ETF with Vertex Pharmaceuticals Inc. and Kraft Heinz Co. Exposure (Nasdaq)

Understanding the dynamics of ETFs, particularly those influenced by Vertex Pharmaceuticals Inc. and Kraft Heinz Co., offers investors a nuanced view of navigating through the potentials within the Nasdaq. Let’s delve into the multifaceted world of such ETFs, ensuring to demystify the essentials, comparisons, and considerations pivotal for potential investment in these financial instruments.

ETF with Vertex Pharmaceuticals Inc. and Kraft Heinz Co. Exposure (Nasdaq): Exposure

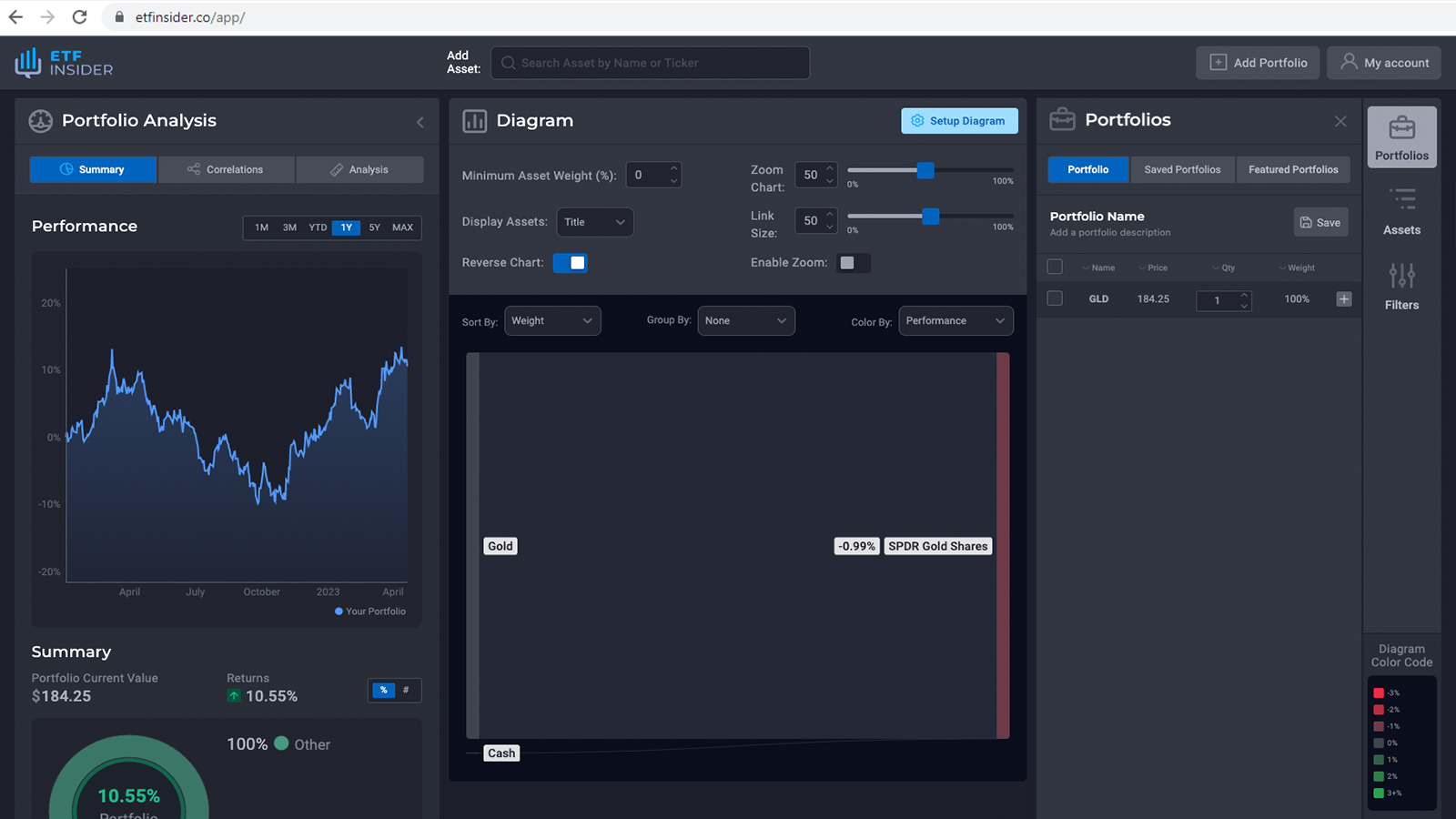

Vertex Pharmaceuticals Inc. and Kraft Heinz Co., both enlisted on the Nasdaq, have been instrumental in shaping the performance of several ETFs. Particularly, the Invesco QQQ Trust (QQQ) and Invesco NASDAQ Composite ETF (QQQJ) are worth noting for their inclusive approach in harnessing the growth and stability of large non-financial companies like Vertex and Kraft Heinz. These companies fortify the ETFs by lending their steady performance trends and substantial market capitalization, thus providing a balanced and robust character to the funds. Hence, investing in ETFs that incorporate such stalwarts allows for a diversified portfolio, ensuring reduced risk and a slice of the companies’ performance indirectly.

ETF with Vertex Pharmaceuticals Inc. and Kraft Heinz Co. Exposure (Nasdaq): Comparisons of

When juxtaposing the ETFs holding Vertex Pharmaceuticals Inc. and Kraft Heinz Co. against other ETFs with different top holdings, one discerns a palpable disparity in risk management and returns potential. For instance, comparing with an ETF like iShares NASDAQ Biotechnology ETF (IBB), which offers extensive exposure to the biotech sector, the ETFs enveloping Vertex and Kraft Heinz present a more diverse portfolio by steering clear from sector-specific myopia. Their embodiment in the ETF allows for a blending of pharmaceuticals and consumer goods sectors, respectively, thereby not only mitigating risks through sectoral diversity but also capturing a wider market scope.

QQQ overlap ETF with Vertex Pharmaceuticals Inc. and Kraft Heinz Co. Exposure (Nasdaq)

QQQ overlap ETF with Vertex Pharmaceuticals Inc. and Kraft Heinz Co. Exposure (Nasdaq)

ETF with Vertex Pharmaceuticals Inc. and Kraft Heinz Co. Exposure (Nasdaq): Benefits to invest on those ETFs

Investing in ETFs, especially those encasing companies like Vertex Pharmaceuticals Inc. and Kraft Heinz Co., accentuates the balance between risk and reward compared to singular stock picking. While the latter might offer staggering returns, the inherent risk associated with investing in an individual stock is substantially higher than in ETFs. The ETFs enwrap the steady, often reliable performance of Vertex and Kraft Heinz, ensuring that the investment is buttressed against market volatilities to a considerable extent. Thus, by opting for such ETFs, investors can harness the stable returns of these companies without the escalated risk of direct stock investment.

ETF with Vertex Pharmaceuticals Inc. and Kraft Heinz Co. Exposure (Nasdaq): Consideration before investing

Though replete with opportunities, investing in ETFs housing Vertex Pharmaceuticals Inc. and Kraft Heinz Co. necessitates scrutiny. Investors must evaluate their risk appetite, financial goals, and investment tenure before diving in. It's crucial to keep abreast of the regulatory changes, market trends, and the financial health of the concerned companies to foresee any possible detriments or advantages in the future. Employing a mindful approach towards fees, considering tax implications, and potentially consulting a financial advisor might further fortify the investment decision, ensuring it’s tailored to individual financial landscapes. Conclusion: Treading through the corridors of ETF investments, especially those influenced by Vertex Pharmaceuticals Inc. and Kraft Heinz Co., entails a judicious blend of risk assessment and opportunity scouting. As the financial realms continually evolve, an informed, vigilant, and adaptive investment approach remains paramount. Disclaimer: This content is for informational purposes only and does not provide any investment advisory services.

Source 1: QQQ ETF issuer

Source 2: QQQ ETF official page

FAQ

What is the QQQ ETF?

The QQQ ETF is an exchange-traded fund that provides investors exposure to specific assets or companies.

What companies does the QQQ ETF have exposure to?

The QQQ ETF has exposure to companies like Vertex Pharmaceuticals Inc. and Kraft Heinz Co. Exposure.

How can I read more about the QQQ ETF?

You can read more about the QQQ ETF in various financial publications, websites, and the official ETF documentation.

Why should I consider investing in the QQQ ETF?

Investing in ETFs can provide diversification, flexibility, and cost-effectiveness. It's important to do your own research or consult with a financial advisor before making investment decisions.

What is the description for the QQQ ETF?

The ETF with Vertex Pharmaceuticals Inc. and Kraft Heinz Co. Exposure (Nasdaq) exposure provides investors with an opportunity to diversify their portfolio while gaining insight into the performance and potential of Vertex Pharmaceuticals Inc. and Kraft Heinz Co. Exposure (Nasdaq). This ETF offers a comprehensive view of the company's standing in the market, its historical performance, and future prospects.

How is the QQQ ETF different from other ETFs?

Each ETF has its own unique investment strategy, holdings, and exposure. It's crucial to understand the specifics of each ETF before investing.