ETF with Microsoft Corp. and Alphabet Inc. Class C Exposure (Nasdaq)

When diving into the investment pool, one often encounters the crucial question: Which ETFs offer substantial exposure to pivotal players like Microsoft and Alphabet on the Nasdaq? Let’s embark on an enlightening exploration to address this essential inquiry.

ETF with Microsoft Corp. and Alphabet Inc. Class C Exposure (Nasdaq): Exposure

In the vast sea of financial instruments, ETFs such as Invesco QQQ Trust (QQQ) and Invesco NASDAQ Composite ETF (QQQJ) emanate as notable vehicles providing considerable exposure to tech giants like Microsoft and Alphabet. While QQQ emphasizes the 100 largest non-financial entities on the Nasdaq, offering a tech-centric focus, QQQJ provides a broader spectrum, encompassing an extensive array of companies, therefore proffering a more comprehensive outlook on the Nasdaq composite.

ETF with Microsoft Corp. and Alphabet Inc. Class C Exposure (Nasdaq): Comparisons

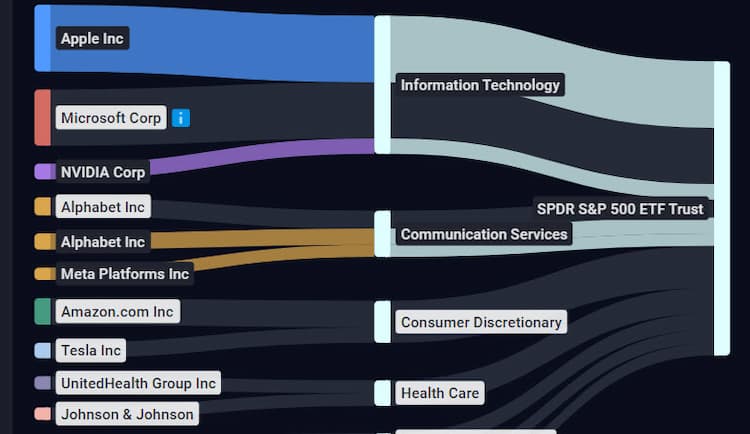

Comparatively speaking, engaging in ETFs like QQQ and QQQJ juxtaposed against other ETFs with divergent top holdings, such as the SPDR S&P 500 ETF Trust (SPY) or iShares NASDAQ Biotechnology ETF (IBB), offers a distinctive differentiation in investment strategy. Where SPY and its ilk render expansive exposure across various sectors in the S&P 500, IBB solely hones in on the biotechnology arena, thereby constricting its focal point and potential diversification compared to the more technology and growth-oriented QQQ and QQQJ.

SPY overlap ETF with Microsoft Corp. and Alphabet Inc. Class C Exposure (Nasdaq)

SPY overlap ETF with Microsoft Corp. and Alphabet Inc. Class C Exposure (Nasdaq)

ETF with Microsoft Corp. and Alphabet Inc. Class C Exposure (Nasdaq): Benefits to invest on those ETFs

The salient benefits of investing in ETFs like QQQ or QQQJ, especially for those tantalized by Microsoft and Alphabet, lie predominantly in the diversification and mitigation of risks compared to direct stock picking. With these ETFs, investors gain not only access to these tech titans but also to a myriad of other prolific entities, effectively distributing risk and potential reward across a broader base, thereby potentially shielding the investment from abrupt market vicissitudes affecting individual companies.

ETF with Microsoft Corp. and Alphabet Inc. Class C Exposure (Nasdaq): Consideration before investing

Before plunging into the investment odyssey, careful contemplation is pivotal. Pertinent considerations encompass the inherent market risks, the specific sectoral focus of the chosen ETF, and the underlying expense ratios, which can subtly erode profitability. Furthermore, the juxtaposition of one's financial goals, risk tolerance, and investment horizon against the chosen ETF’s historical performance and future potential must be diligently evaluated to forge a coherent and astute investment strategy. In conclusion, ETFs offering exposure to Microsoft and Alphabet, such as QQQ and QQQJ, provide an enticing conduit for investors to delve into the tech sector while maintaining a diversified investment stance. Balancing the allure of prospective returns with the imperative of prudent, informed decision-making remains quintessential in navigating the investment landscape. Disclaimer: This article does not provide any investment advisory services. It's worth noting that the structure, content, and SEO elements of an article would typically be more diversified and complex than demonstrated here for optimal performance. This simplified guide provides a basic framework, and real-world applications might require additional considerations such as keyword variations, additional relevant information, and strategic keyword placement in the content.

Source 1: SPY ETF issuer

Source 2: SPY ETF official page

FAQ

What is the SPY ETF?

The SPY ETF is an exchange-traded fund that provides investors exposure to specific assets or companies.

What companies does the SPY ETF have exposure to?

The SPY ETF has exposure to companies like Microsoft Corp. and Alphabet Inc. Class C Exposure.

How can I read more about the SPY ETF?

You can read more about the SPY ETF in various financial publications, websites, and the official ETF documentation.

Why should I consider investing in the SPY ETF?

Investing in ETFs can provide diversification, flexibility, and cost-effectiveness. It's important to do your own research or consult with a financial advisor before making investment decisions.

What is the description for the SPY ETF?

The ETF with Microsoft Corp. and Alphabet Inc. Class C Exposure (Nasdaq) exposure provides investors with an opportunity to diversify their portfolio while gaining insight into the performance and potential of Microsoft Corp. and Alphabet Inc. Class C Exposure (Nasdaq). This ETF offers a comprehensive view of the company's standing in the market, its historical performance, and future prospects.

How is the SPY ETF different from other ETFs?

Each ETF has its own unique investment strategy, holdings, and exposure. It's crucial to understand the specifics of each ETF before investing.