ETF with Vertex Pharmaceuticals Inc. and Cerner Corp. Exposure (Nasdaq)

Exposing your investment portfolio to the pharmaceutical and health care information technology sectors can be achieved effectively through ETFs that encompass Vertex Pharmaceuticals Inc. and Cerner Corp., both traded on Nasdaq. Invesco QQQ Trust (QQQ) and Invesco NASDAQ Composite ETF (QQQJ) can be pivotal in this context, given that they track significant non-financial and a broad range of companies on the Nasdaq, respectively, potentially enveloping the aforementioned firms within their spectra.

ETF with Vertex Pharmaceuticals Inc. and Cerner Corp. Exposure (Nasdaq): Comparisons of

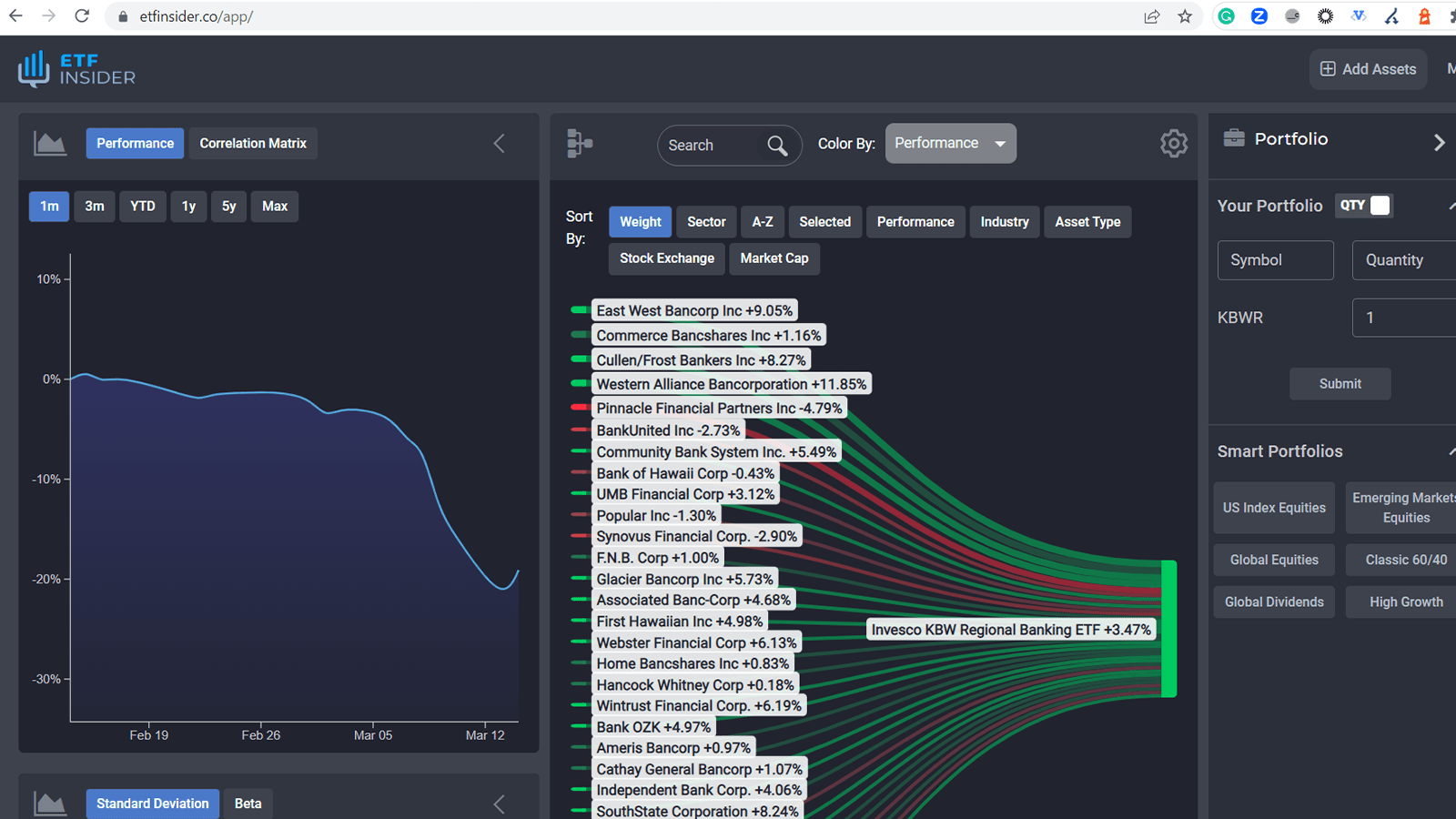

Comparing ETFs like QQQ and QQQJ, which might encompass Vertex Pharmaceuticals and Cerner Corp., with other ETFs with top holdings in similar sectors, such as the iShares NASDAQ Biotechnology ETF (IBB), is crucial for discerning investors. While IBB provides a narrower focus on the biotechnology sector within the Nasdaq, QQQ and QQQJ may present a broader perspective, encapsulating a wider array of companies and thereby, potentially offering a more diversified investment avenue.

QQQ overlap ETF with Vertex Pharmaceuticals Inc. and Cerner Corp. Exposure (Nasdaq)

QQQ overlap ETF with Vertex Pharmaceuticals Inc. and Cerner Corp. Exposure (Nasdaq)

ETF with Vertex Pharmaceuticals Inc. and Cerner Corp. Exposure (Nasdaq): Benefits to invest on those ETFs

Investing in ETFs like QQQ or QQQJ, which may offer exposure to Vertex Pharmaceuticals Inc. and Cerner Corp., as compared to stock picking, carries inherent benefits like risk mitigation through diversification. Given that these ETFs encapsulate a broad spectrum of companies, they may act as a buffer, potentially safeguarding investments from the volatility observed in individual stocks, offering a more stabilized and possibly risk-averse investment trajectory, especially for those looking to avoid the frenzies of the biotech and health care tech sectors.

ETF with Vertex Pharmaceuticals Inc. and Cerner Corp. Exposure (Nasdaq): Consideration before investing

Before venturing into ETF investments with exposure to Vertex Pharmaceuticals Inc. and Cerner Corp., consider factors such as your risk tolerance, investment goals, and the specific ETF’s expense ratio. Additionally, it’s crucial to scrutinize the ETF’s historical performance, its current holdings, and the sectors it majorly exposes you to. An in-depth analysis of the management strategy adopted by the ETF, be it active or passive, should also be a fundamental part of your consideration set, ensuring alignment with your investment philosophy. In conclusion, while Vertex Pharmaceuticals Inc. and Cerner Corp. manifest as noteworthy entities on the Nasdaq, ensuring your ETF investments, like potentially QQQ or QQQJ, are astutely aligned with your financial goals, and risk parameters are paramount. Striking a balance between sector-specific exposure and diversified investment avenues could pave the way for a resilient investment portfolio. Disclaimer: This article does not provide any investment advisory services.

Source 1: QQQ ETF issuer

Source 2: QQQ ETF official page

FAQ

What is the QQQ ETF?

The QQQ ETF is an exchange-traded fund that provides investors exposure to specific assets or companies.

What companies does the QQQ ETF have exposure to?

The QQQ ETF has exposure to companies like Vertex Pharmaceuticals Inc. and Cerner Corp. Exposure.

How can I read more about the QQQ ETF?

You can read more about the QQQ ETF in various financial publications, websites, and the official ETF documentation.

Why should I consider investing in the QQQ ETF?

Investing in ETFs can provide diversification, flexibility, and cost-effectiveness. It's important to do your own research or consult with a financial advisor before making investment decisions.

What is the description for the QQQ ETF?

The ETF with Vertex Pharmaceuticals Inc. and Cerner Corp. Exposure (Nasdaq) exposure provides investors with an opportunity to diversify their portfolio while gaining insight into the performance and potential of Vertex Pharmaceuticals Inc. and Cerner Corp. Exposure (Nasdaq). This ETF offers a comprehensive view of the company's standing in the market, its historical performance, and future prospects.

How is the QQQ ETF different from other ETFs?

Each ETF has its own unique investment strategy, holdings, and exposure. It's crucial to understand the specifics of each ETF before investing.