SPXS VS TECS: A Comprehensive Comparison of ETFs

Exchange-Traded Funds (ETFs) have transformed the investment landscape, offering investors diverse exposure to various sectors and asset classes. In this article, we will conduct an in-depth comparison between two prominent ETFs: SPXS (Direxion Daily S&P 500 Bear 3X Shares) and TECS (Direxion Daily Technology Bear 3X Shares). Our analysis will cover essential aspects, including ETF tickers, full names, issuers, sectors, top holdings, capitalization, strategy, tracking, and exposure.

SPXS VS TECS: Overview

SPXS and TECS serve distinct purposes within the ETF space. SPXS aims to provide investors with triple daily inverse exposure to the S&P 500 Index, which means it seeks to achieve three times the inverse daily performance of the index. On the other hand, TECS targets the technology sector by offering triple daily inverse exposure to the Technology Select Sector Index. These ETFs are designed for investors who anticipate short-term declines in their respective benchmark indices.

SPXS VS TECS: Sectors and Top Holdings

SPXS primarily focuses on providing inverse exposure to the entire S&P 500 Index, encompassing a broad range of sectors such as technology, healthcare, finance, and more. TECS, however, zooms in on the technology sector specifically. It aims to deliver inverse returns of technology-related stocks. Top holdings of SPXS might include companies like Apple, Microsoft, and Amazon due to their significant weight in the S&P 500. In contrast, TECS could hold companies like Apple, Microsoft, and Nvidia as its top constituents, given their prominence in the technology sector.

SPXS overlap SPXS VS TECS: A Comprehensive Comparison of ETFs

SPXS overlap SPXS VS TECS: A Comprehensive Comparison of ETFs

SPXS VS TECS: Capitalization and Strategy

SPXS and TECS exhibit varying capitalization and strategies. SPXS's asset under management (AUM) reflects its role as a tool for investors seeking to hedge against or profit from declines in the S&P 500. TECS, focusing on the technology sector, provides a similar approach but specifically targets technology-related stocks. The difference in capitalization and strategy between these two ETFs creates different risk and return profiles, making it crucial for investors to align their choices with their outlook and risk tolerance.

SPXS VS TECS: Tracking and Exposure

SPXS and TECS employ leverage and aim to deliver daily inverse returns to their respective indices. This means they are designed to magnify daily moves in the opposite direction of their benchmarks. However, it's important to note that these ETFs are primarily designed for short-term trading and should be approached with caution due to the potential for magnified losses in volatile markets.

Conclusion

SPXS and TECS cater to investors seeking short-term inverse exposure to the S&P 500 and the technology sector, respectively. For those interested in delving deeper into the nuances of these ETFs, such as their holdings, correlations, and overlaps, utilizing tools like ETF insider can provide valuable insights. This user-friendly app empowers investors to explore and analyze various financial instruments effectively.

Disclaimer: This article is for informational purposes only and does not provide investment advisory services.

Sources: Direxion ETFs official website, ETF issuer documentation.

SPXS ETF issuer

SPXS ETF official page

SPXS quote and analysis

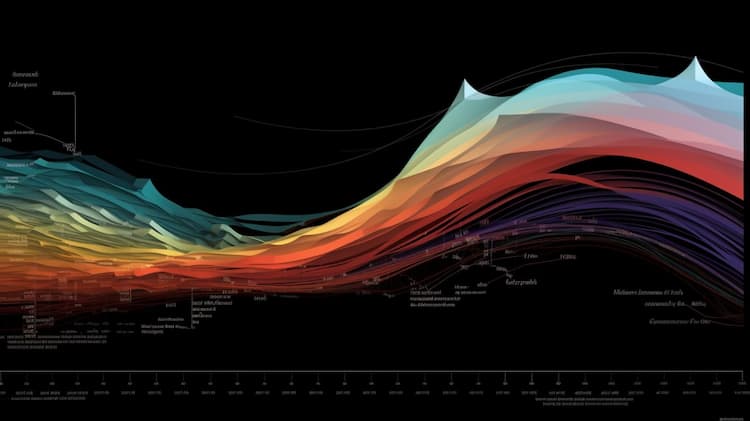

Discover the top holdings, correlations, and overlaps of ETFs using our visualization tool.

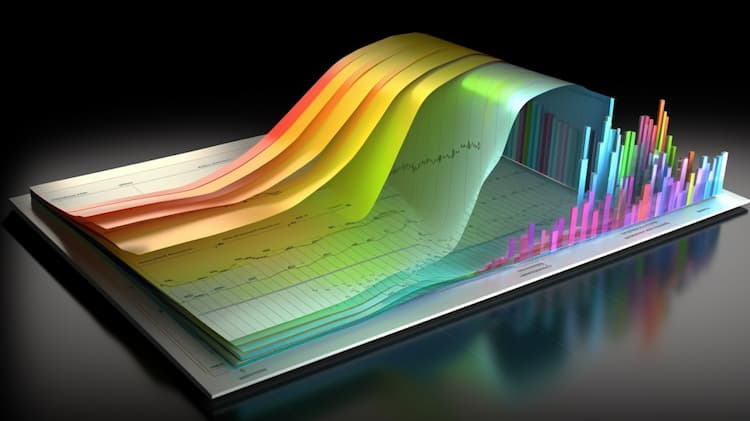

Our app allows you to build and track your portfolio.

To learn more about the SPXS Direxion Daily S&P 500 Bear 3x Shares, access our dedicated page now.