The Unseen Risks of Fund Overlap

Diversification has long been touted as the key to successful investing and the cornerstone of any sound financial plan. By spreading your capital across a range of asset classes and investment vehicles, you can minimize your exposure to risk and maximize your potential for returns - if done correctly.

However, one of the risks that is often overlooked is fund overlap. When you invest in multiple funds, there is a chance that you are inadvertently investing in the same securities. This can negate the benefits of diversification and leave you more exposed to risk than you may realize.

Awareness of Overlapping Assets is Key

The first step to mitigating concentration risk caused by fund overlap is to be aware of any overlapping positions that currently exist. While a small amount of overlap is bound to exist in any fund-based portfolio, it is important to monitor these positions to ensure there is not excessive overlap as this may increase exposure to sector-specific or company risk.

For example, the unsuspecting investor may believe that investing in the iShares S&P 500 ETF (IVV) and the Vanguard Growth ETF (VUG) will help to diversify their portfolio as these funds track different indices and have unique objectives. However, a closer look will reveal that both of these funds have significant overlap with 7 out of top 10 holdings being identical. As a result, this investor would be overexposed to these companies and their respective sector risk without even realizing it. While this may not appear to pose a problem during bull markets, it could leave the investor vulnerable during periods of market turbulence.

Identifying overlapping positions is not always a straightforward task, especially if you are investing in mutual funds as opposed to ETFs. This is because mutual funds are not required to disclose their holdings as frequently as ETFs. As a result, it can be difficult to know exactly what you are invested in and whether there is excessive overlap with other positions in your portfolio.

A Turnkey Solution for Fund Overlap Identification

Identifying concentration risk caused by fund overlap is a critical first step in the fund selection process and the regular monitoring of your portfolio. However, this step is often overlooked by investors due to the lack of transparency and accessibility of this data and the time-consuming nature of the analysis.

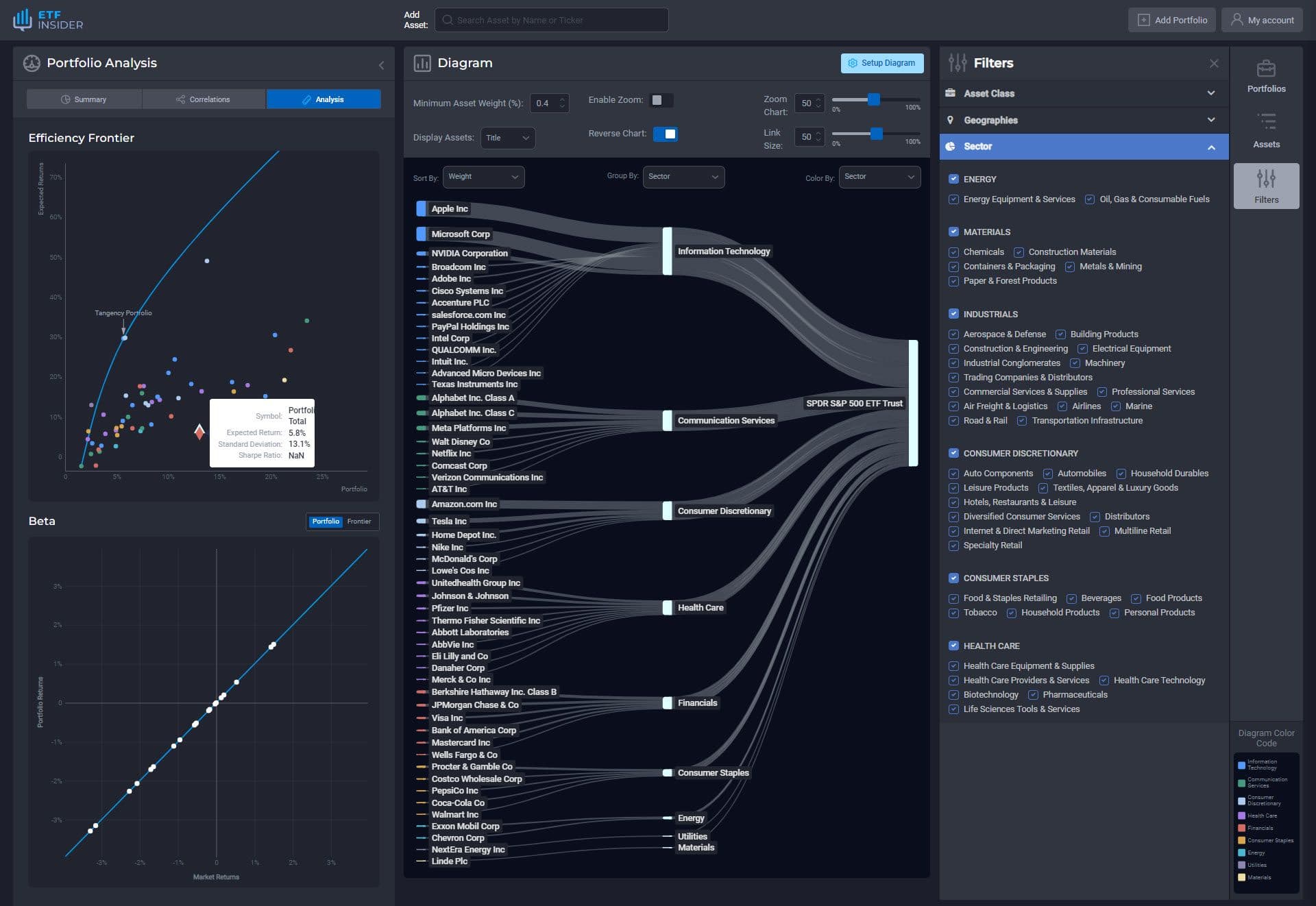

With ETFInsider's ETF and Mutual Fund overlap tool, investors can easily manage their portfolios for concentration risk and quickly identify any overlapping positions. Simply enter the tickers for the funds you are invested in and our software will show you the assets in each fund, how much of your overall portfolio is allocated to each security, and where the overlap exists. This turnkey solution takes the guesswork out of portfolio analysis and gives investors the peace of mind that comes with knowing their portfolio is properly diversified.

Don't let fund overlap take you by surprise. Use ETF Insider's Fund Overlap tool to take control of your portfolio and ensure that you are diversified against concentration risk.