What is the IBDD ETF?

IBDD ETF: Overview

In the intricate world of finance, Exchange-Traded Funds (ETFs) have emerged as popular investment vehicles, providing investors with diverse opportunities to participate in markets. One such ETF, the iShares iBonds Mar 2023 Term Corporate ex-Financials ETF (IBDD), stands out as a unique financial instrument with its specific attributes and investment objectives.

IBDD ETF: What is it?

The IBDD ETF is designed to achieve its investment objectives by investing in a combination of fixed-income securities and other underlying funds, including those managed by iShares. Its primary aim is to correspond to the investment results of the Bloomberg Barclays 2023 Maturity Corporate Index, a benchmark that includes a range of U.S. dollar-denominated, investment-grade corporate bonds scheduled to mature between March 31, 2022, and April 1, 2023.

[Image placeholder]

IBDD ETF: Subtopic 1 - Investment Strategy

To accomplish its goals, the IBDD ETF adopts a passive investment approach, aiming to mirror the performance of its designated index. Unlike actively managed funds, the IBDD ETF doesn't seek to outperform the index but instead strives to provide investors with returns similar to those of the Bloomberg Barclays 2023 Maturity Corporate Index. This strategy involves holding a representative sample of securities that align with the characteristics of the underlying index, maintaining an investment profile akin to that of the benchmark.

IBDD ETF: Subtopic 2 - Investment Composition

The IBDD ETF's portfolio includes a mix of individual fixed-income securities and other iShares funds. While its main focus is on corporate bonds, it may also invest in exchange-traded funds (ETFs), U.S. government securities, short-term paper, cash equivalents, and money market funds. This diversified approach allows investors exposure to various asset classes and market segments while adhering to the overarching investment objective.

IBDD ETF: Subtopic 3 - Termination and Liquidation

It's crucial to note that the IBDD ETF is a term fund with a defined lifespan. As of its plan of liquidation, set for March 31, 2023, the ETF will distribute its remaining net assets to shareholders. The ETF doesn't aim to provide predetermined returns at maturity or through periodic distributions. Instead, its investment strategy centers around tracking the Bloomberg Barclays 2023 Maturity Corporate Index until its termination date.

Conclusion

In the realm of financial instruments, ETFs like the IBDD play a significant role in providing investors with targeted exposure to specific segments of the market. The IBDD ETF's unique investment strategy, which aligns with its underlying index, showcases the variety of approaches available to investors seeking to diversify their portfolios and navigate the intricacies of the financial world.

Disclaimer: This article is for informational purposes only and does not provide investment advisory services.

Sources: The information provided in this article is based on publicly available sources, including the fund's prospectus and official documentation. It's important to conduct thorough research and consult with financial professionals before making any investment decisions.

IBDD ETF issuer

IBDD ETF official page

IBDD quote and analysis

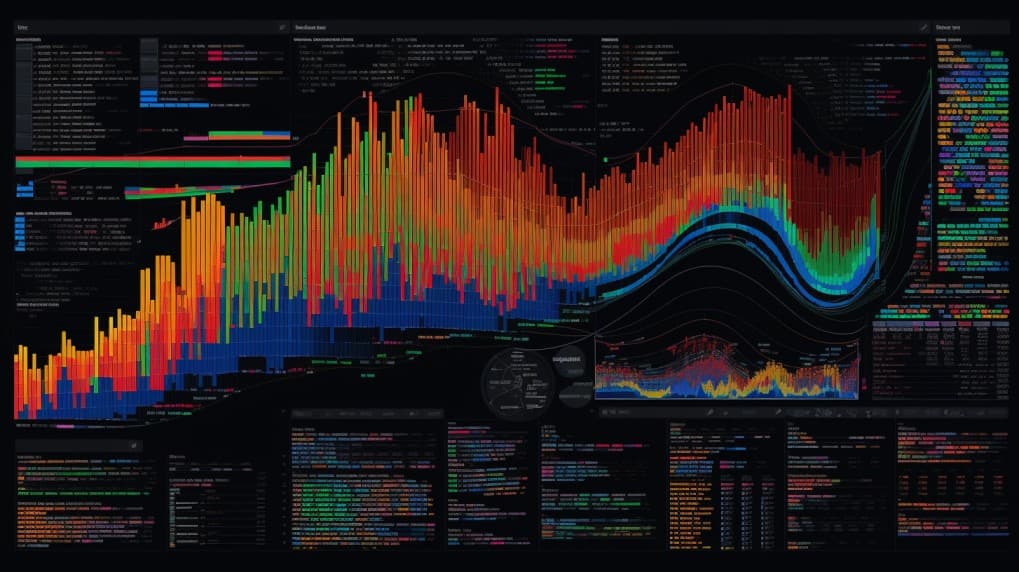

Discover the top holdings, correlations, and overlaps of ETFs using our visualization tool.

Our app allows you to build and track your portfolio.

To learn more about the IBDD iShares iBonds Mar 2023 Term Corporate ETF, access our dedicated page now.

FAQ

What is the IBDD ETF?

IBDD ETF, is an exchange-traded fund that provides investors with exposure to companies operating in the relevant sector.

What is the underlying index that the IBDD ETF aims to track?

IBDD ETF aims to track the performance of a specific index, which includes companies involved in various aspects of the relevant industry.

What types of companies are included in the IBDD ETF?

IBDD ETF includes companies from the relevant industry, which may consist of specialized firms, equipment manufacturers, and other related entities.

How does the IBDD ETF work?

IBDD ETF functions by pooling investors' capital to purchase a diversified portfolio of related stocks, aiming to replicate the performance of the underlying index.

What are the advantages of investing in the IBDD ETF?

Investing in the IBDD ETF offers exposure to a specialized sector with potential for growth and innovation. It allows investors to diversify within the industry, which could experience significant advancements and expansion in the future.