inc. Exposure (Nasdaq): Benefits to invest on those ETFs

Investing in ETFs like QQQ, which hold Texas Instruments and Workday in their portfolios, proffers numerous advantages, such as mitigated risk compared to direct stock picking. This diversification enables investors to avoid being overly reliant on the performance of a single entity. Moreover, ETFs frequently carry lower expense ratios than investing in numerous individual stocks, offering an economic advantage. Also, with continuous adjustments, ETFs ensure alignment with index specifications, providing the investor with a passive investment vehicle that doesn’t necessitate constant supervision or adjustment.

ETF with Texas Instruments Inc. and Workday Inc. Exposure (Nasdaq): Consideration before investing

Discerning investors must contemplate several factors prior to channeling capital into ETFs, such as QQQ, with exposure to Texas Instruments and Workday. In-depth scrutiny of the ETF's expense ratio, tracking error, and overall strategy are pivotal. Additionally, understanding the technological sector’s volatility, the underlying stocks’ performance, and market conditions are imperative. Considering these aspects, alongside an investor’s risk tolerance and investment objectives, facilitates a more informed and prudent investment decision. Conclusion: The enticement of investing in ETFs, especially those with exposure to prolific entities like Texas Instruments and Workday within the Nasdaq, burgeons when considering the diversification and minimized risk they potentially offer. However, prudent scrutiny and adherence to individual investment strategies and goals remain paramount in navigating through the multifaceted world of investing. Disclaimer: This article does not provide any investment advisory services.

Source 1: QQQ ETF issuer

Source 2: QQQ ETF official page

FAQ

What is the QQQ ETF?

The QQQ ETF is an exchange-traded fund that provides investors exposure to specific assets or companies.

What companies does the QQQ ETF have exposure to?

The QQQ ETF has exposure to companies like Texas Instruments Inc. and Workday Inc. Exposure.

How can I read more about the QQQ ETF?

You can read more about the QQQ ETF in various financial publications, websites, and the official ETF documentation.

Why should I consider investing in the QQQ ETF?

Investing in ETFs can provide diversification, flexibility, and cost-effectiveness. It's important to do your own research or consult with a financial advisor before making investment decisions.

What is the description for the QQQ ETF?

The ETF with Texas Instruments Inc. and Workday Inc. Exposure (Nasdaq) exposure provides investors with an opportunity to diversify their portfolio while gaining insight into the performance and potential of Texas Instruments Inc. and Workday Inc. Exposure (Nasdaq). This ETF offers a comprehensive view of the company's standing in the market, its historical performance, and future prospects.

How is the QQQ ETF different from other ETFs?

Each ETF has its own unique investment strategy, holdings, and exposure. It's crucial to understand the specifics of each ETF before investing.