5 Key Differences between S&P 500 Mutual Funds and ETFs

The five core differences between S&P 500 Mutual Funds and ETFs with the goal of helping you make an informed investment decision.

The SPDR S&P 500 ETF Trust (SPY) is one of the most widely recognized and popular funds in the investment world. Established in January 1993, SPY aims to track the Standard & Poor's (S&P) 500 Index, comprising 500 large-cap U.S. stocks. Being the first index exchange-traded fund listed on U.S. exchanges, SPY has set a precedent in the investment community. By reflecting the market size, liquidity, and industry dynamics of the U.S. equity market, the SPY ETF has become a go-to investment vehicle for investors seeking exposure to the large-cap segment of the market.

While the provided source doesn't explicitly mention the dividend aspect of the SPDR S&P 500 ETF Trust (SPY), we can infer that as a tracker of the S&P 500 Index, SPY likely mirrors the dividend distribution of the underlying index. This involves quarterly distributions derived from the constituent companies' individual dividend policies and performances. Investors seeking both capital growth and regular income find SPY to be an attractive option, as it offers diversification with the potential for dividend returns.

Tracking the S&P 500 Index is at the core of the SPDR S&P 500 ETF Trust's investment strategy. SPY holds 500 large-cap U.S. stocks selected based on market size, liquidity, and industry. The fund's aim to closely align with the S&P 500 serves as one of the main benchmarks of the U.S. equity market, indicating the financial health and stability of the economy. With an average annual return of just under 10% since its inception, SPY has proven its ability to effectively track the index, making it a preferred choice for investors.

The correlation aspect of the SPDR S&P 500 ETF Trust (SPY) plays a crucial role in understanding its behavior in relation to the broader U.S. equity market. Since SPY tracks the S&P 500 Index, its correlation with the overall market is expected to be high. This strong correlation makes SPY an effective tool for hedging, diversification, and risk management within investment portfolios. Investors often analyze SPY's correlation with other assets and sectors to make informed decisions, thus providing valuable insights into broader market trends.

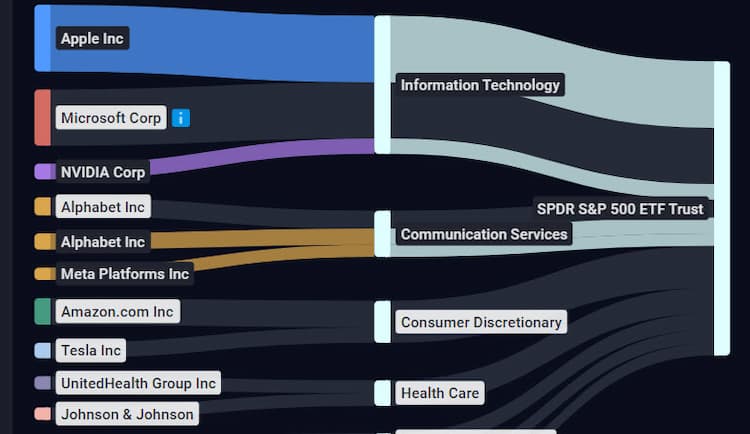

Approximately one-quarter of the SPDR S&P 500 ETF Trust (SPY) is invested in the information technology sector. By reflecting the sector composition of the S&P 500 Index, SPY provides exposure to various sectors, including technology, healthcare, finance, and more. The balanced exposure to different economic segments enhances SPY's appeal as a diversified investment tool. Investors seeking alignment with various market sectors find SPY to be a versatile and efficient means of achieving their investment goals.

The exposure characteristic of the SPDR S&P 500 ETF Trust (SPY) emphasizes its comprehensive focus on the U.S. equity market. By mirroring the S&P 500 Index, SPY offers investors access to the large-cap segment of the U.S. stock market. This broad exposure enables investors to capitalize on the growth and resilience inherent in the American economy. Whether used as a core holding or as part of a more complex investment strategy, SPY's market exposure provides flexibility and adaptability to suit various investment needs and preferences.

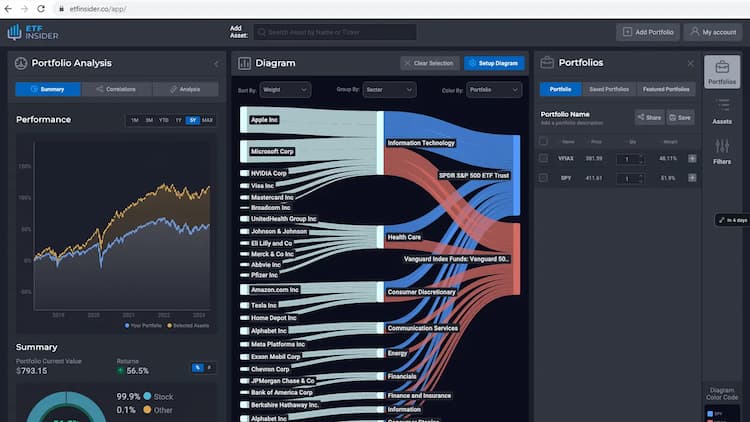

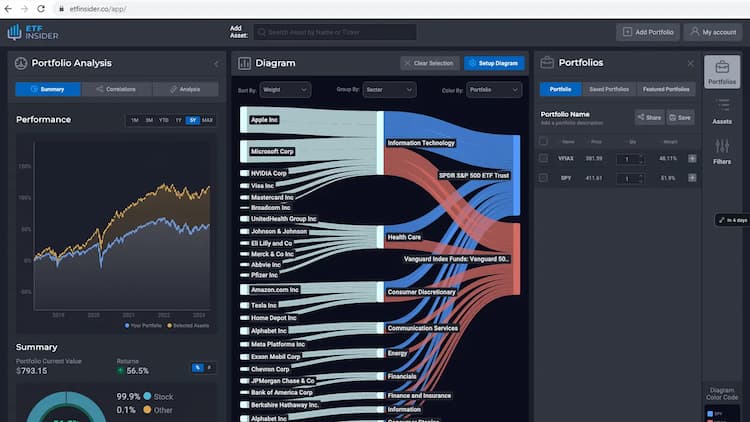

ETF Insider is a data-driven portfolio analytics and optimization platform that introduces a more efficient and practical way to visualize, analyze and optimize portfolios.

Rather than focusing on the surface-level attributes of ETFs and Mutual Funds, ETF Insider goes deeper by examining the underlying holdings of exchange traded products.

By organizing and structuring that data, investors can easily navigate within their overlapping layers.

This innovative perspective combined with modern data visualization and modeling tools, provides an entirely new approach to portfolio optimization that can quickly expose both portfolio inefficiencies and opportunities.

The five core differences between S&P 500 Mutual Funds and ETFs with the goal of helping you make an informed investment decision.

SPY (SPDR S&P 500 ETF Trust) and IWM (iShares Russell 2000 ETF) are both exchange-traded funds (ETFs) that represent different segments of the U.S. stock market. While SPY tracks the performance of the S&P 500 index, which consists of large-cap stocks, IWM tracks the Russell 2000 index, comprising small-cap stocks. While there may be some correlation between the two ETFs due to overall market movements, their focus on different market segments means they can also exhibit divergent performance at times.

Determining the precise percentage of XBI's holdings in SPY requires accessing the latest information from the official sources of both ETFs.

ETF Insider is a novel portfolio optimization tool that uses the power of data visualization to gain insight into portfolio compositions, concentration risks, portfolio efficiency and more. Complex financial data can be transformed into visually appealing and easily digestible graphs and charts, allowing investors to quickly identify trends and make well-informed investment decisions. Not only does this save time, but it also increases the accuracy and effectiveness of portfolio management.