What is the best Nifty 50 ETF?

For investors aspiring to tap into the prowess of India's top 50 large-cap behemoths, the NIFTY 50 ETFs serve as a diversified gateway to the Indian equity terrain. This write-up delves into the premier NIFTY 50 ETFs, setting them against their peers to guide astute investment deliberations.

Highlighting Top NIFTY 50 ETFs : Leading Contenders

The ICICI Prudential Nifty ETF (NSE: ICICINIFTY), helmed by ICICI Prudential Mutual Fund, has etched a formidable footprint in tracking the Nifty 50 index, presenting a diversified mosaic of India's flagship large-cap entities.

Joining the ranks, we have:

UTI Nifty Index Fund (NSE: UTINIFTETF): Orchestrated by UTI Mutual Fund, it aspires to echo the cadence of the Nifty 50 index.

SBI ETF Nifty 50 (NSE: SETFNIF50): SBI Mutual Fund's creation, it illuminates the vibrancy of the Nifty 50 index.

HDFC Index Fund Nifty 50 Plan (NSE: HDFCNIFETF): With the acumen of HDFC Mutual Fund, it stays attuned to the Nifty 50 index dynamics.

When juxtaposed with counterparts, these ETFs unfurl a competitive expense narrative, commendable liquidity, and an allegiance to the Nifty 50 index, endorsing their stature for investors anchored to India's economic narrative.

Probing Deeper into NIFTY 50 ETFs : Global Reverberations

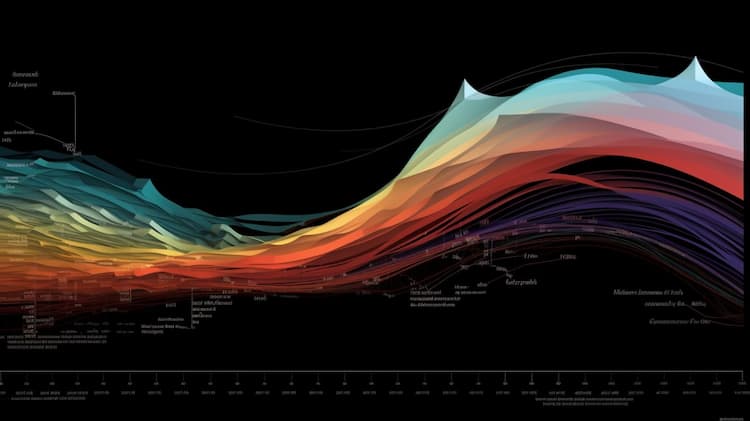

Beyond the domestic marquee, the resonance of Indian equities reverberates in the global ETF space. US ETFs, notably EPI, NFTY, INDI, and INDA, pivot towards Indian equities, thereby enriching the tapestry for investors keen on harmonizing domestic and offshore exposures.

INDA overlap What is the best Nifty 50 ETF?

INDA overlap What is the best Nifty 50 ETF?

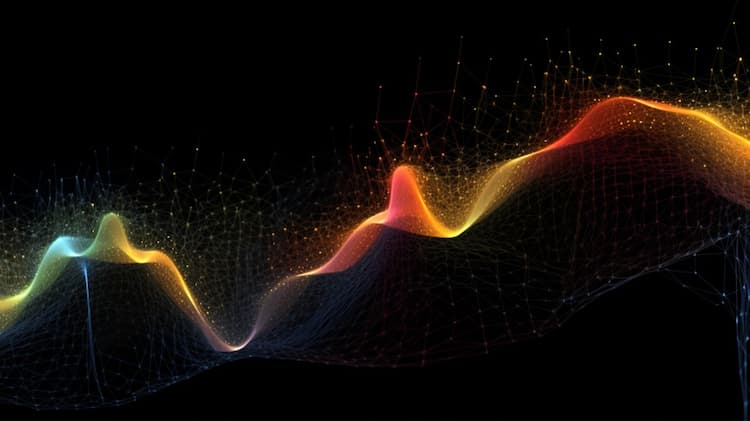

NIFTY 50 ETF Dynamics : Delving into Performance & Risk

Unearthing the quintessential NIFTY 50 ETF mandates an excavation through historical trajectories, expense architectures, liquidity spectra, and risk containment blueprints. Additionally, marrying these insights with individual financial vistas, risk appetites, and timelines is pivotal.

Wrapping Up NIFTY 50 ETFs : Final Thoughts

In summation, luminaries like ICICINIFTY, UTINIFTETF, SETFNIF50, and HDFCNIFETF radiate prominently in the NIFTY 50 ETF constellation. Their symbiosis with global stalwarts such as EPI, NFTY, INDI, and INDA sketches a comprehensive investment tapestry. Nonetheless, meticulous due diligence and alignment with individual financial contours remain sacrosanct.

Disclaimer: This discourse is informational and steers clear of investment advisories.

Sources:

Get startedFAQ

What is the Nifty 50 ETF?

The Nifty 50 ETF is an exchange-traded fund that aims to track the performance of the Nifty 50 index. This index represents the performance of the 50 largest and most liquid stocks listed on the National Stock Exchange of India (NSE).

What are the advantages of investing in the Nifty 50 ETF?

Investing in the Nifty 50 ETF offers diversification across 50 large-cap Indian companies, providing exposure to various sectors of the Indian economy. It allows investors to gain broad market exposure with a single investment and provides liquidity through trading on the stock exchange.

How does the Nifty 50 ETF work?

The Nifty 50 ETF operates by pooling investors' money to purchase a portfolio of securities that mirrors the performance of the Nifty 50 index. The ETF aims to replicate the index's performance by holding the same stocks in the same proportions as the index.

What factors should I consider when choosing the best Nifty 50 ETF?

When selecting the best Nifty 50 ETF, you may consider factors such as expense ratio, tracking error (how closely the ETF tracks the index), trading volume, fund size, and the reputation and experience of the ETF provider.

Can you recommend some popular Nifty 50 ETFs?

While specific recommendations are subjective and depend on individual investment goals, some popular Nifty 50 ETFs include: