What are the best index ETFs?

When it comes to investing in the stock market, Exchange-Traded Funds (ETFs) have gained significant popularity among investors. ETFs provide a convenient and cost-effective way to gain exposure to various market segments, including indexes. In this article, we will explore some of the best index ETFs available in the market and compare them to similar options.

Comparing Real ETFs: SPDR S&P 500 ETF Trust and Invesco QQQ Trust

Two of the top index ETFs in the market are the SPDR S&P 500 ETF Trust and the Invesco QQQ Trust. The SPDR S&P 500 ETF Trust tracks the S&P 500 index, offering investors broad exposure to the U.S. large-cap equity market. On the other hand, the Invesco QQQ Trust tracks the Nasdaq 100 index, providing exposure to leading non-financial companies listed on the Nasdaq Stock Market. Both ETFs have competitive expense ratios and a strong track record of delivering consistent returns.

Understanding ETFs and their Benefits

ETFs are investment funds that are listed and traded on stock exchanges, similar to individual stocks. They aim to replicate the performance of an underlying index, such as the S&P 500 or Nasdaq 100. ETFs provide several advantages to investors, including diversification, transparency, and flexibility. By investing in an ETF, investors can gain exposure to a basket of securities with a single trade, reducing the risk associated with individual stocks.

Choosing the Right Index ETF

When selecting an index ETF, investors should consider several factors. These include the expense ratio, tracking error, liquidity, and the underlying index. The expense ratio represents the annual cost of owning the ETF, while tracking error measures how closely the ETF tracks its underlying index. Liquidity is important for ease of trading, especially when investing in smaller or niche market segments. Additionally, understanding the composition and methodology of the underlying index is crucial to align investment objectives with the ETF's holdings.

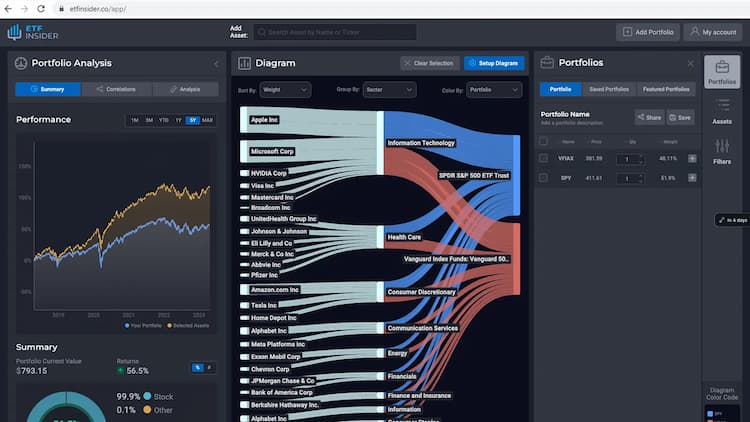

QQQ,SPY overlap What are the best index ETFs?

QQQ,SPY overlap What are the best index ETFs?

The Future of Index ETFs

Index ETFs have gained significant traction in recent years and are expected to continue growing in popularity. As more investors recognize the benefits of passive investing and seek cost-effective solutions, the demand for index ETFs is likely to increase. Additionally, advancements in technology and the availability of new indexes will likely lead to the introduction of innovative and specialized index ETFs, catering to specific market segments or investment themes.

Conclusion

In summary, the best index ETFs provide investors with a cost-effective and efficient way to gain exposure to various market segments. When selecting an ETF, it is important to consider factors such as expense ratio, tracking error, liquidity, and the underlying index. By conducting thorough research and understanding individual investment objectives, investors can make informed decisions about which index ETFs align best with their investment strategies.

Disclaimer: This article is for informational purposes only and does not provide any investment advisory services.

Sources:

SPDR S&P 500 ETF Trust:

Invesco QQQ Trust:

Investopedia:

FAQ

What are the best index ETFs?

The best index ETFs can vary depending on individual preferences and investment goals. However, here are six popular index ETFs worth considering:

What factors should I consider when evaluating index ETFs?

When evaluating index ETFs, consider factors such as expense ratios, tracking error, liquidity, assets under management (AUM), index methodology, and the overall market outlook for the specific index the ETF tracks.

How do I choose the right index ETF for my investment goals?

To choose the right index ETF for your investment goals, consider your risk tolerance, investment time horizon, desired exposure to specific market segments or asset classes, and your preference for diversification.

Are there any specific risks associated with investing in index ETFs?

While index ETFs generally offer broad market exposure and diversification, they are still subject to market risks. These risks include market volatility, economic downturns, geopolitical events, and fluctuations in the underlying index.

How can I research the performance of index ETFs?

You can research the performance of index ETFs by analyzing historical returns, comparing them to the performance of the underlying index, reviewing fund prospectuses and fact sheets, and considering ratings and analysis from reputable financial research providers.