ETF with Vertex Pharmaceuticals Inc. and Verisk Analytics Inc. Exposure (Nasdaq)

Both Vertex Pharmaceuticals Inc. and Verisk Analytics Inc. have made a notable imprint on the NASDAQ, offering prospective options for investors who are interested in pharmaceuticals and analytics sectors, respectively. The associated ETFs can be a savvy option for those who want to mitigate risks and gain diversified exposure.

ETF with Vertex Pharmaceuticals Inc. and Verisk Analytics Inc. Exposure (Nasdaq): Exposure

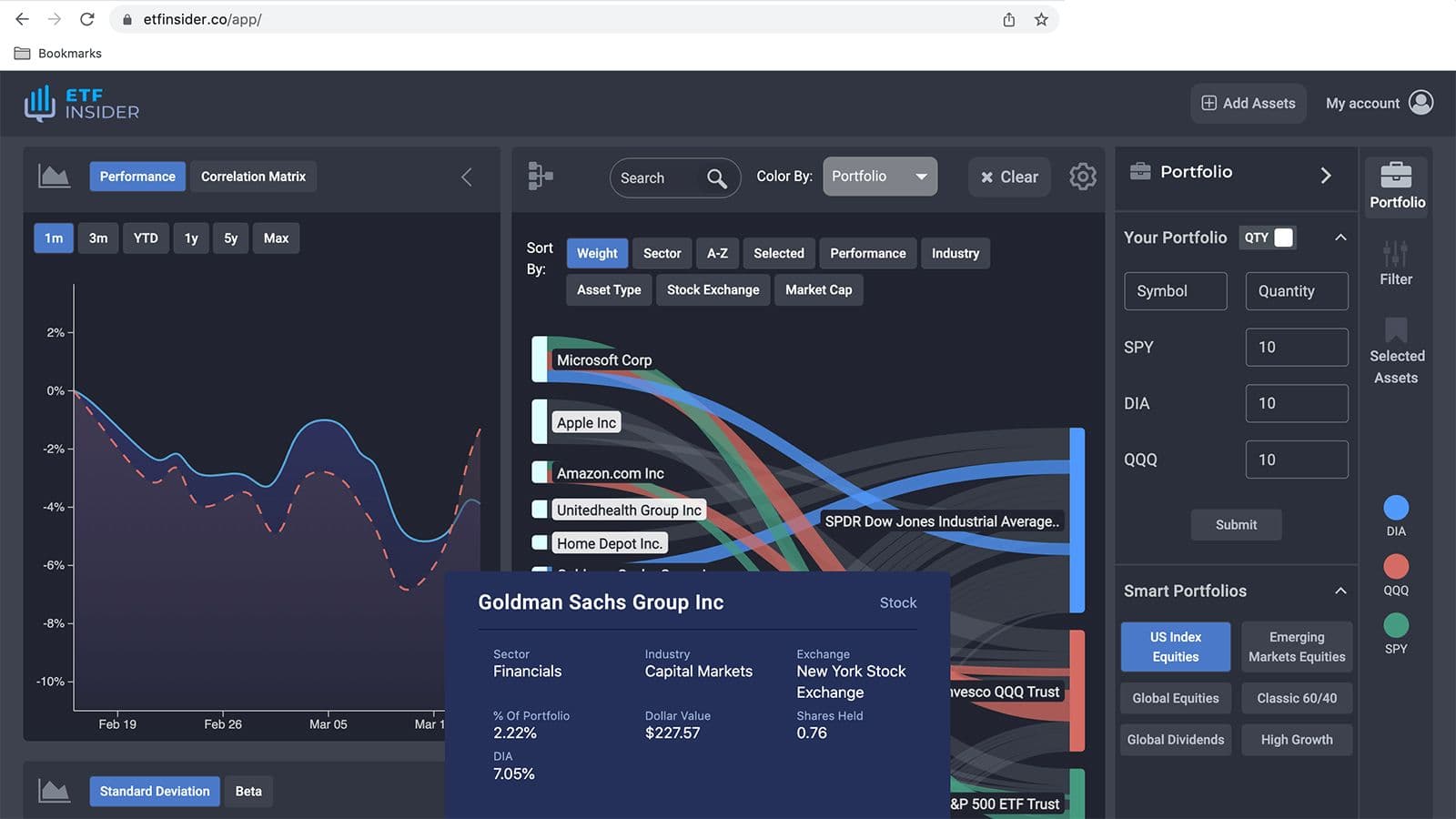

Investing in ETFs, such as Invesco QQQ Trust (QQQ) or Invesco NASDAQ Composite ETF (QQQJ), which track the NASDAQ, inherently exposes investors to the fluctuations of the companies listed therein, including Vertex Pharmaceuticals and Verisk Analytics. The exposure to these entities can potentially offer growth, given their respective stances in their industries; Vertex in the biopharmaceutical sector and Verisk in data analytics. It’s pivotal to consider the specific sectors' potential, their market cap, and how they coalesce within the larger index to decipher the nature of exposure.

ETF with Vertex Pharmaceuticals Inc. and Verisk Analytics Inc. Exposure (Nasdaq): Comparisons of

Comparing ETFs like the Invesco QQQ Trust and Invesco NASDAQ Composite ETF to those that track other indices or sectors is vital. The QQQ, for instance, provides broad exposure to the tech-dominated NASDAQ-100, while QQQJ embodies a broader perspective, including a wider array of NASDAQ-listed entities. On the other hand, sector-specific ETFs like iShares NASDAQ Biotechnology ETF (IBB) would concentrate on the biotechnological sector. Therefore, considering Vertex and Verisk, investing in a more all-encompassing ETF might dilute specific exposure but enhance diversification.

QQQ overlap ETF with Vertex Pharmaceuticals Inc. and Verisk Analytics Inc. Exposure (Nasdaq)

QQQ overlap ETF with Vertex Pharmaceuticals Inc. and Verisk Analytics Inc. Exposure (Nasdaq)

ETF with Vertex Pharmaceuticals Inc. and Verisk Analytics Inc. Exposure (Nasdaq): Benefits to invest on those ETFs

Choosing to invest in ETFs over individual stock picking can confer several advantages. Primarily, it allows investors to sidestep the intricate and often volatile nature of individual stock investment, especially within sectors known for high volatility like biopharmaceuticals. ETFs like QQQ and QQQJ offer a well-diversified exposure to Nasdaq’s top-performing companies, including but not limited to Vertex and Verisk, thereby reducing the potential risk associated with individual stock investment and providing a smoother investment experience.

ETF with Vertex Pharmaceuticals Inc. and Verisk Analytics Inc. Exposure (Nasdaq): Consideration before investing

Despite the allure, before investing, it’s imperative to consider various factors. These may include, but aren't limited to, the ETF’s expense ratio, your investment goals, risk tolerance, and the specific ETF's historical performance. Furthermore, acknowledging the sector-specific risks involved, such as regulatory changes in the pharmaceutical sector or technological advancements affecting data analytics firms, is quintessential. It’s always prudent to peruse the ETF’s prospectus and understand its investment strategy and potential risks thoroughly. In conclusion, ETFs offer an intriguing vehicle to gain exposure to industry giants like Vertex Pharmaceuticals Inc. and Verisk Analytics Inc. while maintaining a diversified and risk-mitigated investment profile. Always align your investment choices with your financial objectives and risk tolerance to navigate through the investment journey adeptly. Disclaimer: This article does not provide investment advisory services, and it is not intended to recommend any particular strategy or investment product. Always consult a financial advisor before making any investment decisions.

Source 1: QQQ ETF issuer

Source 2: QQQ ETF official page

FAQ

What is the QQQ ETF?

The QQQ ETF is an exchange-traded fund that provides investors exposure to specific assets or companies.

What companies does the QQQ ETF have exposure to?

The QQQ ETF has exposure to companies like Vertex Pharmaceuticals Inc. and Verisk Analytics Inc. Exposure.

How can I read more about the QQQ ETF?

You can read more about the QQQ ETF in various financial publications, websites, and the official ETF documentation.

Why should I consider investing in the QQQ ETF?

Investing in ETFs can provide diversification, flexibility, and cost-effectiveness. It's important to do your own research or consult with a financial advisor before making investment decisions.

What is the description for the QQQ ETF?

The ETF with Vertex Pharmaceuticals Inc. and Verisk Analytics Inc. Exposure (Nasdaq) exposure provides investors with an opportunity to diversify their portfolio while gaining insight into the performance and potential of Vertex Pharmaceuticals Inc. and Verisk Analytics Inc. Exposure (Nasdaq). This ETF offers a comprehensive view of the company's standing in the market, its historical performance, and future prospects.

How is the QQQ ETF different from other ETFs?

Each ETF has its own unique investment strategy, holdings, and exposure. It's crucial to understand the specifics of each ETF before investing.