ETF with Apple Inc. and Vertex Pharmaceuticals Inc. Exposure (Nasdaq)

Navigating through the financial markets to find the right investment tool can be a convoluted task for both beginners and seasoned investors alike. With a focus on Exchange Traded Funds (ETFs), particularly those that provide exposure to notable companies like Apple Inc. and Vertex Pharmaceuticals Inc., let's delve into a detailed understanding and comparative analysis to guide investment decisions in the Nasdaq arena.

ETF with Apple Inc. and Vertex Pharmaceuticals Inc. Exposure (Nasdaq): Exposure

Exploring ETFs that provide significant exposure to high-performing companies like Apple Inc. and Vertex Pharmaceuticals Inc., which are traded on Nasdaq, becomes imperative for discerning investors. Both of these companies are key players in their respective sectors and offer an enticing mix of stability and growth potential. ETFs such as the Invesco QQQ Trust (QQQ) or the Invesco NASDAQ Composite ETF (QQQJ) tend to have substantial holdings in Apple given its stature and market cap. For biotechnology enthusiasts eyeing Vertex, the iShares NASDAQ Biotechnology ETF (IBB) can be a pertinent choice, providing a strategic investment pathway into the biotech sector without having to hedge bets on a single stock.

ETF with Apple Inc. and Vertex Pharmaceuticals Inc. Exposure (Nasdaq): Comparisons of

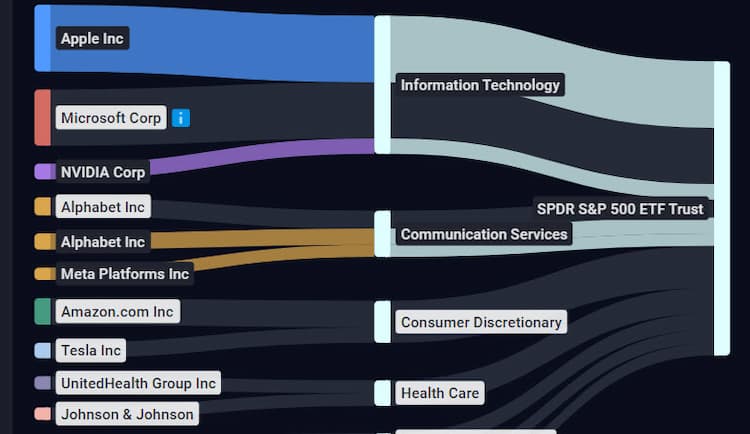

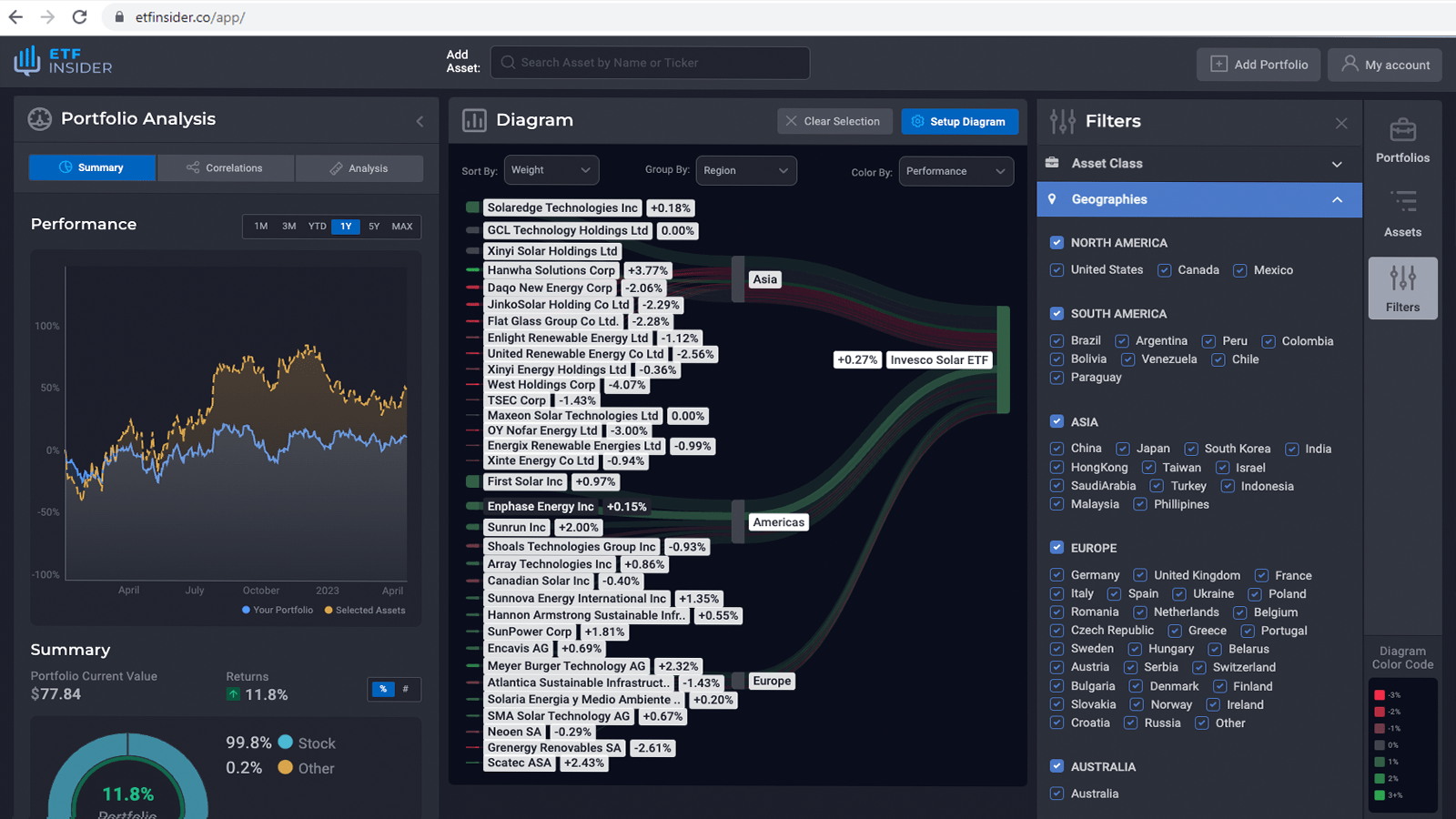

Drawing a comparison, ETFs with a solid footing in Apple and Vertex often exhibit a balanced dichotomy between technology and healthcare sectors. While ETFs like QQQ predominantly cater to the technology and internet sector, with significant exposure to Apple, IBB leans towards the biotechnology space, encapsulating companies like Vertex. On the contrary, if we glance at SPDR S&P 500 ETF Trust (SPY) or iShares Core S&P 500 ETF (IVV) from the S&P 500 offerings, they cater to a wider array of sectors and could be considered by investors looking for diversified exposure beyond the tech and biotech spheres.

SPY overlap ETF with Apple Inc. and Vertex Pharmaceuticals Inc. Exposure (Nasdaq)

SPY overlap ETF with Apple Inc. and Vertex Pharmaceuticals Inc. Exposure (Nasdaq)

ETF with Apple Inc. and Vertex Pharmaceuticals Inc. Exposure (Nasdaq): Benefits to invest on those ETFs

Investing in ETFs with notable holdings in Apple and Vertex Pharma yields several benefits as opposed to direct stock picking. Firstly, it provides a buffer against the volatility associated with individual stocks by ensuring diversification. An investment in, say, the Invesco QQQ Trust, while giving considerable exposure to a tech giant like Apple, also spreads the risk across other prominent companies in the Nasdaq-100. Similarly, the iShares NASDAQ Biotechnology ETF, while channeling investments into Vertex Pharmaceuticals, also diversifies investors’ capital among various other biotech entities, thus, mitigating risks and offering a stable investment avenue.

ETF with Apple Inc. and Vertex Pharmaceuticals Inc. Exposure (Nasdaq): Consideration before investing

Prior to capital allocation in ETFs with substantial exposure to Apple and Vertex, it's pivotal for investors to analyze various facets like their risk tolerance, investment goals, and the expense ratios associated with the ETFs. Ensuring that the ETFs align with one’s investment strategy and financial objectives is paramount. Furthermore, being mindful of the sectoral risks, such as regulatory changes in the biotechnology sector or competitive dynamics in the tech industry, is crucial for maintaining a balanced and resilient portfolio. Conclusion: Understanding the mechanics and implications of investing in ETFs, especially those tethered to stalwarts like Apple and Vertex Pharmaceuticals, ensures a sturdy, diversified, and strategic investment. Navigating through the myriad of available ETF options with sagacity ensures not only capital growth but also a shield against potential market volatilities. Disclaimer: This article does not provide investment advisory services. Note: Ensure to conduct thorough research or consult a financial advisor before making any investment decisions.

Source 1: SPY ETF issuer

Source 2: SPY ETF official page

FAQ

What is the SPY ETF?

The SPY ETF is an exchange-traded fund that provides investors exposure to specific assets or companies.

What companies does the SPY ETF have exposure to?

The SPY ETF has exposure to companies like Apple Inc. and Vertex Pharmaceuticals Inc. Exposure.

How can I read more about the SPY ETF?

You can read more about the SPY ETF in various financial publications, websites, and the official ETF documentation.

Why should I consider investing in the SPY ETF?

Investing in ETFs can provide diversification, flexibility, and cost-effectiveness. It's important to do your own research or consult with a financial advisor before making investment decisions.

What is the description for the SPY ETF?

The ETF with Apple Inc. and Vertex Pharmaceuticals Inc. Exposure (Nasdaq) exposure provides investors with an opportunity to diversify their portfolio while gaining insight into the performance and potential of Apple Inc. and Vertex Pharmaceuticals Inc. Exposure (Nasdaq). This ETF offers a comprehensive view of the company's standing in the market, its historical performance, and future prospects.

How is the SPY ETF different from other ETFs?

Each ETF has its own unique investment strategy, holdings, and exposure. It's crucial to understand the specifics of each ETF before investing.