How can I invest in the USMV ETF?

Investing in exchange-traded funds (ETFs) has gained popularity among investors looking for diversified exposure to various asset classes. One such ETF is the USMV (Ticker: USMV), which stands for the iShares Edge MSCI Min Vol USA ETF. If you're interested in investing in the USMV ETF, this article will provide you with a comprehensive guide to get started. Please note that this article is for informational purposes only and does not provide any investment advisory services.

Understanding the USMV ETF

The USMV ETF is designed to track the performance of the MSCI USA Minimum Volatility Index. This index consists of U.S. large and mid-cap stocks that demonstrate lower volatility characteristics compared to their peers. The fund aims to provide investors with exposure to a portfolio of stocks that have historically shown lower risk profiles. By investing in the USMV ETF, you can potentially reduce the overall volatility of your investment portfolio.

To learn more about the USMV ETF and its underlying index, you can visit the official iShares website for detailed information and prospectus: iShares Official Website.

Opening a Brokerage Account

Before you can invest in the USMV ETF, you'll need to open a brokerage account. A brokerage account allows you to buy and sell ETF shares through an online platform. There are numerous brokerage firms available, each with its own set of features and fees. It's essential to research and compare different brokerage options to find the one that best suits your investment goals and preferences.

To open a brokerage account, you can visit the websites of popular brokerage firms like Vanguard, Fidelity, or Charles Schwab. These firms provide a wide range of investment products, including ETFs, and offer user-friendly platforms for managing your investments. Make sure to review the account opening requirements, fees, and any minimum investment amounts associated with the brokerage firm you choose.

USMV overlap How can I invest in the USMV ETF?

USMV overlap How can I invest in the USMV ETF?

Purchasing USMV ETF Shares

Once you have a brokerage account, you can proceed to purchase USMV ETF shares. Using your brokerage platform, search for the USMV ETF by its ticker symbol (USMV). You'll find detailed information about the fund, including its current price, historical performance, and expense ratio. Before making a purchase, it's recommended to review the fund's prospectus and consider factors such as its investment objective, holdings, and historical performance.

When you're ready to invest, specify the number of shares you want to purchase and place an order through your brokerage account. You can choose between different order types, such as market orders (executed at the current market price) or limit orders (executed at a specified price or better). Keep in mind that brokerage firms may charge a commission or transaction fee for buying or selling ETF shares, so it's important to understand these costs before making a trade.

Monitoring Your Investment

Once you've invested in the USMV ETF, it's crucial to regularly monitor your investment and stay updated on market trends. ETF prices can fluctuate based on various factors such as market conditions, economic news, and changes in the underlying index. By staying informed, you can make informed decisions about holding, selling, or buying additional shares of the USMV ETF based on your investment strategy and goals.

Remember to review your investment portfolio periodically and rebalance it if necessary. Rebalancing involves adjusting the asset allocation to maintain your desired risk level and investment objectives. Consult with a financial advisor if you need assistance in managing your investment portfolio or determining the appropriate allocation for the USMV ETF.

Please note that this article is for informational purposes only and does not provide any investment advisory services. Investing in ETFs and financial instruments involves risks, including the potential loss of principal. It's important to conduct thorough research, assess your risk tolerance, and consult with a qualified financial professional before making any investment decisions.

Investing in the USMV ETF can be a strategic way to gain exposure to U.S. stocks with lower volatility characteristics. By understanding the basics of the USMV ETF, opening a brokerage account, purchasing shares, and monitoring your investment, you can begin your journey in this popular ETF. Remember to consider your investment goals, risk tolerance, and seek professional advice if needed. Happy investing!

Source 1: USMV issuer website

Source 2: Reuters article about USMV

USMV quote and analysis

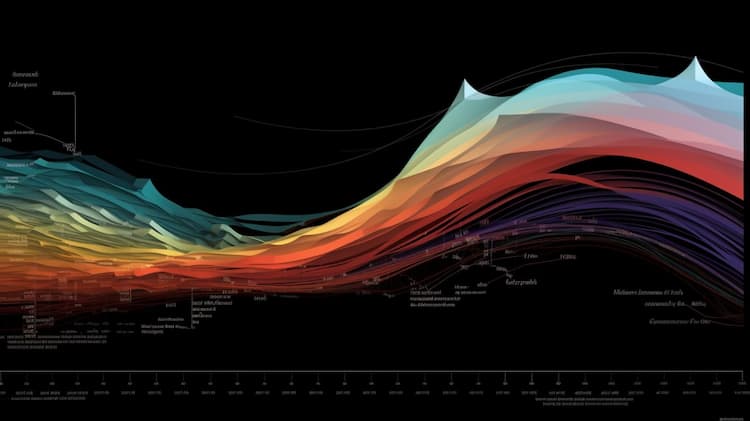

Discover the top holdings, correlations, and overlaps of ETFs using our visualization tool.

Our app allows you to build and track your portfolio.

To learn more about the USMV iShares MSCI USA Min Vol Factor ETF, access our dedicated page now.

FAQ

What is the USMV ETF?

The USMV ETF, or iShares MSCI USA Minimum Volatility ETF, is an exchange-traded fund that aims to provide investors with exposure to U.S. equities while focusing on minimum volatility.

What is the underlying index that the USMV ETF aims to track?

The USMV ETF aims to track the performance of the MSCI USA Minimum Volatility Index, which is designed to represent the performance of U.S. stocks with lower volatility characteristics.

What types of companies are included in the USMV ETF?

The USMV ETF includes a diverse range of companies from various sectors within the U.S. equity market. It seeks to select stocks with lower volatility characteristics while maintaining broad sector representation.

How does the USMV ETF work?

The USMV ETF works by employing an index-based approach that selects and weights stocks based on their historical price volatility. The ETF's portfolio is constructed to potentially provide lower volatility compared to the broader U.S. equity market.

What are the advantages of investing in the USMV ETF?

Investing in the USMV ETF offers potential benefits such as reduced exposure to market volatility, potentially providing a smoother investment experience. It may appeal to investors seeking a more defensive approach to equity investing while still maintaining exposure to U.S. stocks.