ETF with Tesla, Inc. and Ross Stores Inc. Exposure (Nasdaq)

Navigating through the complexities of the financial markets, ETFs (Exchange Traded Funds) stand out as an accessible and diverse means for investors to gain exposure to an array of assets. Particularly, ones associated with high-flying firms like Tesla, Inc., and retail giant Ross Stores Inc., which are enlisted on the Nasdaq, pique substantial interest due to their notable market performances.

ETF with Tesla, Inc. and Ross Stores Inc. Exposure (Nasdaq): Exposure

When we dwell on ETFs containing Tesla and Ross Stores, it's imperative to recognize that these companies have carved distinct niches within their respective sectors. Invesco QQQ Trust (QQQ) stands out by tracking the NASDAQ-100 Index, which encapsulates prominent non-financial companies like Tesla, providing a secure vessel for investors to capitalize on its growth without direct stock purchase. Similarly, for a broader outlook, Invesco NASDAQ Composite ETF (QQQJ) shadows the NASDAQ Composite Index, offering wider exposure including firms like Ross Stores, thereby harmonizing a balance between retail and tech within an investment portfolio.

ETF with Tesla, Inc. and Ross Stores Inc. Exposure (Nasdaq): Comparisons of

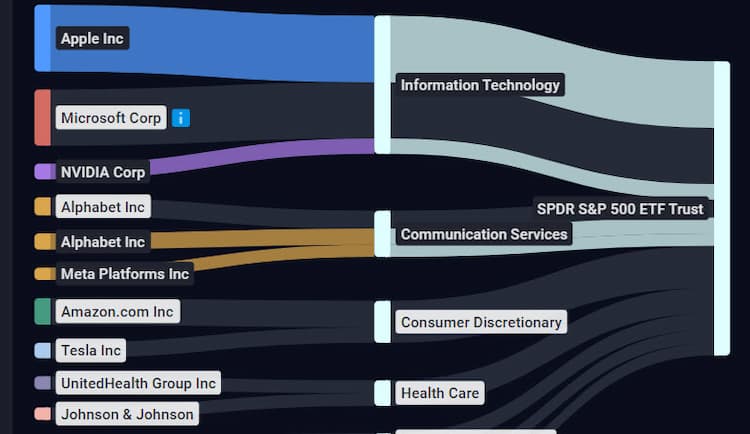

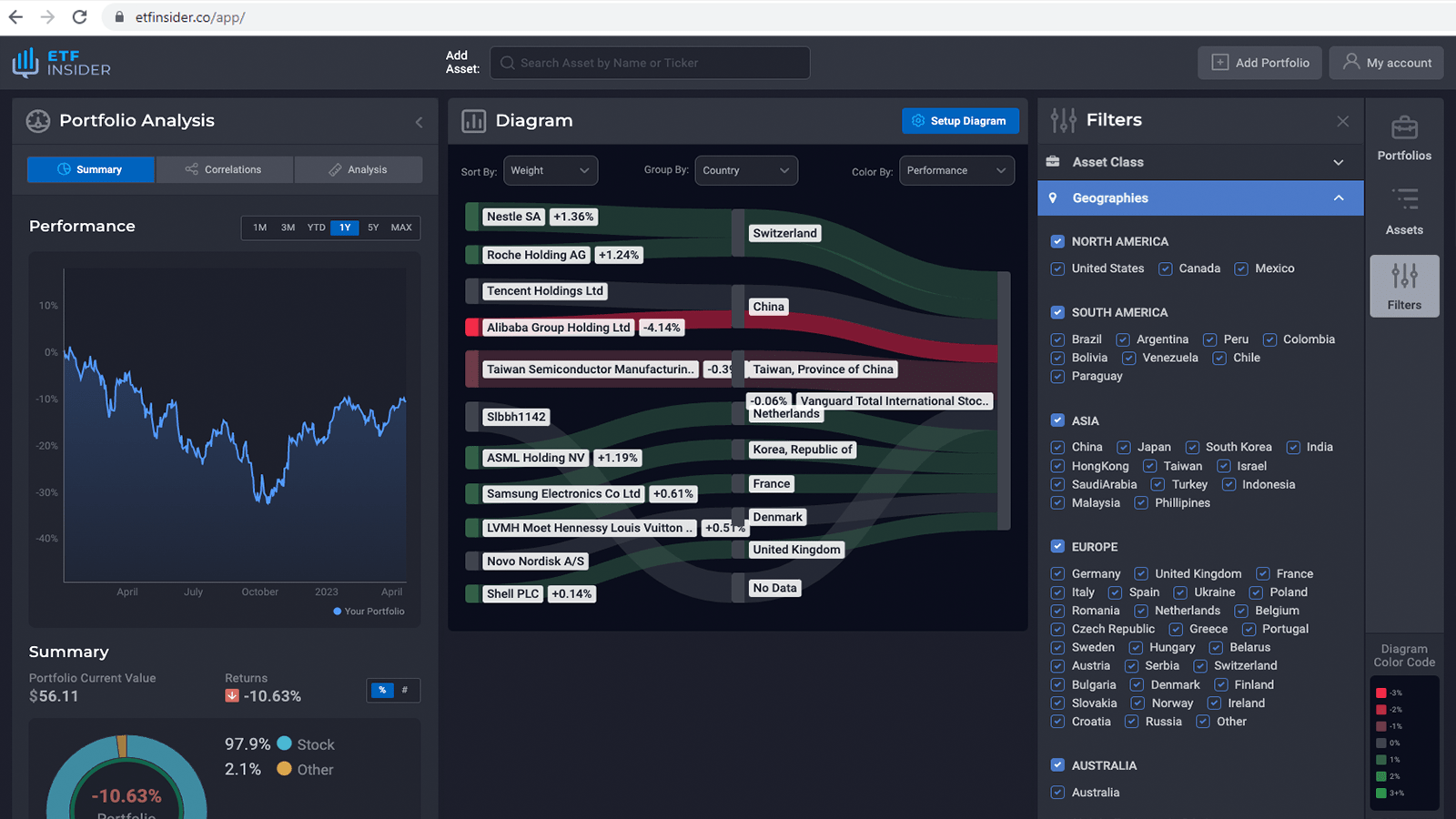

Comparing ETFs concentrating on Tesla and Ross Stores with other top holdings, it’s evident that the sectoral exposure and risk parameters swing distinctively. Whereas SPDR S&P 500 ETF Trust (SPY) provides a general perspective of the S&P 500, enabling investors to tap into a comprehensive segment of the market, investing in ETFs like QQQ enables a focus on tech-heavy portfolios, significantly influenced by Tesla’s performance. On the other side, with Ross Stores being a notable player in the retail sector, incorporating an ETF like QQQJ ensures a diversification, amalgamating various company sizes and sectors, offering a distinct risk-reward profile compared to more sector-specific ETFs.

SPY overlap ETF with Tesla, Inc. and Ross Stores Inc. Exposure (Nasdaq)

SPY overlap ETF with Tesla, Inc. and Ross Stores Inc. Exposure (Nasdaq)

ETF with Tesla, Inc. and Ross Stores Inc. Exposure (Nasdaq): Benefits to invest on those ETFs

Opting for ETFs like QQQ and QQQJ, which encapsulate titans like Tesla and Ross Stores, presents an array of advantages, paramount being the risk mitigation through diversification. Instead of directing capital solely towards individual stocks and thereby grappling with company-specific volatilities, investing in these ETFs allow participants to sidestep certain perils, availing the boons of Tesla’s innovative strides and Ross Stores’ retail prowess without being excessively subjected to their respective sectoral vulnerabilities. Additionally, it provides a passive investment strategy, negating the necessity to consistently monitor individual stock performances and making recalibrations, which is pivotal for long-term investment horizons.

ETF with Tesla, Inc. and Ross Stores Inc. Exposure (Nasdaq): Consideration before investing

Before plunging into investment, considering several facets is crucial to assure that the chosen ETF aligns with one’s financial objectives and risk tolerance. Acknowledging the expense ratio, understanding the underlying assets, and comprehending how fluctuations within associated sectors (like automotive for Tesla and retail for Ross Stores) could impact the ETF, form the bedrock for informed investment decisions. Additionally, perusing through the historical performance, scrutinizing the ETF’s strategy, and assessing how it complements one’s investment portfolio and strategy are imperative to harness the potential returns while being cognizant of the inherent risks. Conclusion: Investing in ETFs encompassing stalwarts like Tesla and Ross Stores proffers a balanced avenue to tap into their growth while mitigating direct investment risks. By judiciously comparing, comprehending benefits, and considering pertinent factors before investing, one can astutely navigate through the financial corridors of ETF investments. Disclaimer: This article does not provide any investment advisory services. Always consult with a professional advisor before making investment decisions.

Source 1: SPY ETF issuer

Source 2: SPY ETF official page

FAQ

What is the SPY ETF?

The SPY ETF is an exchange-traded fund that provides investors exposure to specific assets or companies.

What companies does the SPY ETF have exposure to?

The SPY ETF has exposure to companies like Tesla, Inc. and Ross Stores Inc. Exposure.

How can I read more about the SPY ETF?

You can read more about the SPY ETF in various financial publications, websites, and the official ETF documentation.

Why should I consider investing in the SPY ETF?

Investing in ETFs can provide diversification, flexibility, and cost-effectiveness. It's important to do your own research or consult with a financial advisor before making investment decisions.

What is the description for the SPY ETF?

The ETF with Tesla, Inc. and Ross Stores Inc. Exposure (Nasdaq) exposure provides investors with an opportunity to diversify their portfolio while gaining insight into the performance and potential of Tesla, Inc. and Ross Stores Inc. Exposure (Nasdaq). This ETF offers a comprehensive view of the company's standing in the market, its historical performance, and future prospects.

How is the SPY ETF different from other ETFs?

Each ETF has its own unique investment strategy, holdings, and exposure. It's crucial to understand the specifics of each ETF before investing.