What is the best S&P 500 ETF?

In this article, we will explore the best S&P 500 ETF, an exchange-traded fund that aims to track the performance of the S&P 500 Index, one of the most widely followed benchmarks for the U.S. stock market. The S&P 500 ETF provides investors with exposure to a diversified portfolio of large-cap U.S. companies and is a popular choice for those seeking long-term growth and stability.

Comparing the Best S&P 500 ETF

One real S&P 500 ETF that investors may consider is the "SPDR S&P 500 ETF Trust" (Ticker: SPY). This ETF is one of the oldest and most widely traded funds that track the S&P 500 Index. It provides investors with exposure to the 500 largest publicly traded companies in the U.S., representing various sectors of the economy.

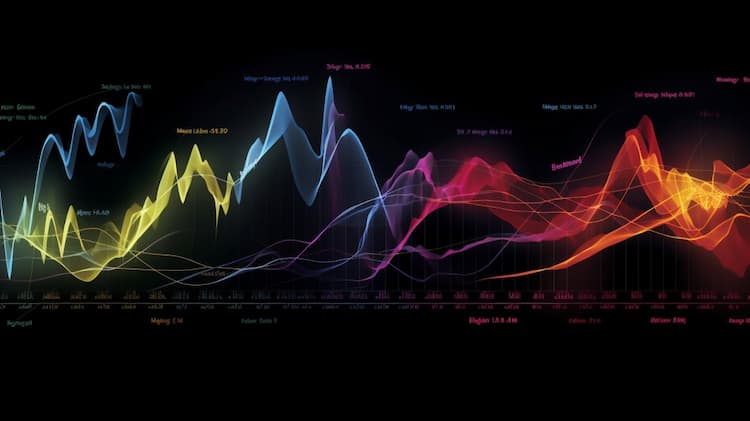

To find the best S&P 500 ETF, we will compare "SPDR S&P 500 ETF Trust" (SPY) with other similar S&P 500 ETFs available in the market. Investors can assess factors such as expense ratios, trading volume, and fund size to make an informed decision.

Benefits of Investing in the Best S&P 500 ETF

The best S&P 500 ETF offers several benefits, including instant diversification across 500 large-cap U.S. companies, low expense ratios, and high liquidity due to its popularity among investors. This ETF provides a cost-effective way to gain exposure to the overall U.S. stock market and can serve as a core holding in a well-diversified investment portfolio.

Additionally, the best S&P 500 ETF historically has shown strong long-term performance, making it an attractive choice for investors seeking growth potential over time.

SPY overlap What is the best S&P 500 ETF?

SPY overlap What is the best S&P 500 ETF?

Risks and Considerations

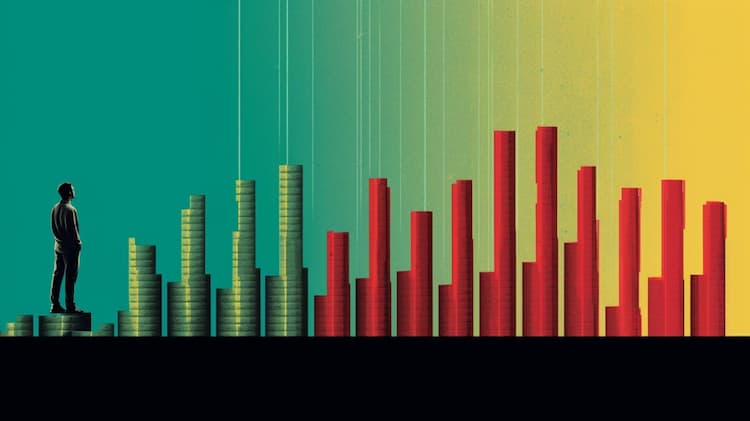

While the best S&P 500 ETF offers broad exposure to the U.S. stock market, it is not immune to market fluctuations and economic downturns. Investors should be prepared for short-term volatility and fluctuations in the value of their investments.

Furthermore, it is essential to understand that past performance does not guarantee future results, and it is crucial to have a long-term investment horizon when investing in equity-based ETFs.

Conclusion

Selecting the best S&P 500 ETF is an important decision for investors seeking exposure to the U.S. stock market's top companies. By comparing "SPDR S&P 500 ETF Trust" (SPY) with other similar S&P 500 ETFs, investors can determine the fund that aligns best with their investment goals and risk tolerance.

Disclaimer: This article is for informational purposes only and does not provide any investment advisory services.

Sources:

SPY ETF issuer

SPY ETF official page

FAQ

What is the SPY ETF?

The SPY ETF, also known as the SPDR S&P 500 ETF Trust, is an exchange-traded fund that aims to track the performance of the S&P 500 index, which is a widely recognized benchmark for the U.S. stock market.

How does the SPY ETF work?

The SPY ETF operates by holding a portfolio of stocks that closely mirrors the composition and weightings of the underlying S&P 500 index. Investors can buy shares of the SPY ETF, which represents an ownership stake in the underlying stocks.

What are the advantages of investing in the SPY ETF?

Investing in the SPY ETF offers several advantages, including broad exposure to the U.S. stock market, diversification across 500 large-cap companies, lower costs compared to actively managed funds, and the ability to trade throughout the trading day.

Are there any alternatives to the SPY ETF for tracking the S&P 500?

Yes, there are other ETFs that aim to track the S&P 500 index, such as the iShares Core S&P 500 ETF (IVV) and the Vanguard S&P 500 ETF (VOO). These ETFs have similar objectives but may have slight differences in expense ratios or fund structures.

How can I invest in the SPY ETF or other S&P 500 ETFs?

To invest in the SPY ETF or other S&P 500 ETFs, you can open an account with a brokerage firm that offers access to ETFs. Once your account is set up, you can buy shares of the desired ETF using the ticker symbol, such as SPY for the SPDR S&P 500 ETF Trust.