How does the FEMB ETF work?

The world of finance is adorned with a plethora of investment opportunities. Among the vast array, ETFs, or Exchange Traded Funds, have garnered significant attention due to their unique blend of features from both stocks and mutual funds. One such enticing proposition is the FEMB ETF. This blog post elucidates the mechanics of the FEMB ETF, its underlying exposure, benefits, and considerations one should evaluate before investing.

FEMB ETF: Overview

The FEMB ETF, or the First Trust Emerging Markets Local Currency Bond ETF, is designed to offer investors an avenue to gain exposure to the local currency denominated sovereign debt of emerging market countries. The allure of emerging markets lies in their potential for higher growth, which could translate into profitable ventures for investors. With its specific focus on local currency bonds, the FEMB ETF presents a unique proposition amidst the gamut of investment opportunities in the financial markets.

FEMB ETF: Underlying and Exposure: What Does It Track and How?

The FEMB ETF tracks the Bloomberg Barclays Emerging Market Local Currency Sovereign Index, which is reflective of the performance of the local currency bonds in emerging markets. By doing so, it provides investors with a diversified exposure to emerging markets’ sovereign debt while simultaneously mitigating the risks associated with foreign currency fluctuations. The ETF employs a sampling strategy, meaning it holds a representative sample of bonds included in the index, which assists in closely mirroring the index's performance while maintaining a manageable level of liquidity and trading costs.

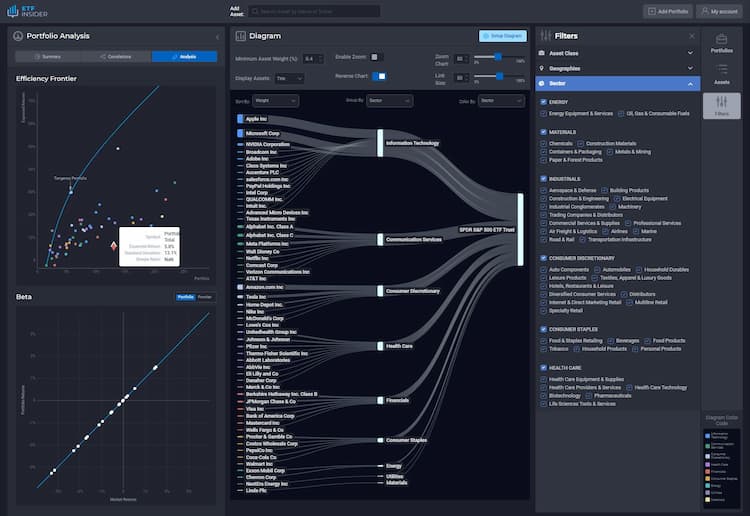

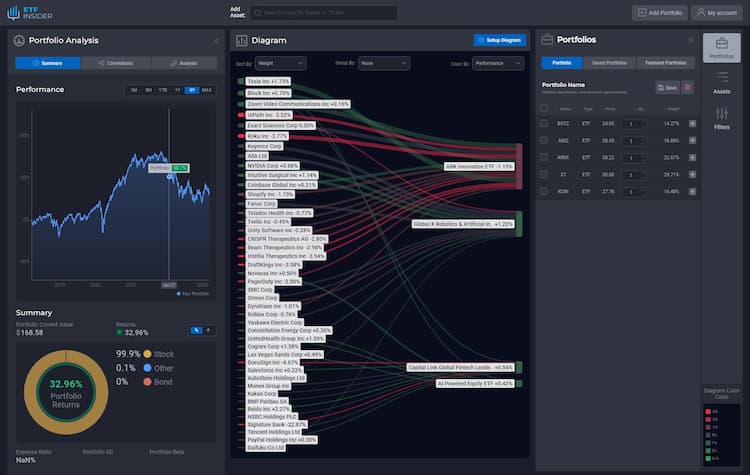

FEMB overlap How does work the FEMB ETF?

FEMB overlap How does work the FEMB ETF?

FEMB ETF: Benefits of Investing

Investing in the FEMB ETF comes with a slew of benefits. Firstly, it provides a diversified exposure to emerging market bonds, thus allowing investors to tap into the growth potential of these markets. Secondly, the local currency denomination aids in mitigating foreign exchange risk which is a common deterrent for investors eyeing foreign investments. Additionally, the FEMB ETF, being an exchange-traded fund, offers liquidity akin to stocks, enabling investors to buy or sell shares during market hours. The transparency in holdings and the relatively lower expense ratio compared to mutual funds make FEMB ETF an attractive option for investors seeking cost-efficiency alongside potential returns.

FEMB ETF: Considerations Before Investing

While the FEMB ETF presents a lucrative investment opportunity, it is crucial to weigh certain considerations before diving in. Emerging markets, though ripe with potential, are often accompanied by higher volatility and political or economic instability. The local currency denomination, while shielding from forex risk, may be impacted by the monetary policies of the respective emerging nations. It's imperative that investors have a thorough understanding of the risks involved and assess whether the FEMB ETF aligns with their investment goals and risk tolerance.

Conclusion

The FEMB ETF is a captivating investment avenue that blends the promise of emerging markets with the relatively stable nature of sovereign bonds. The mitigation of foreign exchange risk and the liquidity offered are laudable features that make it a noteworthy consideration for investors. However, a thorough understanding and risk assessment are quintessential before making an investment decision. With meticulous consideration, the FEMB ETF can be a beneficial addition to a diversified investment portfolio, potentially paving the way for favorable returns in the long run.

Sources

First Trust Emerging Markets Local Currency Bond ETF (FEMB) - First Trust Advisors

Bloomberg Barclays Indices – Bloomberg

ETFs Basics Tutorial - Investopedia

FEMB ETF issuer

FEMB ETF official page

FAQ

What is the FEMB ETF?

The FEMB ETF is an exchange-traded fund that provides investors with exposure to a specific sector.

What is the underlying index that the FEMB ETF aims to track?

The FEMB ETF aims to track the performance of a specific index, which includes companies involved in its respective sector.

What types of companies are included in the FEMB ETF?

The FEMB ETF includes companies from its focused industry.

How does the FEMB ETF work?

The FEMB ETF functions by pooling investors' capital to purchase a diversified portfolio of sector-related stocks.

What are the advantages of investing in the FEMB ETF?

Investing in the FEMB ETF offers exposure to a specialized sector with potential for growth.