What is the EOPS ETF?

EOPS ETF: Overview

In the ever-evolving landscape of financial instruments, Exchange-Traded Funds (ETFs) have gained immense popularity as versatile investment vehicles. One such intriguing option is the EOPS ETF, which stands for Enhanced Opportunity Portfolio Strategy. This article delves into the world of EOPS ETFs, shedding light on their structure, strategies, and potential benefits.

EOPS ETF: A Multifaceted Approach

At its core, the EOPS ETF aims to achieve a balance between capital preservation and total return. The fund's methodology employs a dynamic macro (top-down) and micro (bottom-up) strategy, enabling it to navigate a diverse range of asset classes and individual investments. This approach grants the EOPS ETF the flexibility to seize various investment opportunities across the financial landscape.

The fund's asset allocation strategy is rooted in the evaluation of fundamental investment valuations across different asset classes. This tactic enables the fund manager to identify instances where market prices deviate significantly from fundamental values. As a result, the EOPS ETF is equipped to shift between long and short positions, allocate to cash, and capitalize on opportunities within global capital markets.

[Image_placeholder]

EOPS ETF: Unveiling the Asset Mix

The EOPS ETF's investment portfolio spans an array of asset classes, seeking to provide diversified exposure and manage risk effectively. These asset classes encompass equities of varying market capitalizations, fixed-income securities including high-yield bonds, commodities, real estate investment trusts (REITs), currencies, and options. The fund's strategy involves both long and short positions, and it may utilize exchange-traded funds (ETFs), exchange-traded notes (ETNs), and derivative instruments such as futures, swaps, and options to achieve its objectives. The EOPS ETF also employs a unique approach to short positions, investing in inverse ETFs and ETNs, as well as derivative instruments that provide inverse exposure to specific asset classes or currencies. This blend of traditional and alternative investment instruments positions the fund to navigate different market conditions and enhance returns while managing risks.

EOPS ETF: Navigating Risk and Returns

A distinguishing feature of the EOPS ETF is its active risk management techniques that include options, ETFs, and individual equities to hedge net exposure. This strategy aligns with the fund's goal of preserving capital while seeking to capture opportunities within the market. The fund's net long exposure typically ranges from 70% to 110% of total net assets, although short-term variations can lead it to range from -100% to 225% during active directional exposure phases.The EOPS ETF's investment decisions are grounded in relative valuations. The fund manager purchases or shorts securities based on the perceived attractiveness of their risk-reward profiles compared to other available opportunities. This proactive approach enables the fund to capitalize on discrepancies between intrinsic valuations and market prices, optimizing its investment choices over time.

Conclusion

In the dynamic world of finance, the EOPS ETF offers investors a distinctive opportunity to participate in a versatile investment strategy that blends capital preservation with potential returns. Its broad spectrum of asset classes, coupled with its active management techniques, makes it a noteworthy choice for those seeking a diversified approach to their investment portfolio.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. The EOPS ETF's performance and outcomes are subject to market conditions and inherent risks. Readers are encouraged to conduct their own research and consult financial professionals before making investment decisions.

Sources:

The Adviser's Investment Strategy for the EOPS ETF

EOPS ETF Fund Overview and Asset Allocation

EOPS ETF Risk Management and Active Approach

Fund Valuation and Investment Decision-Making Process

EOPS ETF issuer

EOPS ETF official page

EOPS quote and analysis

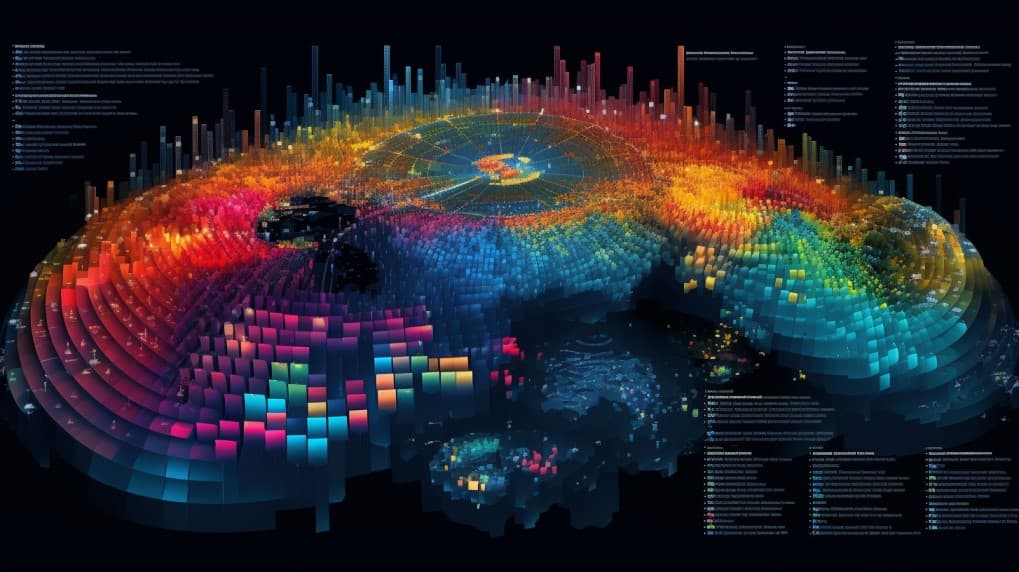

Discover the top holdings, correlations, and overlaps of ETFs using our visualization tool.

Our app allows you to build and track your portfolio.

To learn more about the EOPS Emles Alpha Opportunities ETF, access our dedicated page now.

FAQ

What is the EOPS ETF?

EOPS ETF, is an exchange-traded fund that provides investors with exposure to companies operating in the relevant sector.

What is the underlying index that the EOPS ETF aims to track?

EOPS ETF aims to track the performance of a specific index, which includes companies involved in various aspects of the relevant industry.

What types of companies are included in the EOPS ETF?

EOPS ETF includes companies from the relevant industry, which may consist of specialized firms, equipment manufacturers, and other related entities.

How does the EOPS ETF work?

EOPS ETF functions by pooling investors' capital to purchase a diversified portfolio of related stocks, aiming to replicate the performance of the underlying index.

What are the advantages of investing in the EOPS ETF?

Investing in the EOPS ETF offers exposure to a specialized sector with potential for growth and innovation. It allows investors to diversify within the industry, which could experience significant advancements and expansion in the future.