ETF with PayPal Holdings Inc. exposure

When it comes to investing in the stock market, exchange-traded funds (ETFs) have gained significant popularity due to their diversified portfolios and ease of trading. In this article, we will delve into ETFs that offer exposure to PayPal Holdings Inc. We'll explore a list of these ETFs, compare their features and holdings, discuss the benefits of investing in them, and provide important considerations for potential investors.

List of ETFs with PayPal Holdings Inc. Exposure

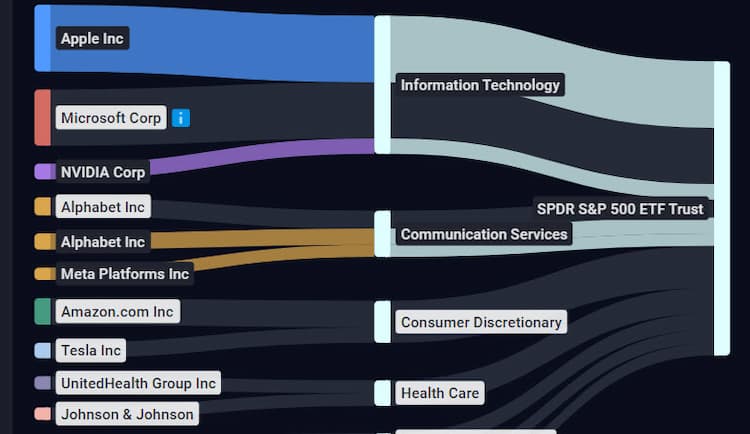

Before we dive into the details of each ETF, let's first take a look at the list of ETFs that include PayPal Holdings Inc. in their portfolios. These ETFs allow investors to indirectly invest in PayPal through a diversified basket of assets. SPDR S&P 500 ETF Trust (SPY): While not solely focused on PayPal, SPY includes the stock as one of its holdings within a diverse range of S&P 500 companies. iShares Core S&P 500 ETF (IVV): IVV also offers exposure to PayPal through its representation of the S&P 500 index. Vanguard S&P 500 ETF (VOO): VOO, similar to IVV, includes PayPal as part of its S&P 500 holdings. Invesco S&P 500 ETF (SPY): This ETF tracks the S&P 500 index and provides investors with exposure to PayPal along with other large-cap U.S. stocks. Schwab U.S. Large-Cap ETF (SCHX): SCHX offers cost-effective exposure to PayPal and other U.S. large-cap stocks within the S&P 500. iShares S&P 500 Value ETF (IVE): IVE focuses on the value segment of the S&P 500, which includes PayPal as one of its holdings. iShares S&P 500 Growth ETF (IVW): IVW concentrates on the growth segment of the S&P 500, encompassing companies like PayPal with high growth potential.

ETFs with PayPal Holdings Inc.: Comparisons of SPY, IVV, and VOO

Now, let's compare SPY, IVV, and VOO to gain a better understanding of their differences: SPY is known for its high liquidity and closely mirrors the S&P 500 index's performance. IVV offers low expenses and aims to provide long-term growth potential by tracking the S&P 500 index. VOO is offered by Vanguard and boasts a low expense ratio while seeking to replicate the performance of the S&P 500 index. While all three ETFs provide exposure to PayPal through their S&P 500 holdings, investors may choose based on factors such as liquidity, expenses, and brand preference.

SPY overlap ETF with PayPal Holdings Inc. exposure

SPY overlap ETF with PayPal Holdings Inc. exposure

PayPal Holdings Inc.: Benefits of Investing in These ETFs

Investing in ETFs with PayPal Holdings Inc. exposure offers several advantages over individual stock picking: Diversification: ETFs hold a basket of assets, reducing the risk associated with individual stock investments. This diversification can help protect your portfolio from company-specific volatility. Liquidity: ETFs are traded on exchanges like stocks, ensuring you can buy and sell them easily throughout the trading day. Lower Expenses: ETFs generally have lower expense ratios compared to mutual funds, making them cost-effective for long-term investors. Professional Management: These ETFs are managed by financial professionals who aim to track the performance of their respective indexes, ensuring you're making informed investment decisions.

PayPal Holdings Inc.: Considerations Before Investing

Before investing in ETFs with PayPal exposure, consider the following: Risk Tolerance: Assess your risk tolerance and investment goals to determine if these ETFs align with your financial strategy. Diversification: While ETFs offer diversification, it's essential to review the other holdings within the fund to ensure they align with your overall investment objectives. Costs: Analyze the expense ratios of these ETFs to ensure they fit your budget and long-term investment plan. Market Conditions: Keep an eye on market conditions and economic trends that may affect PayPal and the broader market. Conclusion: Investing in ETFs with PayPal Holdings Inc. exposure can be a prudent way to benefit from the company's performance while enjoying the advantages of diversification, liquidity, and professional management. However, investors should carefully consider their risk tolerance and financial goals before making investment decisions. Disclaimer: This article is for informational purposes only and does not provide investment advisory services."

Source 1: SPY ETF issuer

Source 2: SPY ETF official page

FAQ

What is the SPY ETF?

The SPY ETF is an exchange-traded fund that provides investors exposure to specific assets or companies.

What companies does the SPY ETF have exposure to?

The SPY ETF has exposure to companies like PayPal Holdings Inc..

How can I read more about the SPY ETF?

You can read more about the SPY ETF in various financial publications, websites, and the official ETF documentation.

Why should I consider investing in the SPY ETF?

Investing in ETFs can provide diversification, flexibility, and cost-effectiveness. It's important to do your own research or consult with a financial advisor before making investment decisions.

What is the description for the SPY ETF?

The ETF with PayPal Holdings Inc. exposure provides investors with an opportunity to diversify their portfolio while gaining insight into the performance and potential of PayPal Holdings Inc.. This ETF offers a comprehensive view of the company's standing in the market, its historical performance, and future prospects.

How is the SPY ETF different from other ETFs?

Each ETF has its own unique investment strategy, holdings, and exposure. It's crucial to understand the specifics of each ETF before investing.