ETF Analysis

How can I invest in the INDA ETF?

Title: Investing in the INDA ETF: A Guide for Investors Description: This article provides a concise guide for investors interested in investing in the INDA ETF (iShares MSCI India ETF). It highlights the key steps and considerations involved in investing in this exchange-traded fund, offering insights into its purpose, performance, and potential benefits for those looking to gain exposure to the Indian stock market.

How does the AAXJ ETF work?

The AAXJ ETF, also known as the iShares MSCI All Country Asia ex Japan ETF, is designed to track the performance of Asian equity markets, excluding Japan. This exchange-traded fund (ETF) allows investors to gain exposure to a diversified portfolio of stocks from various Asian countries, including China, South Korea, Taiwan, and India, among others. The AAXJ ETF provides a convenient way for investors to participate in the growth potential of Asian markets while diversifying their investment across multiple countries and sectors within the region.

How can I invest in the AAXJ ETF?

To invest in the AAXJ ETF (iShares MSCI All Country Asia ex Japan Index Fund), you can follow these steps: Open a brokerage account with a reputable financial institution that offers access to ETF trading. Fund your account with the desired investment amount. Search for the AAXJ ETF using its ticker symbol and place a buy order for the number of shares you want to purchase. Review and confirm the transaction, considering any associated fees. Note: It's important to conduct thorough research and consider your investment goals and risk tolerance before investing in any ETF or financial instrument. Consulting with a financial advisor can also provide valuable insights tailored to your specific situation.

How does the IYF ETF work?

The IYF ETF, or iShares U.S. Financials ETF, is a type of exchange-traded fund that aims to track the performance of the U.S. financial sector. It invests in a diversified portfolio of stocks from companies in industries such as banking, insurance, and real estate. Investors can buy shares of the IYF ETF on the stock exchange, allowing them to gain exposure to a broad range of financial companies in a convenient and cost-effective manner.

How can I invest in the IYF ETF?

To invest in the IYF ETF (iShares U.S. Financials ETF), you can follow these steps: Open a brokerage account with a reputable financial institution that offers access to ETFs. Fund your brokerage account with the desired investment amount. Search for the IYF ETF using its ticker symbol and place a buy order for the number of shares you wish to purchase. Monitor your investment periodically and consider consulting with a financial advisor to ensure it aligns with your investment goals and risk tolerance. This article provides a concise guide on how to invest in the IYF ETF, enabling readers to understand the necessary steps involved in accessing this specific financial instrument.

How does the EWL ETF work?

The EWL ETF, or Environmental, Social, and Governance (ESG) Weighted Large Cap ETF, is an investment fund that aims to provide exposure to large-cap stocks with high ESG ratings. It selects and weights its holdings based on various ESG criteria, such as environmental impact, social responsibility, and corporate governance practices. This article provides a brief overview of how the EWL ETF operates and its focus on sustainable investing in alignment with ESG principles.

How can I invest in the EWL ETF?

To invest in the EWL ETF (Exchange-Traded Fund), you can follow a few simple steps. First, open an account with a brokerage firm that offers access to the stock market. Then, search for the ticker symbol "EWL" on the brokerage's trading platform. Finally, place an order to buy shares of the EWL ETF, specifying the desired quantity. Ensure you review the fund's prospectus and understand its investment objectives, risks, and fees before making any investment decisions.

Advantages of investing in the MCHI ETF

Investing in the MCHI ETF offers several advantages, including diversification, liquidity, accessibility, cost-effectiveness, and transparency.

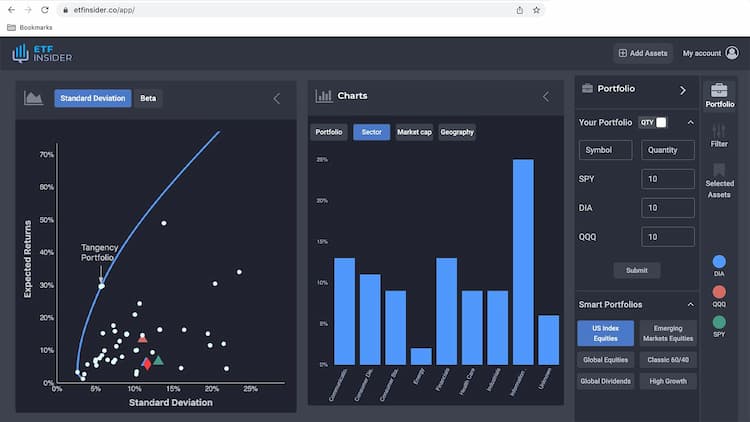

Automated/Algorithmic Trading is not as Good

There are now advanced data visualization tools, such as ETF Insider, that help bridge the gap between complete automation and active investment management.