ETF with Vertex Pharmaceuticals Inc. and Check Point Software Technologies Ltd. Exposure (Nasdaq)

Investing in ETFs allows for a balanced exposure to various sectors, providing a shield against the volatility often experienced with individual stocks. Vertex Pharmaceuticals Inc., a prominent player in the cystic fibrosis market, and Check Point Software Technologies Ltd., a multinational provider of software and hardware products for IT security, are vital components of various ETFs, notably those tracking the Nasdaq. For instance, Invesco QQQ Trust (QQQ) is an ETF that tracks the NASDAQ-100 Index and includes large non-financial companies such as Vertex and Check Point, offering investors an avenue to indirectly invest in these companies while maintaining a diversified portfolio.

ETF with Vertex Pharmaceuticals Inc. and Check Point Software Technologies Ltd. Exposure (Nasdaq): Comparisons of

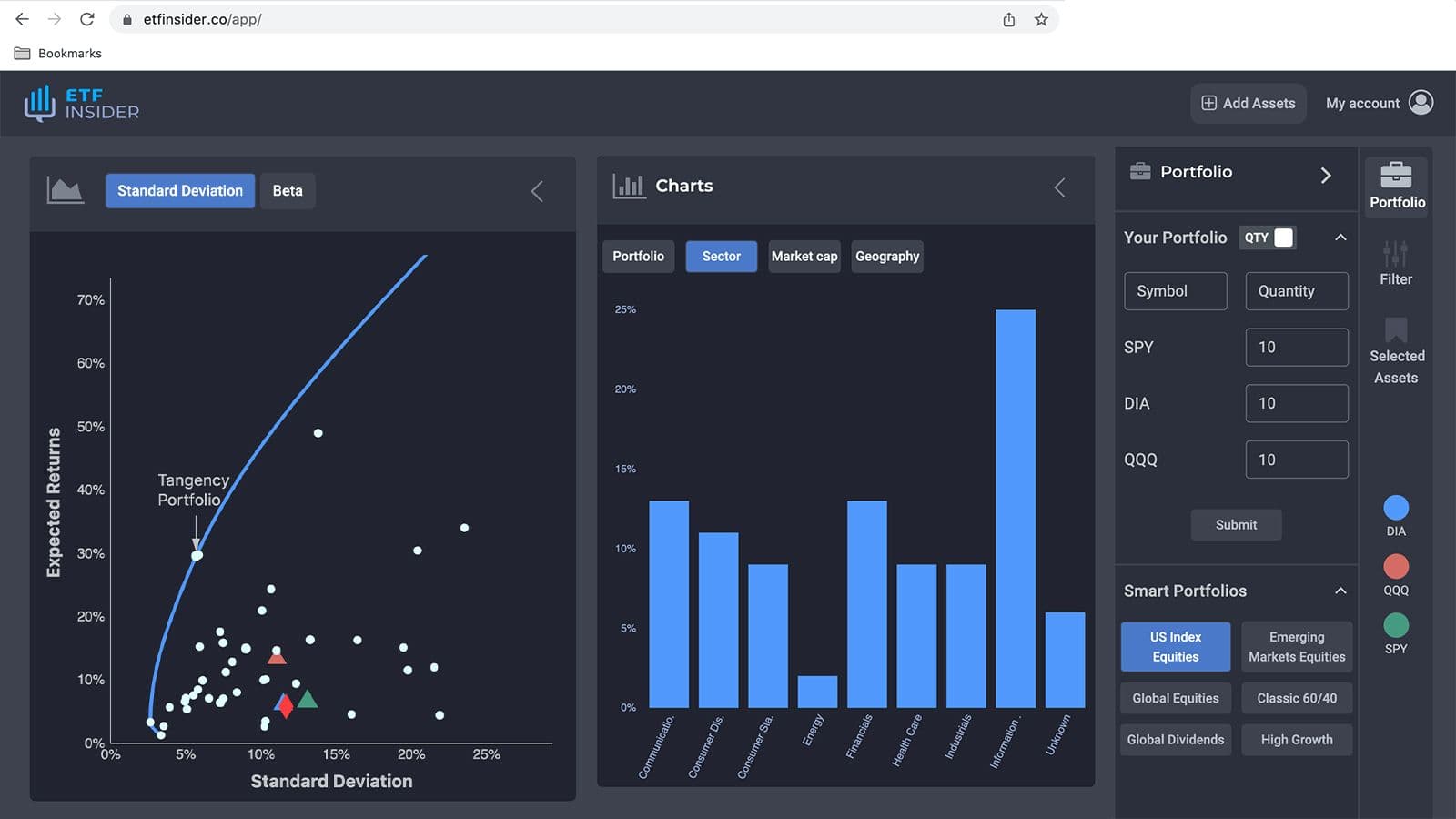

When observing ETFs holding Vertex Pharmaceuticals Inc. and Check Point Software Technologies Ltd., it's crucial to compare their performances and risk factors with other top holdings within similar ETFs. For instance, while ETFs like QQQ focus on the NASDAQ-100, providing a technology-centric investment avenue, Invesco NASDAQ Composite ETF (QQQJ) envelops a wider spectrum of companies in the Nasdaq Composite Index. The differentiating factors such as expense ratios, dividend yields, and sector allocations need a microscopic view to ascertain the fitment into an investor’s portfolio vis-à-vis direct investment into single stocks like Vertex and Check Point.

QQQ overlap ETF with Vertex Pharmaceuticals Inc. and Check Point Software Technologies Ltd. Exposure (Nasdaq)

QQQ overlap ETF with Vertex Pharmaceuticals Inc. and Check Point Software Technologies Ltd. Exposure (Nasdaq)

ETF with Vertex Pharmaceuticals Inc. and Check Point Software Technologies Ltd. Exposure (Nasdaq): Benefits to invest on those ETFs

Investing in ETFs containing Vertex Pharmaceuticals Inc. and Check Point Software Technologies Ltd. provides a more safeguarded route compared to direct stock picking, particularly for investors cautious of sector-specific risks. ETFs like QQQ and QQQJ provide a more balanced exposure to the tech and healthcare sectors, respectively, shielding investors from company-specific volatilities and enabling them to leverage the broad upward movements of sectors or indexes. Furthermore, the inherent diversification, coupled with the passive management of most ETFs, generally means lower fees and lesser active management risk compared to investing in individual stocks or actively managed funds.

ETF with Vertex Pharmaceuticals Inc. and Check Point Software Technologies Ltd. Exposure (Nasdaq): Consideration before investing

Before jumping on the investment bandwagon with ETFs exposing to Vertex Pharmaceuticals Inc. and Check Point Software Technologies Ltd., it's imperative to consider several factors. These include understanding the weightage of these companies within the ETF, the ETF’s overall performance, its expense ratio, and how it aligns with your investment goals and risk tolerance. Additionally, being aware of other holdings within the ETF and the sector-wise allocation aids in ensuring that your investment is not inadvertently skewing your portfolio away from your desired asset allocation or risk level. In conclusion, while ETFs offer a somewhat shielded and diversified investment route to companies like Vertex Pharmaceuticals and Check Point Software Technologies, thorough research and consideration of various facets, including the investor’s own risk appetite and investment horizon, are pivotal. The interplay between various ETFs, especially against the backdrop of their index-tracking performances and individual stock exposures, forms a vital part of this comprehensive decision-making process. Disclaimer: This article does not provide any investment advisory services. Always consult a financial advisor before making investment decisions.

Source 1: QQQ ETF issuer

Source 2: QQQ ETF official page

FAQ

What is the QQQ ETF?

The QQQ ETF is an exchange-traded fund that provides investors exposure to specific assets or companies.

What companies does the QQQ ETF have exposure to?

The QQQ ETF has exposure to companies like Vertex Pharmaceuticals Inc. and Check Point Software Technologies Ltd. Exposure.

How can I read more about the QQQ ETF?

You can read more about the QQQ ETF in various financial publications, websites, and the official ETF documentation.

Why should I consider investing in the QQQ ETF?

Investing in ETFs can provide diversification, flexibility, and cost-effectiveness. It's important to do your own research or consult with a financial advisor before making investment decisions.

What is the description for the QQQ ETF?

The ETF with Vertex Pharmaceuticals Inc. and Check Point Software Technologies Ltd. Exposure (Nasdaq) exposure provides investors with an opportunity to diversify their portfolio while gaining insight into the performance and potential of Vertex Pharmaceuticals Inc. and Check Point Software Technologies Ltd. Exposure (Nasdaq). This ETF offers a comprehensive view of the company's standing in the market, its historical performance, and future prospects.

How is the QQQ ETF different from other ETFs?

Each ETF has its own unique investment strategy, holdings, and exposure. It's crucial to understand the specifics of each ETF before investing.