Bullish or Bearish Q1 GDP? Here are 4 Factors to Consider

As we enter the second quarter of 2023, there is growing anticipation and speculation about the outlook for the Q1 Gross Domestic Product (GDP) in the US, as it will set the tone for the remainder of the year. While there are a plethora of factors that contribute to economic growth or decline, four vital factors officially determine a country's GDP.

In this article, let's delve into some interesting insights (as we wait for official economic data for the first three months of the year) into whether the outlook for 2023 Q1 GDP is bullish or bearish based on what we have seen on these four factors:

1. Consumer Consumption

First of all, consumer consumption is a significant driver of economic growth or decline (it accounts for roughly two-thirds of the GDP). Despite challenges and issues (particularly in the banking industry), consumer confidence remained high in the first quarter due to a relatively stable job market and wages coupled with an almost complete reopening of the economy since the heights of the pandemic. This, in turn, resulted in increased consumer spending, particularly in the retail sector. Hence, consumer consumption will likely be a positive factor for Q1.

2. Domestic Investments

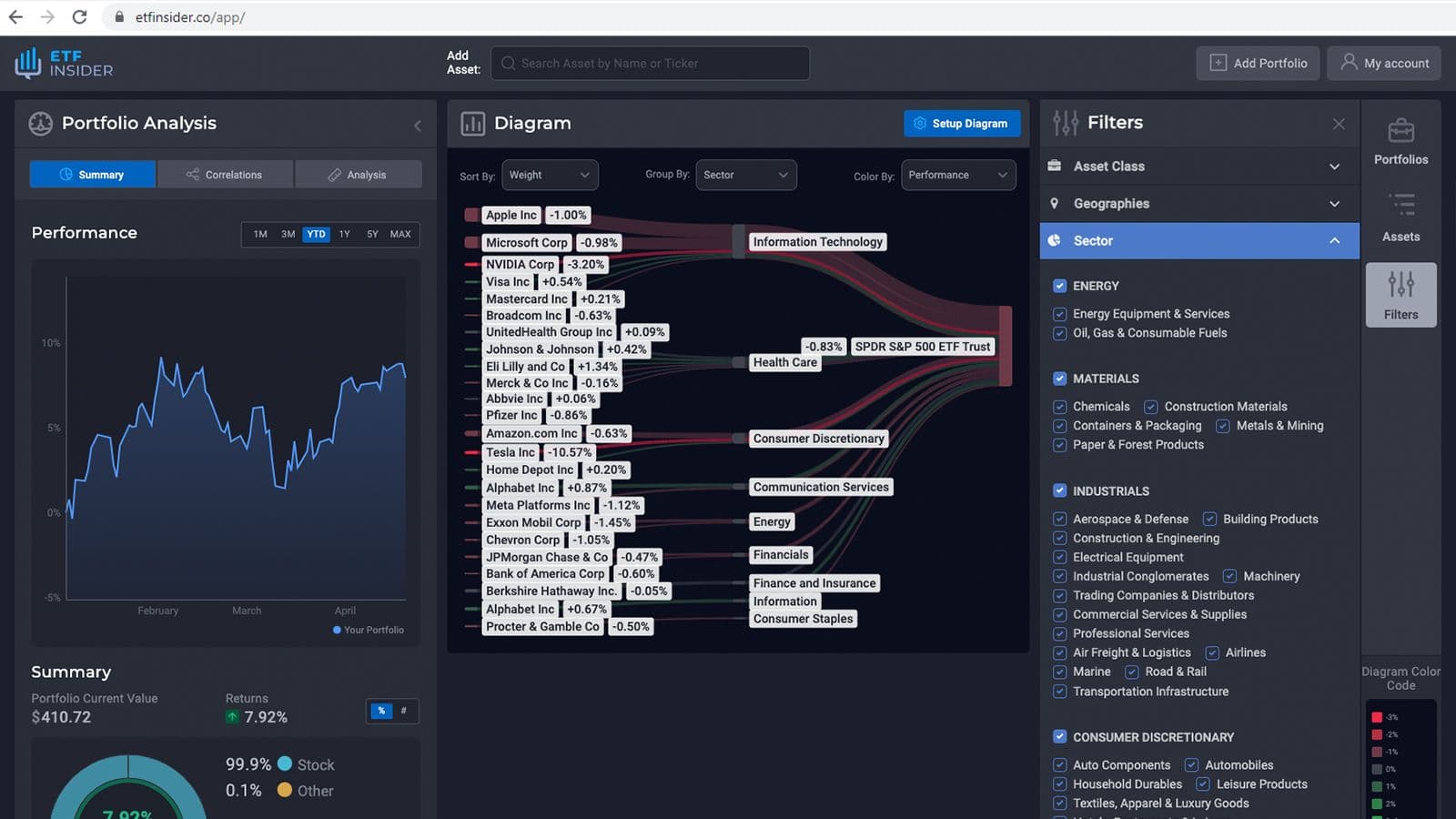

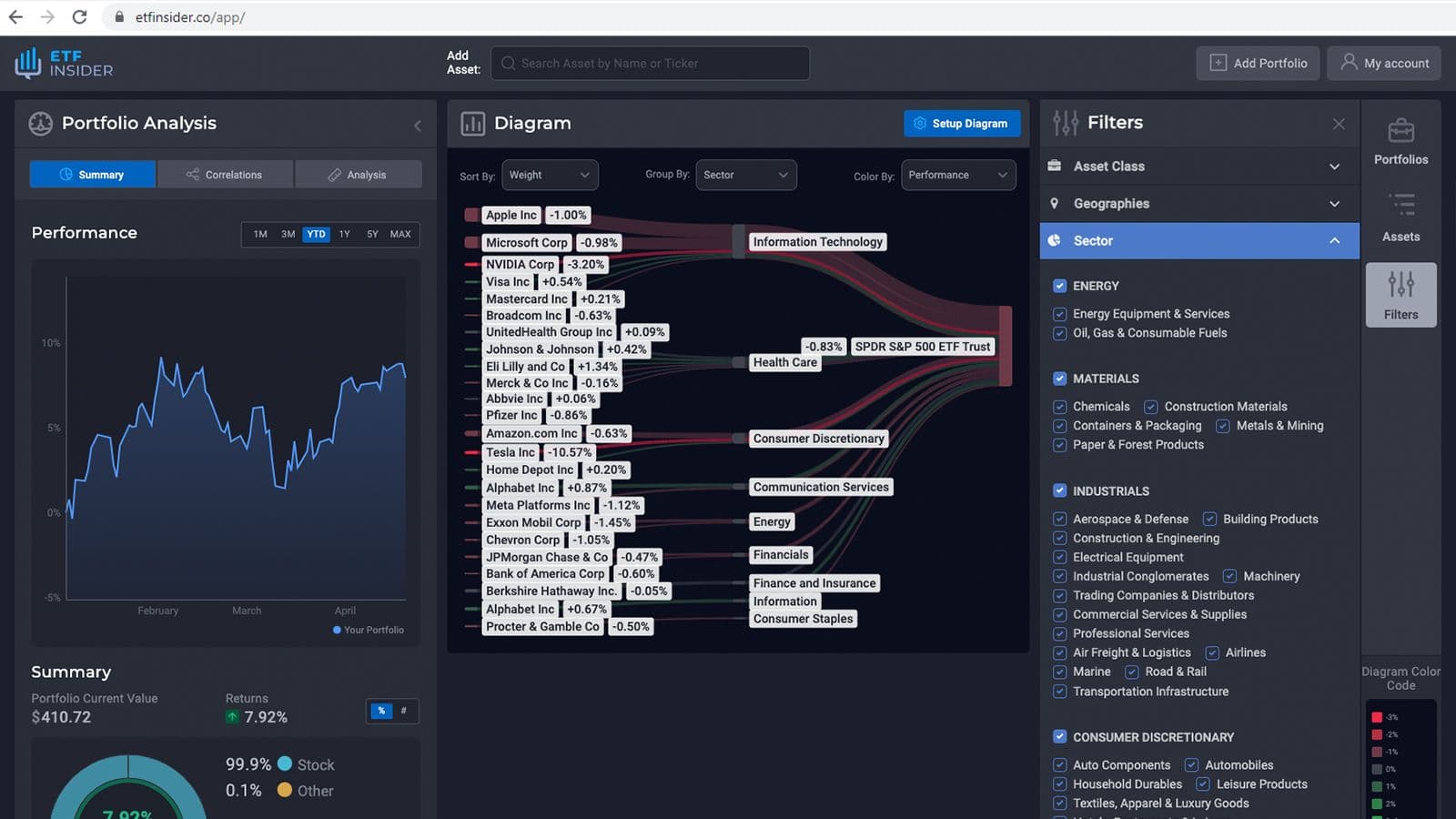

Second, domestic investments also play a critical role in GDP growth/decline. In the first quarter of 2023, there was a shift in investments in technology (mainly AI-related), renewable energy, and even real estate despite the rising rates. Nevertheless, the rising rates have hampered investments. This is, of course, unsurprising, given that this is one of the things that the Fed wants to slow down to curb inflation. Regardless, the stock market is still up by roughly 7% Year-To-Date (YTD), indicating a likely positive net investment result.

S&P500 ETF filtered by sectors (ETF Insider web-app)

S&P500 ETF filtered by sectors (ETF Insider web-app)

3. Net Exports

On the other hand, net exports, which is the difference between total exports and imports, have been on the positive side for the longest time. This trend will likely continue to the first quarter of the year. Albeit, it was only a relatively slight increase considering this was likely offset by increased imports due to increased domestic demand. Hence, compared to the other factors, this might have a neutral impact on the GDP as a whole.

4. Government Spending

Finally, government spending is not only a critical factor in determining the GDP but also one of the principal fiscal policies employed by countries, including the US. In the first quarter of 2023, we saw a slight increase in government spending, particularly on infrastructure and defense (substantially to support its arms export to Ukraine). However, this was also offset by decreased spending on social programs. As a result, the impact of government spending on the GDP in the first quarter of 2023 is expected to be also somewhat neutral.

Conclusion

Based on the four criteria discussed above, it is more likely that the outlook for the 2023 Q1 GDP is bullish. Consumer consumption and domestic investments are expected to positively impact the GDP, while net exports and government spending are expected to be on neutral territory. Nevertheless, this will only be confirmed once the US Bureau of Economic Analysis (BEA) publishes the official GDP result and breakdown later this month.

Given this uncertainty, it is essential to have a resilient portfolio that can withstand economic challenges and downturns. Fortunately, there are now sophisticated portfolio management tools, such as ETF Insider, that look out for you when things get rough and present you with a real-time visual breakdown of your investments, allowing you to adjust your exposure and diversification levels precisely to your needs.

Get started