ETF with Texas Instruments Inc. and O'Reilly Automotive Inc. Exposure (Nasdaq)

Investing in Exchange-Traded Funds (ETFs) can provide investors with a diversified portfolio while minimizing risk and maximizing potential returns. Texas Instruments and O'Reilly Automotive, two potent entities traded on Nasdaq, offer compelling investment narratives through several ETFs that capture the dynamism of the technology and automotive sectors, respectively.

ETF with Texas Instruments Inc. and O'Reilly Automotive Inc. Exposure (Nasdaq): Exposure

Both Texas Instruments and O'Reilly Automotive are influential companies with a substantial impact in their respective sectors and, as such, are incorporated into various ETFs that track the Nasdaq and S&P 500. For instance, considering Texas Instruments, which holds a pivotal place in semiconductor manufacturing, investors might look towards ETFs like Invesco QQQ Trust (QQQ) or Invesco NASDAQ Composite ETF (QQQJ) for broader exposure to the tech sector. On the other hand, O'Reilly Automotive, a titan in the auto parts industry, could indirectly be accessed through broader ETFs or sector-specific ones like First Trust NASDAQ-100 Technology Sector Index Fund (QTEC), which might encompass related automotive tech entities. The key to strategic investment is ensuring that the chosen ETFs provide adequate exposure to these sectors, aiding in the potential mitigation of risk through diversification.

ETF with Texas Instruments Inc. and O'Reilly Automotive Inc. Exposure (Nasdaq): Comparisons of

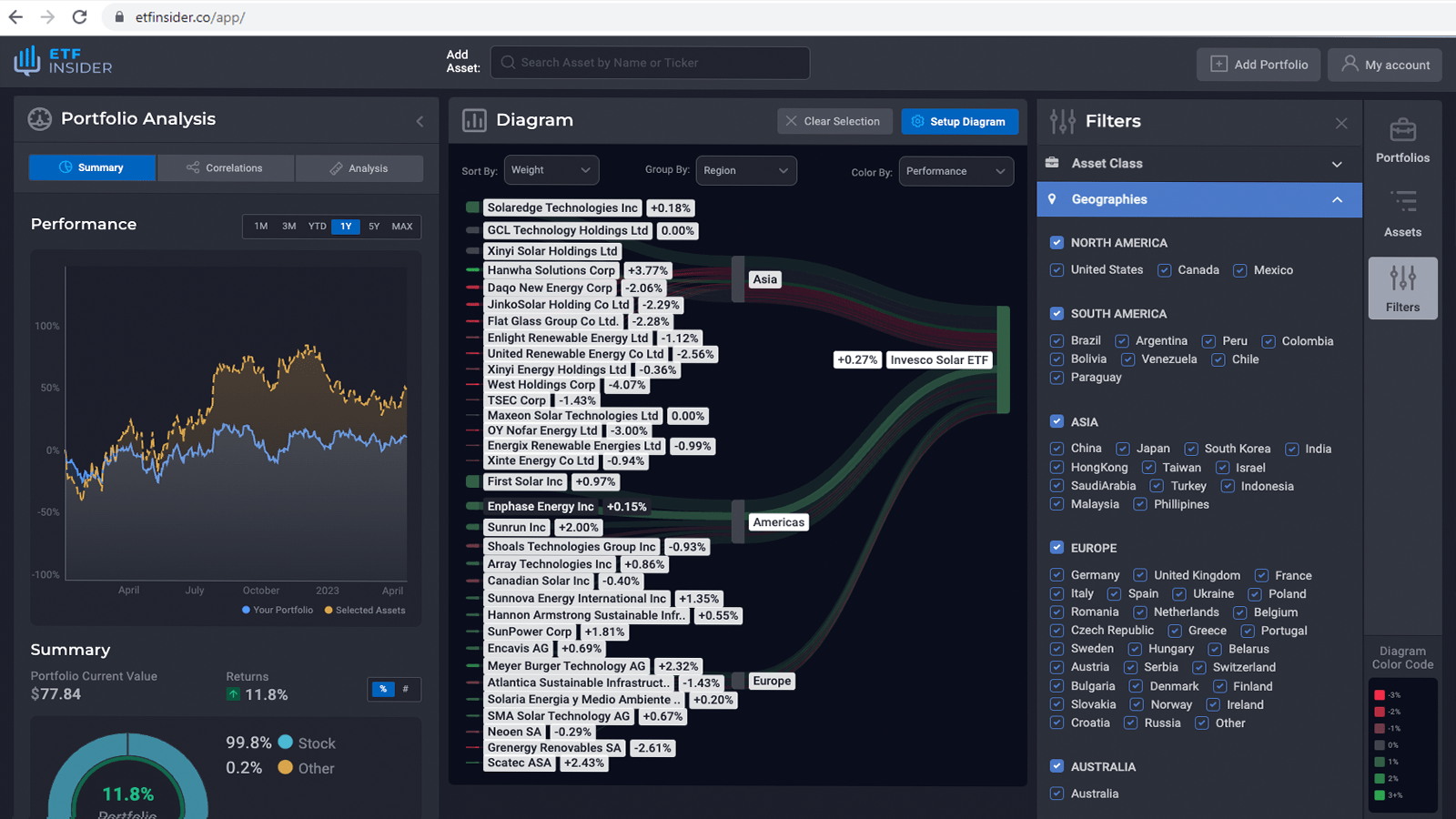

When exploring ETFs featuring Texas Instruments and O'Reilly Automotive, potential investors might also explore alternative ETFs that could offer comparable or potentially superior returns. The iShares NASDAQ Biotechnology ETF (IBB), for instance, could serve as a proxy for those interested in a distinct sector within the Nasdaq. Comparing these ETFs involves analyzing factors such as historical performance, expense ratio, and sector exposure. A robust ETF should not only exhibit a historically stable or upward-trending performance but should also encompass a diversified portfolio that aligns with the investor’s financial goals and risk tolerance.

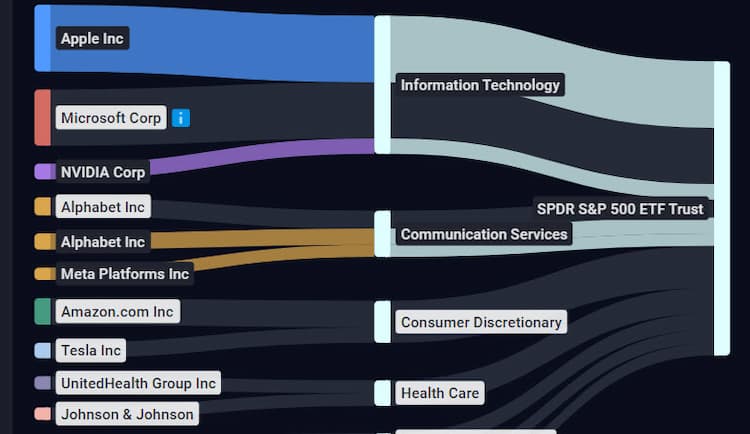

SPY overlap ETF with Texas Instruments Inc. and O'Reilly Automotive Inc. Exposure (Nasdaq)

SPY overlap ETF with Texas Instruments Inc. and O'Reilly Automotive Inc. Exposure (Nasdaq)

ETF with Texas Instruments Inc. and O'Reilly Automotive Inc. Exposure (Nasdaq): Benefits to invest on those ETFs

Opting for ETFs that house stocks like Texas Instruments and O'Reilly Automotive can be more beneficial than individual stock picking for several reasons. Firstly, ETFs generally provide a broader exposure to the market or specific sectors, potentially mitigating risks associated with the performance of individual stocks. For example, Invesco QQQ Trust (QQQ) not only exposes an investor to Texas Instruments but also to a variety of other influential tech companies. Additionally, ETFs like the SPDR S&P 500 ETF Trust (SPY) or iShares Core S&P 500 ETF (IVV) can offer lower expense ratios and are known for their liquidity, making them an economically viable option for investors seeking exposure to large-cap U.S. stocks, including O'Reilly Automotive.

ETF with Texas Instruments Inc. and O'Reilly Automotive Inc. Exposure (Nasdaq): Consideration before investing

Before diving into an investment, several considerations must be kept in mind. Potential investors should thoroughly examine the ETF’s past performance, although it’s crucial to note that past performance is not indicative of future results. Additionally, understanding the ETF’s structure, expense ratios, and tax implications is paramount. Moreover, the investor must acknowledge their risk tolerance and investment horizon. ETFs that offer exposure to companies like Texas Instruments and O'Reilly Automotive must align with the investor's overall strategy and financial objectives to be a viable investment option. Conclusion: A well-rounded investment strategy, especially involving notable entities like Texas Instruments and O'Reilly Automotive, involves thorough research and strategic considerations. Employing ETFs, that house such stocks, to enhance and diversify a portfolio can potentially offer a balanced mix of risk management and lucrative returns. Disclaimer: This article does not provide investment advisory services.

Source 1: SPY ETF issuer

Source 2: SPY ETF official page

FAQ

What is the SPY ETF?

The SPY ETF is an exchange-traded fund that provides investors exposure to specific assets or companies.

What companies does the SPY ETF have exposure to?

The SPY ETF has exposure to companies like Texas Instruments Inc. and O'Reilly Automotive Inc. Exposure.

How can I read more about the SPY ETF?

You can read more about the SPY ETF in various financial publications, websites, and the official ETF documentation.

Why should I consider investing in the SPY ETF?

Investing in ETFs can provide diversification, flexibility, and cost-effectiveness. It's important to do your own research or consult with a financial advisor before making investment decisions.

What is the description for the SPY ETF?

The ETF with Texas Instruments Inc. and O'Reilly Automotive Inc. Exposure (Nasdaq) exposure provides investors with an opportunity to diversify their portfolio while gaining insight into the performance and potential of Texas Instruments Inc. and O'Reilly Automotive Inc. Exposure (Nasdaq). This ETF offers a comprehensive view of the company's standing in the market, its historical performance, and future prospects.

How is the SPY ETF different from other ETFs?

Each ETF has its own unique investment strategy, holdings, and exposure. It's crucial to understand the specifics of each ETF before investing.