ETF with Texas Instruments Inc. and CSX Corp. Exposure (Nasdaq)

Understanding the ins and outs of investing in ETFs with exposure to prominent companies such as Texas Instruments Inc. and CSX Corp., which are traded on the Nasdaq, can open up avenues for diversified investment strategies. With a spotlight on various ETFs that trace both the S&P 500 and the Nasdaq, this article illuminates the landscape of investing in such financial instruments.

ETF with Texas Instruments Inc. and CSX Corp. Exposure (Nasdaq) : Exposure

Investing in ETFs that house shares of potent corporations like Texas Instruments and CSX Corp. provides an entrée into the technological and transportation sectors respectively, both of which are pivotal elements in the Nasdaq index. Texas Instruments, an eminent player in the semiconductor industry, and CSX Corp., a vital entity in the rail transport domain, hold considerable weight in the Nasdaq index, thereby making ETFs with exposure to these corporations noteworthy. ETFs like the Invesco QQQ Trust (QQQ) and the Invesco NASDAQ Composite ETF (QQQJ) encapsulate a myriad of technological and transport firms and could potentially offer investors a proportion of the vibrant Nasdaq market through their investment channels.

ETF with Texas Instruments Inc. and CSX Corp. Exposure (Nasdaq) : Comparisons of

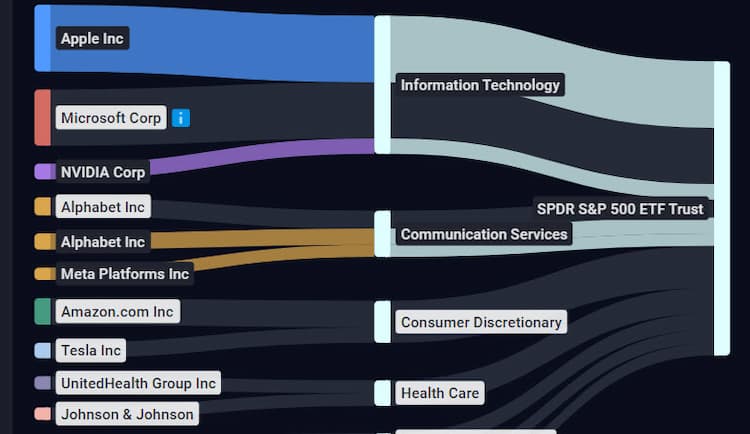

When paralleling ETFs housing Texas Instruments and CSX Corp. with other prime holding ETFs, a discernible distinction arises in the sectorial exposure and market capitalization. In comparison to the SPDR S&P 500 ETF Trust (SPY) or the Vanguard S&P 500 ETF (VOO), which encapsulate a broader spectrum of companies across varied sectors, the focus-oriented ETFs on the Nasdaq may offer more pronounced exposure to technological, biotechnological, and internet-oriented entities. Moreover, ETFs tracking the Nasdaq tend to house companies with exponential growth potentials, such as those in the tech and internet sectors, potentially offering distinct risk and return profiles compared to broader market ETFs.

SPY overlap ETF with Texas Instruments Inc. and CSX Corp. Exposure (Nasdaq)

SPY overlap ETF with Texas Instruments Inc. and CSX Corp. Exposure (Nasdaq)

ETF with Texas Instruments Inc. and CSX Corp. Exposure (Nasdaq): Benefits to Invest on Those ETFs

One of the primary benefits of investing in ETFs with Texas Instruments and CSX Corp. exposure, as opposed to direct stock picking, resides in the inherent diversification and reduced company-specific risk. This means that investors have the capability to mitigate potential losses, as the investment is not pinned to the performance of a single entity. Further, with the robust historical performance of the tech and transport sectors within the Nasdaq, such ETFs often carry the propensity for appreciable capital gains and dividends. Lastly, the opportunity to invest in the growth of both the semiconductor and transportation industries through a single financial instrument provides an amalgamated, yet sector-specific investment strategy.

ETF with Texas Instruments Inc. and CSX Corp. Exposure (Nasdaq) : Consideration Before Investing

Conclusive deliberation before investing in ETFs, particularly those with exposure to specific companies or sectors, must encompass an array of factors. Notably, understanding the underlying assets, scrutinizing the expense ratio, and acquainting oneself with the ETF’s historical performance is paramount. Moreover, investors should fathom the inherent risks related to the sectors – technological and transport – as well as be mindful of the economic cycles that may impact these industries. Recognizing the role of such ETFs within a broader investment portfolio, in terms of risk management and asset allocation, should guide informed investment decisions. Conclusion: Investing in ETFs, especially those with a specific industry focus, can offer unique opportunities and risks, providing a pathway to explore the dynamics of various market sectors. With strategic comprehension and meticulous consideration of various facets, investors can potentially harness the vigor of the technology and transportation sectors through precise ETF investments. Disclaimer: This article does not provide any investment advisory services.

Source 1: SPY ETF issuer

Source 2: SPY ETF official page

FAQ

What is the SPY ETF?

The SPY ETF is an exchange-traded fund that provides investors exposure to specific assets or companies.

What companies does the SPY ETF have exposure to?

The SPY ETF has exposure to companies like Texas Instruments Inc. and CSX Corp. Exposure.

How can I read more about the SPY ETF?

You can read more about the SPY ETF in various financial publications, websites, and the official ETF documentation.

Why should I consider investing in the SPY ETF?

Investing in ETFs can provide diversification, flexibility, and cost-effectiveness. It's important to do your own research or consult with a financial advisor before making investment decisions.

What is the description for the SPY ETF?

The ETF with Texas Instruments Inc. and CSX Corp. Exposure (Nasdaq) exposure provides investors with an opportunity to diversify their portfolio while gaining insight into the performance and potential of Texas Instruments Inc. and CSX Corp. Exposure (Nasdaq). This ETF offers a comprehensive view of the company's standing in the market, its historical performance, and future prospects.

How is the SPY ETF different from other ETFs?

Each ETF has its own unique investment strategy, holdings, and exposure. It's crucial to understand the specifics of each ETF before investing.