ETF with Broadcom Inc. and Vertex Pharmaceuticals Inc. Exposure (Nasdaq)

Navigating the myriad of financial instruments available in today's market, especially those tied to dynamic sectors like technology and pharmaceuticals, can be daunting. This exploration into ETFs that provide exposure to two notable Nasdaq entities, Broadcom Inc. and Vertex Pharmaceuticals Inc., will offer a detailed and thoughtful guide for potential investors.

ETF with Broadcom Inc. and Vertex Pharmaceuticals Inc. Exposure (Nasdaq): Exposure

Investing in Exchange Traded Funds (ETFs) like Invesco QQQ Trust (QQQ) and Invesco NASDAQ Composite ETF (QQQJ) can provide investors with not only a slice of the tech and pharmaceutical industries but specifically, notable access to companies like Broadcom and Vertex. Broadcom Inc., a global technology company, and Vertex Pharmaceuticals Inc., known for its significant strides in clinical pharmacology, are mainstays in various ETFs that track the Nasdaq, offering a blend of stability and growth potential for astute investors. This exposure allows an investor to partake in the success of these companies without having to invest directly in their stocks.

ETF with Broadcom Inc. and Vertex Pharmaceuticals Inc. Exposure (Nasdaq): Comparisons of

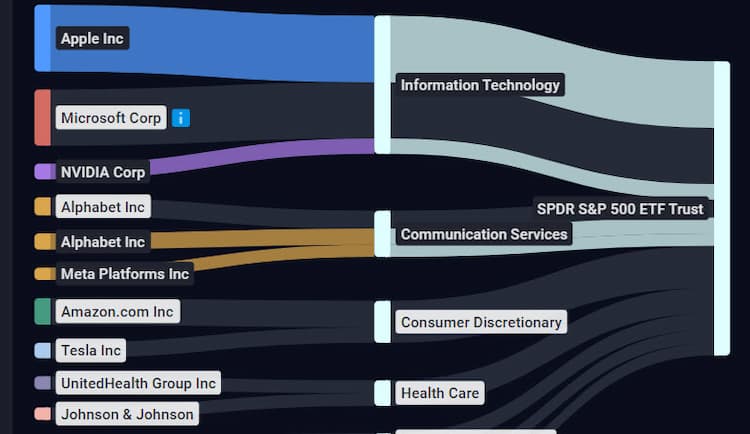

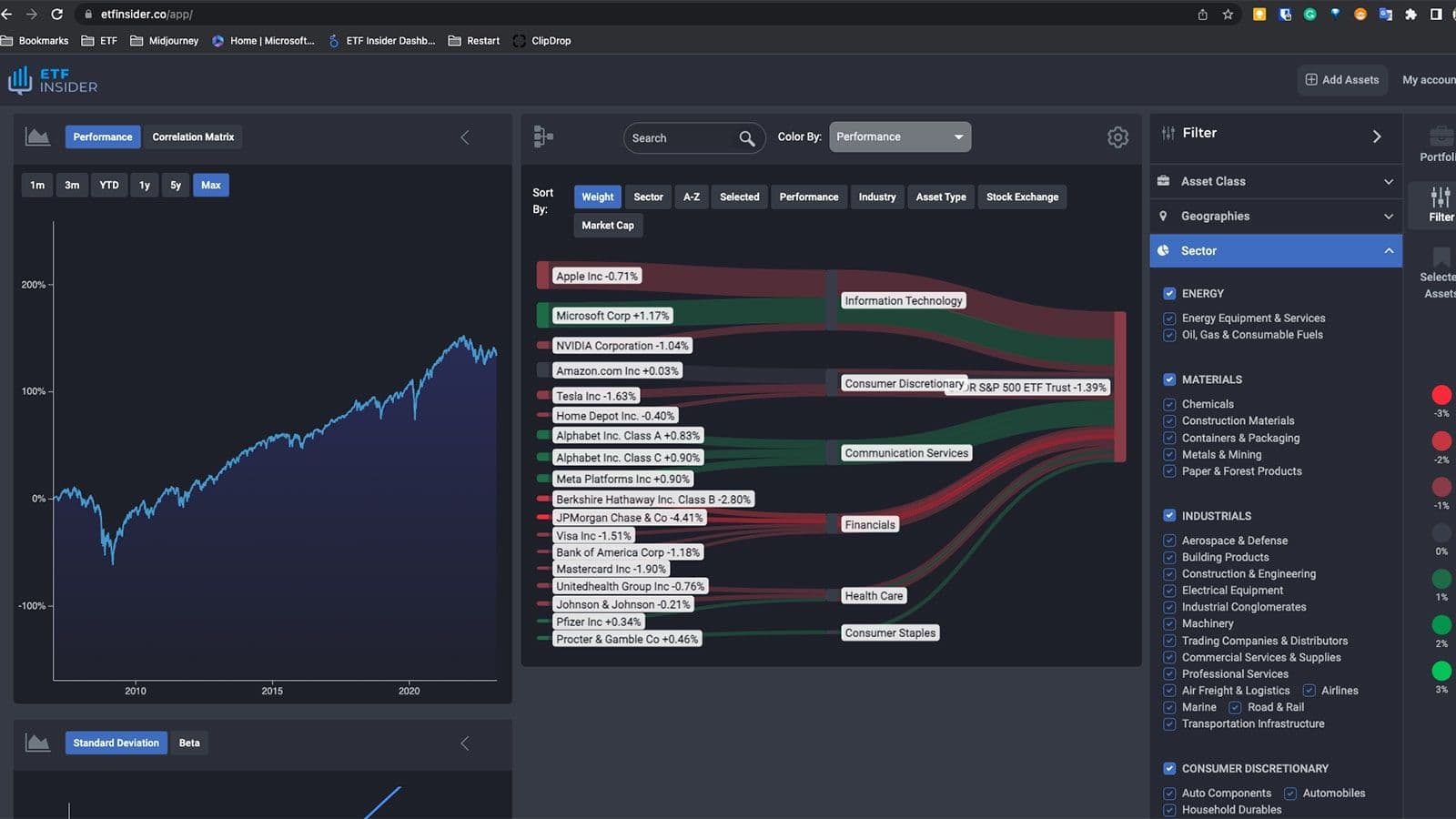

Comparing ETFs with substantial holdings in Broadcom and Vertex to those that don't, clear disparities in performance and risk mitigation become apparent. Take, for instance, the Invesco QQQ Trust (QQQ) which primarily focuses on the tech industry, juxtaposing it with SPDR S&P 500 ETF Trust (SPY), which encompasses a broader market perspective. While both ETFs provide a diversified investment platform, QQQ provides a more concentrated exposure to the tech sector, including Broadcom and Vertex, potentially offering heightened sector-specific growth but also possibly carrying correlated risks.

SPY overlap ETF with Broadcom Inc. and Vertex Pharmaceuticals Inc. Exposure (Nasdaq)

SPY overlap ETF with Broadcom Inc. and Vertex Pharmaceuticals Inc. Exposure (Nasdaq)

ETF with Broadcom Inc. and Vertex Pharmaceuticals Inc. Exposure (Nasdaq): Benefits to Invest in Those ETFs

Investing in ETFs holding Broadcom and Vertex presents numerous advantages when contrasted with direct stock picking. First, it mitigates risks by offering diversified exposure to a basket of companies rather than tying fortunes to the performance of a single entity. Furthermore, these specific ETFs, such as QQQ and QQQJ, delve into the tech and pharmaceutical sectors, combining the innovative and growth-oriented nature of these industries with the relative safety of diversified investment. Not to mention, ETFs often bring with them lower expense ratios than managing a diversified portfolio of individual stocks, providing a cost-efficient avenue to access the potentially lucrative markets in which Broadcom and Vertex operate.

ETF with Broadcom Inc. and Vertex Pharmaceuticals Inc. Exposure (Nasdaq): Consideration Before Investing

Before allocating capital to ETFs exposed to Broadcom and Vertex, a comprehensive understanding of the potential risks and market dynamics is imperative. Sector-specific ETFs, while they can offer robust growth, also bring sector-specific risks – technological and pharmaceutical sectors, for example, can be significantly impacted by regulatory changes, market trends, and innovation cycles. Additionally, the performance of sector-focused ETFs, even those with stalwart entities like Broadcom and Vertex, can still be influenced heavily by market volatilities and global economic trends, demanding a balanced approach and a well-diversified investment strategy. Conclusion: Understanding the specificities and potentialities of ETFs that have exposure to notable companies like Broadcom Inc. and Vertex Pharmaceuticals Inc. can equip investors with the knowledge to make informed, strategic decisions, blending the vigor of sector-specific investment with the prudence of diversified strategy. Disclaimer: This article does not provide investment advisory services and should not be used as a substitute for professional advice.

Source 1: SPY ETF issuer

Source 2: SPY ETF official page

FAQ

What is the SPY ETF?

The SPY ETF is an exchange-traded fund that provides investors exposure to specific assets or companies.

What companies does the SPY ETF have exposure to?

The SPY ETF has exposure to companies like Broadcom Inc. and Vertex Pharmaceuticals Inc. Exposure.

How can I read more about the SPY ETF?

You can read more about the SPY ETF in various financial publications, websites, and the official ETF documentation.

Why should I consider investing in the SPY ETF?

Investing in ETFs can provide diversification, flexibility, and cost-effectiveness. It's important to do your own research or consult with a financial advisor before making investment decisions.

What is the description for the SPY ETF?

The ETF with Broadcom Inc. and Vertex Pharmaceuticals Inc. Exposure (Nasdaq) exposure provides investors with an opportunity to diversify their portfolio while gaining insight into the performance and potential of Broadcom Inc. and Vertex Pharmaceuticals Inc. Exposure (Nasdaq). This ETF offers a comprehensive view of the company's standing in the market, its historical performance, and future prospects.

How is the SPY ETF different from other ETFs?

Each ETF has its own unique investment strategy, holdings, and exposure. It's crucial to understand the specifics of each ETF before investing.