Unveiling IEFA ETF Correlations: Which Funds Move in Harmony with IEFA?"

The world of Exchange-Traded Funds (ETFs) offers a myriad of opportunities for investors to diversify their portfolios and gain exposure to various asset classes, sectors, and geographical regions. Among these ETFs, the iShares Core MSCI EAFE ETF (IEFA) stands out as a significant player, providing exposure to a broad range of companies in Europe, Australasia, and the Far East.

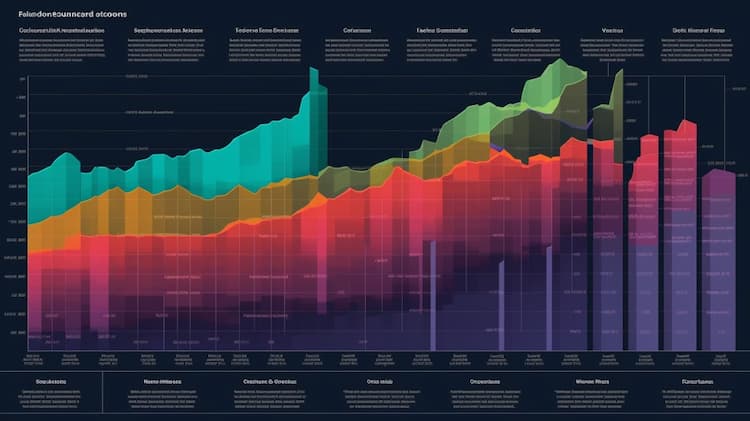

Understanding the correlations between IEFA and other ETFs is crucial for investors seeking to optimize their portfolios. Correlation, which ranges from -1.00 to 1.00, is a statistical measure that describes how investments move in relation to each other. A correlation of 1.00 means the funds move perfectly in sync, while a correlation of -1.00 indicates they move in exactly opposite directions. Correlations near zero suggest that the funds have little to no relationship in their movements.

Correlations and Their Significance

IEFA and EFA: Perfect Unison

Recent studies have shown that the IEFA ETF has high correlations with several other funds. The EAFE Stocks (EFA) fund, for example, has a perfect correlation of 1.00 with IEFA, indicating that they move in perfect unison. This is expected given that both ETFs are designed to track the same or very similar indices.

High Correlations with Europe (VGK) and Pacific (VPL) ETFs

Similarly, the Europe (VGK) and Pacific (VPL) ETFs also show a high correlation with IEFA, with ranges from 0.98 to 0.99 and 0.93 to 0.97, respectively. These correlations can be attributed to the significant overlap in their underlying holdings, as all three ETFs focus on equities from developed markets outside of North America.

Correlation with World All Countries (VT) and Emerging Markets (EEM) ETFs

The IEFA ETF also has high correlation with the World All Countries (VT) ETF, with a range from 0.95 to 0.96, and the Emerging Markets (EEM) ETF, with a range from 0.82 to 0.85. These correlations may be slightly lower due to the broader geographic diversification of these funds.

Notable Correlations with US-Focused Funds

Interestingly, IEFA also shows notable correlation with various US-focused funds. It has correlations ranging from 0.86 to 0.90 with the US Total Stock Market (VTI) ETF and from 0.86 to 0.89 with the US Large Cap (SPY) ETF. Even the US REITs (VNQ) ETF shows a correlation ranging from 0.65 to 0.91 with IEFA.

Bond Market Correlations

In the bond market, IEFA displays a correlation ranging from 0.39 to 0.87 with the US Total Bond Market (BND) ETF. It also has high correlations with the Emerging Market Bonds (EMB) ETF, ranging from 0.75 to 0.94, and the Investment Grade Bonds (LQD) ETF, ranging from 0.59 to 0.91.

Implications for Investors

It's important for investors to note that while high correlations can indicate potential for diversification, they can also signal risks. Having highly-correlated positions in a portfolio may lead to increased risk during market downturns, as these investments are likely to move in the same direction.

In conclusion, understanding the correlations between IEFA and other ETFs can provide valuable insights for investors looking to build a diversified and resilient portfolio. As always, it's crucial to remember that past performance is not indicative of future results, and investors should thoroughly research and consider their risk tolerance before making investment decisions.

Source 1: IEFA issuer website

Source 2: Reuters article about IEFA

IEFA quote and analysis

Discover the top holdings, correlations, and overlaps of ETFs using our visualization tool.

Our app allows you to build and track your portfolio.

To learn more about the IEFA iShares Core MSCI EAFE ETF, access our dedicated page now.

FAQ

What is the IEFA ETF?

The IEFA ETF, or iShares Core MSCI EAFE ETF, is an exchange-traded fund that provides investors with exposure to international equity markets, excluding the United States and Canada.

What is the underlying index that the IEFA ETF aims to track?

The IEFA ETF aims to track the performance of the MSCI EAFE Investable Market Index (IMI), which represents a broad range of companies from developed markets in Europe, Australasia, and the Far East.

What types of companies are included in the IEFA ETF?

The IEFA ETF includes companies from various sectors, such as financials, industrials, consumer goods, healthcare, and more, representing a diverse range of developed market companies outside of the United States and Canada.

How does the IEFA ETF work?

The IEFA ETF works by pooling investors' funds to purchase a portfolio of securities that closely replicate the performance of the underlying index. By investing in the IEFA ETF, investors gain exposure to a broad basket of international companies from developed markets.

What are the advantages of investing in the IEFA ETF?

Investing in the IEFA ETF offers potential benefits such as diversification across developed international markets, exposure to companies from various countries and sectors, the opportunity to participate in global economic growth, and the ability to access international markets without the need for individual stock selection. It simplifies investing in international equities, offers liquidity, and allows for portfolio diversification.