What are the advantages of investing in the IYT ETF?

Investing in exchange-traded funds (ETFs) has become increasingly popular among investors seeking diversification and exposure to specific sectors or industries. One such ETF that has gained attention is the IYT (iShares Transportation Average ETF). In this article, we will explore the advantages of investing in the IYT ETF and why it may be a suitable choice for investors looking to capitalize on the transportation industry's growth potential.

IYT: Access to the Transportation Sector

The IYT ETF is designed to track the performance of the Dow Jones Transportation Average Index, which comprises 20 transportation-related stocks. By investing in the IYT ETF, investors gain exposure to a diversified portfolio of companies in the transportation sector. This includes airlines, railroads, trucking companies, logistics firms, and other industry participants. The ETF provides a convenient way for investors to access the transportation sector without having to individually select and manage multiple stocks.

One of the key advantages of investing in the IYT ETF is the ability to participate in the growth potential of the transportation industry. As economies expand and global trade continues to increase, the demand for transportation services tends to rise. By holding shares in the IYT ETF, investors can potentially benefit from the sector's growth, as well as from the success of individual companies within the index.

IYT: Diversification and Risk Mitigation

Investing in the IYT ETF offers investors a level of diversification within the transportation sector. The ETF holds a basket of stocks from various companies in the industry, reducing the risk associated with investing in a single stock. Diversification helps spread the risk across different holdings and can help mitigate the impact of any individual company's poor performance on the overall investment.

Furthermore, the IYT ETF provides exposure to a broad range of transportation-related sub-sectors, such as airlines, railroads, and trucking companies. This diversification across different segments of the transportation industry helps to minimize the risk associated with investing in a specific sub-sector. It allows investors to benefit from the growth potential of multiple segments within the transportation industry, which may perform differently under different market conditions.

IYT overlap What are the advantages of investing in the IYT ETF?

IYT overlap What are the advantages of investing in the IYT ETF?

IYT: Liquidity and Transparency

The IYT ETF is listed on major stock exchanges, making it a highly liquid investment vehicle. Investors can easily buy or sell shares of the IYT ETF throughout the trading day at market prices. The liquidity of the ETF ensures that investors can enter or exit their positions quickly and efficiently, without the need to rely on the liquidity of individual stocks.

Additionally, as an ETF, the IYT provides transparency to investors. The fund publishes its holdings on a daily basis, allowing investors to see the underlying securities it holds. This transparency provides investors with the ability to make informed investment decisions and monitor the fund's performance.

Disclaimer: This article is for informational purposes only and does not provide investment advice.

IYT

Compared to actively managed funds, the IYT ETF offers cost-efficiency. With a low expense ratio, the ETF aims to minimize the costs associated with fund management. This cost advantage is beneficial to investors, as it allows them to keep a higher portion of their investment returns. The lower expenses of ETFs make them an attractive option for investors looking for cost-effective ways to gain exposure to specific sectors or industries.

Furthermore, the IYT ETF is easily accessible to both individual and institutional investors. Investors can purchase shares of the ETF through their brokerage accounts, similar to buying individual stocks. This accessibility provides investors with the flexibility to invest in the IYT ETF based on their investment goals, risk tolerance, and investment time horizon.

The IYT ETF offers several advantages to investors seeking exposure to the transportation industry. By investing in the IYT ETF, investors can gain access to a diversified portfolio of transportation-related stocks, participate in the sector's growth potential, and benefit from risk mitigation through diversification. The ETF's liquidity, transparency, cost-efficiency, and accessibility further enhance its appeal as an investment option. However, it's important to conduct thorough research and consider individual investment objectives and risk tolerance before making any investment decisions.

Disclaimer: This article is for informational purposes only and does not provide investment advice.

Source 1: IYT issuer website

Source 2: Reuters article about IYT

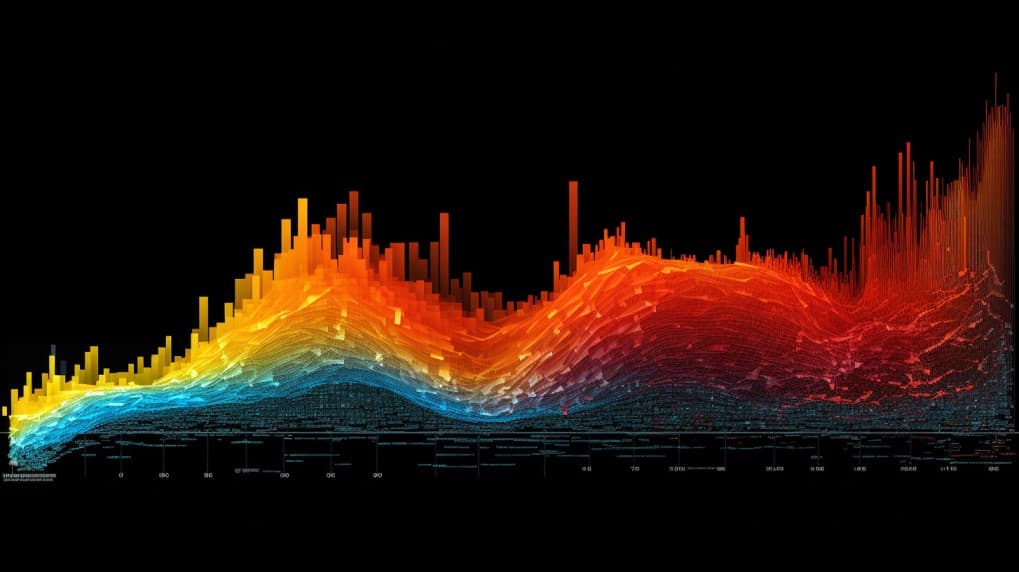

IYT quote and analysis

Discover the top holdings, correlations, and overlaps of ETFs using our visualization tool.

Our app allows you to build and track your portfolio.

To learn more about the IYT iShares US Transportation ETF, access our dedicated page now.

FAQ

What stocks are in IYT?

The specific stocks held by the IYT ETF, or iShares Transportation Average ETF, can change over time. To obtain the current holdings of the IYT ETF, it is recommended to refer to the official fund documentation or the ETF provider's website for the most up-to-date information.

What is the IYT ETF?

The IYT ETF is an exchange-traded fund that aims to provide investors with exposure to the transportation sector of the U.S. equity market.

What is the underlying index that the IYT ETF aims to track?

The IYT ETF aims to track the performance of the Dow Jones Transportation Average Index, which represents a group of transportation stocks that are listed on U.S. stock exchanges.

What types of companies are included in the IYT ETF?

The IYT ETF includes companies from various segments of the transportation industry, such as airlines, railroads, trucking, shipping, and logistics. This provides investors with exposure to a diversified range of transportation-related companies.

How does the IYT ETF work?

The IYT ETF works by pooling investors' funds to purchase a portfolio of securities that closely replicate the performance of the underlying index. By investing in the IYT ETF, investors gain exposure to the overall performance of the transportation sector in the U.S. equity market.