How does the CHIQ ETF work?

Investing in the stock market can often feel like navigating through turbulent waters, especially for individuals who are new to the investment game. However, with the advent of Exchange Traded Funds (ETFs), the process has been simplified, allowing a broader spectrum of investors to participate and profit. One such fund that has garnered attention is the CHIQ ETF. This fund allows investors to dive into the consumer discretionary sector of China, promising exposure to a burgeoning market. Let's take a closer look at how the CHIQ ETF operates, its benefits, and considerations before making an investment decision.

CHIQ ETF: Overview

The CHIQ ETF, or the Global X MSCI China Consumer Discretionary ETF, is designed to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the MSCI China Consumer Discretionary 10/50 Index. Through this ETF, investors can gain exposure to various Chinese companies in the consumer discretionary sector, including those engaged in the automobile, consumer electronics, and luxury goods industries, among others.

CHIQ ETF: Underlying and Exposure: What Does It Track and How?

By tracking the MSCI China Consumer Discretionary 10/50 Index, the CHIQ ETF gives investors a window into the consumer discretionary sector of China, which is expected to grow as the middle class expands and consumption rates increase. The ETF encompasses a diversified range of companies, thus offering a degree of risk management while ensuring exposure to the dynamic consumer market in China. It operates by investing at least 80% of its total assets in the securities of the underlying index and in ADRs and GDRs based on the securities in the underlying index.

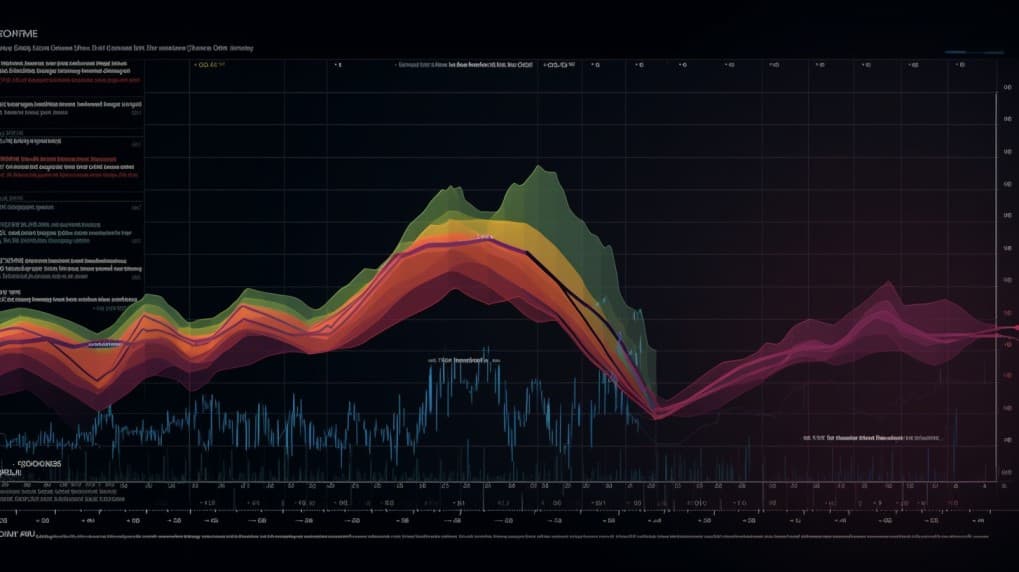

CHIQ overlap How does work the CHIQ ETF?

CHIQ overlap How does work the CHIQ ETF?

CHIQ ETF: Benefits of Investing

Investing in the CHIQ ETF comes with several advantages. Firstly, it offers diversification by spreading the investment across a variety of companies within the consumer discretionary sector in China. This diversification can potentially lead to lower investment risk. Secondly, with its focus on the consumer discretionary sector, investors have the opportunity to benefit from the increasing consumption rates in China, powered by a growing middle-class population. Lastly, the ETF structure allows for easy trading, similar to the trading of individual stocks, providing liquidity and transparency to investors.

CHIQ ETF: Considerations Before Investing

Before jumping on the CHIQ ETF investment bandwagon, it's crucial to weigh some considerations. The primary concern is the geopolitical and regulatory risks associated with investing in Chinese companies. Moreover, the consumer discretionary sector is often susceptible to economic fluctuations, which may impact the performance of the ETF. It’s also crucial to analyze the fee structure of the CHIQ ETF to ensure it aligns with your investment goals.

Conclusion

The CHIQ ETF offers a unique avenue for investors to tap into the consumer discretionary sector of China, which is poised for growth owing to the rising middle-class population and their increasing consumption rates. While the diversification and the potential for high returns are appealing, understanding the associated risks, particularly the geopolitical and regulatory uncertainties, is crucial for making an informed investment decision. Like with any investment, thorough research and possibly consulting with a financial advisor is advisable to ascertain if the CHIQ ETF aligns with your overall investment strategy.

Sources:

Global X ETFs official website.

MSCI official website.

CHIQ ETF issuer

CHIQ ETF official page

CHIQ quote and analysis

Discover the top holdings, correlations, and overlaps of ETFs using our visualization tool.

Our app allows you to build and track your portfolio.

To learn more about the CHIQ Global X MSCI China Consumer Discretionary ETF, access our dedicated page now.

FAQ

What is the CHIQ ETF?

The CHIQ ETF is an exchange-traded fund that provides investors with exposure to a specific sector.

What is the underlying index that the CHIQ ETF aims to track?

The CHIQ ETF aims to track the performance of a specific index, which includes companies involved in its respective sector.

What types of companies are included in the CHIQ ETF?

The CHIQ ETF includes companies from its focused industry.

How does the CHIQ ETF work?

The CHIQ ETF functions by pooling investors' capital to purchase a diversified portfolio of sector-related stocks.

What are the advantages of investing in the CHIQ ETF?

Investing in the CHIQ ETF offers exposure to a specialized sector with potential for growth.