ETF with Applied Materials Inc. exposure

Investing in ETFs has become a widespread strategy for those wanting to balance risk while participating in the financial markets. Specifically, examining the weightage of companies like Applied Materials Inc., which is traded on both the S&P 500 and NASDAQ, provides a lens to understand specific ETF investments better.

ETF with Applied Materials Inc. exposure: exposure

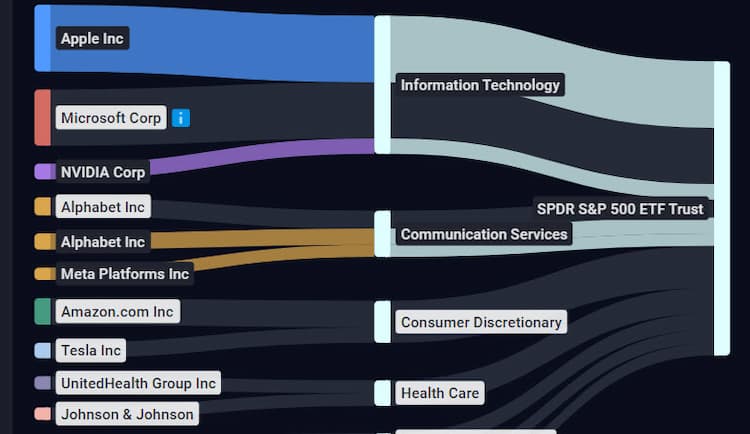

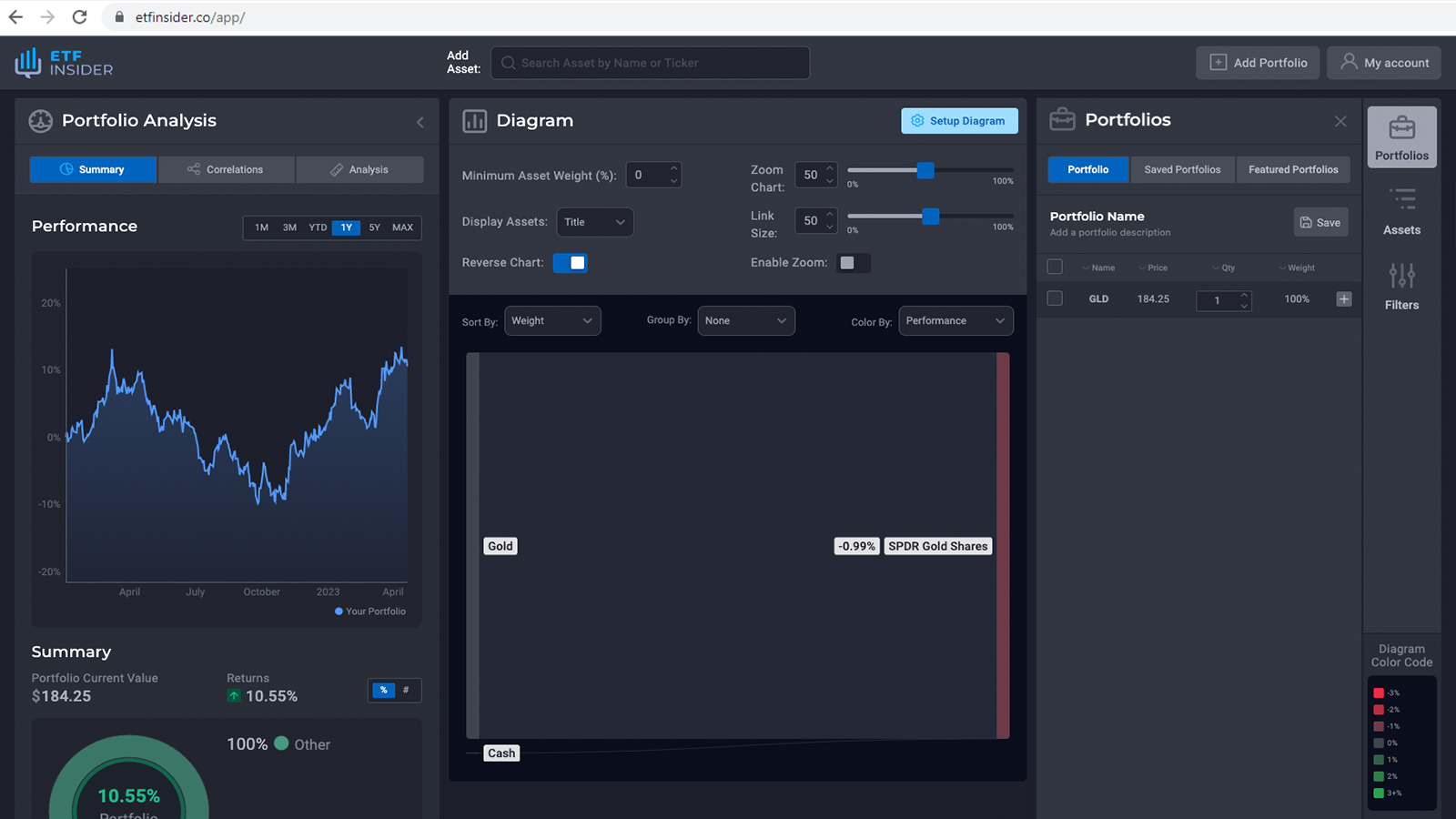

Applied Materials Inc., a company well-recognized in the semi-conductor industry, holds a position in numerous ETFs that track some of the most noted indexes - the S&P 500 and NASDAQ. For instance, the SPDR S&P 500 ETF Trust (SPY) and Invesco QQQ Trust (QQQ), which are acclaimed for their high liquidity and stable performance, accommodate Applied Materials Inc. within their vast, diversified portfolios. Investors seeking exposure to this company, directly and indirectly, might consider these ETFs not only for the individual company performance but also for the collective strength of all portfolio holdings.

ETF with Applied Materials Inc. exposure: comparisons of

Comparatively, investing in ETFs like iShares Core S&P 500 ETF (IVV) or Invesco NASDAQ Composite ETF (QQQJ) not only provides investors with exposure to Applied Materials Inc. but also diversifies their investment across several sectors and companies, mitigating the risks associated with single-stock investments. Moreover, considering ETFs with specialized focuses, such as iShares S&P 500 Value ETF (IVE) and iShares NASDAQ Biotechnology ETF (IBB), allows investors to strategically position themselves in segments of the market (e.g., value-oriented or biotechnology companies), potentially leveraging sector-specific growth while still capitalizing on the stability of well-established companies like Applied Materials Inc.

SPY overlap ETF with Applied Materials Inc. exposure

SPY overlap ETF with Applied Materials Inc. exposure

ETF with Applied Materials Inc. exposure: benefits to invest on those ETFs

Investing in ETFs with exposure to Applied Materials Inc. offers a plethora of benefits when contrasted with direct stock picking. For one, the inherent diversification of ETFs safeguards investors from the volatility and risk of single-stock investments. ETFs such as Vanguard S&P 500 ETF (VOO) or Invesco QQQ Trust (QQQ) allow investors to potentially capitalize on the upward movement of Applied Materials Inc. while being insulated from company-specific downturns, owing to the myriad of other holdings within the ETF. Furthermore, the lowered expense ratios and ease of trading ETFs provide cost and logistic efficiencies that can be particularly advantageous to retail investors.

ETF with Applied Materials Inc. exposure: consideration before investing

When pondering upon investing in ETFs that include Applied Materials Inc. in their portfolio, several considerations must be acknowledged. The investor should gauge their own risk tolerance, investment horizon, and financial objectives. Moreover, understanding the ETF’s strategy, scrutinizing its expense ratio, and analyzing its historical performance relative to corresponding benchmarks are imperative steps before investment. Investors should also be wary of the sector-specific risks, market volatility, and economic factors that might influence the semiconductor industry and, subsequently, Applied Materials Inc.'s performance.

Conclusion

ETFs proffering exposure to stalwarts like Applied Materials Inc. amalgamate the prospects of individual company growth with the safety net of diversified investment. Whether through direct exposure or through correlated sectoral exposure, such ETF investments must be navigated with a robust understanding of the ETF’s structure, strategy, and the underlying market dynamics.

Disclaimer

This article does not provide any investment advisory services.

Source 1: SPY ETF issuer

Source 2: SPY ETF official page

FAQ

What is the SPY ETF?

The SPY ETF is an exchange-traded fund that provides investors exposure to specific assets or companies.

What companies does the SPY ETF have exposure to?

The SPY ETF has exposure to companies like Applied Materials Inc..

How can I read more about the SPY ETF?

You can read more about the SPY ETF in various financial publications, websites, and the official ETF documentation.

Why should I consider investing in the SPY ETF?

Investing in ETFs can provide diversification, flexibility, and cost-effectiveness. It's important to do your own research or consult with a financial advisor before making investment decisions.

What is the description for the SPY ETF?

The ETF with Applied Materials Inc. exposure provides investors with an opportunity to diversify their portfolio while gaining insight into the performance and potential of Applied Materials Inc.. This ETF offers a comprehensive view of the company's standing in the market, its historical performance, and future prospects.

How is the SPY ETF different from other ETFs?

Each ETF has its own unique investment strategy, holdings, and exposure. It's crucial to understand the specifics of each ETF before investing.