5 Reasons Why EPS is One of The Most Important Stock Market Metrics

Let's take a closer look at perhaps one of the crucial metrics successful investors (including Warren Buffet!) and analysts utilize to assess stocks and investment funds.

The EPS WisdomTree U.S. LargeCap Fund is managed by WisdomTree, Inc., a prominent player in the exchange-traded fund (ETF) industry. Established in 2006, WisdomTree has been known for its innovative and strategic approach to index investing. The EPS ETF aims to track the WisdomTree U.S. LargeCap Index, which consists of the 500 largest companies ranked by market capitalization in the WisdomTree U.S. Total Market Index. With a focus on companies that have generated positive cumulative earnings over the past four fiscal quarters, EPS provides investors exposure to the large-cap segment of the U.S. stock market with an emphasis on fundamentally weighted companies.

The EPS ETF focuses on tracking the performance of the WisdomTree U.S. Earnings 500 Index, which consists of companies with positive cumulative earnings over the past four fiscal quarters. While dividend distribution isn't the primary objective, investors can expect dividends reflective of the underlying index's constituents. Dividends are typically distributed quarterly and are influenced by the earnings performance and dividend policies of the included companies.

Tracking the performance of the WisdomTree U.S. Earnings 500 Fund is at the heart of EPS Tracking ETF's strategy. The ETF employs a passive management approach, aiming to mirror the performance of the WisdomTree U.S. Earnings 500 Index. This index comprises 500 large-cap U.S. companies selected based on positive cumulative earnings over their most recent four fiscal quarters. EPS Tracking ETF primarily invests in securities that resemble the risk-return profile of the index constituents. With a focus on earnings-weighted allocation and sector diversification, EPS Tracking ETF offers investors exposure to the performance of profitable U.S. companies while maintaining alignment with the index methodology.

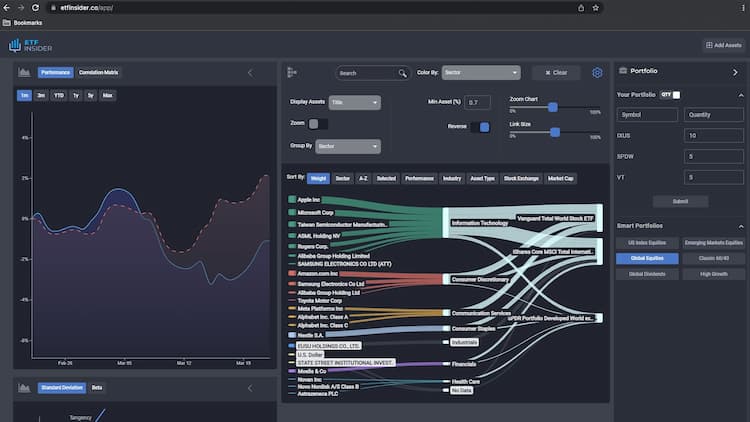

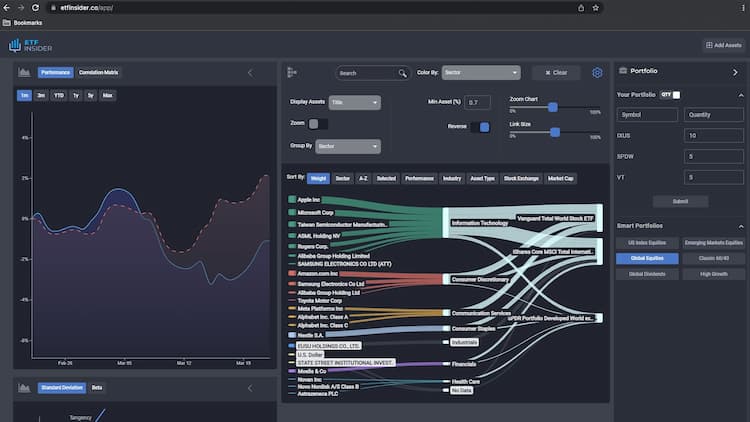

Understanding the correlation of EPS (Earnings per Share) with various market factors and economic indicators is fundamental for investors aiming to assess the profitability and growth potential of companies represented in the ETF. EPS is a crucial metric used by analysts and investors to evaluate a company's financial health and performance over time. By studying the correlation of EPS with market trends and other fundamental indicators, investors can make more informed decisions regarding their investment strategies. ETF Insider provides a comprehensive analysis of EPS correlations, empowering investors with valuable insights to optimize their investment decisions and capitalize on market trends effectively. With its intuitive web app and visualization tools, ETF Insider enables investors to explore the correlations between EPS and various market factors, facilitating a deeper understanding of the ETF's underlying assets and their performance dynamics.

The EPS ETF primarily focuses on the technology sector, aiming to track the performance of the Index, which includes companies within the technology industry. With a significant portion of the fund allocated to technology, investors gain exposure to innovative companies driving advancements in various fields such as software, hardware, and semiconductor manufacturing. This concentration allows investors to capitalize on the growth potential of the tech sector, which often leads the market in innovation and disruption. However, it's important to note that this sector-specific focus may lead to increased volatility and risk compared to more diversified ETFs.

The EPS ETF (Exchange-Traded Fund) reflects its focus on large-cap companies within the U.S. equity market. Employing a passive management approach, EPS tracks the performance of the WisdomTree U.S. LargeCap Earnings Index. This index comprises the 500 largest companies by market capitalization within the WisdomTree U.S. Total Market Index, all of which have generated positive cumulative earnings over the last four fiscal quarters. With a diversified exposure across various sectors such as communication services, consumer discretionary, information technology, and more, EPS offers investors a way to access the earnings potential of the most significant players in the American economy.

ETF Insider is a data-driven portfolio analytics and optimization platform that introduces a more efficient and practical way to visualize, analyze and optimize portfolios.

Rather than focusing on the surface-level attributes of ETFs and Mutual Funds, ETF Insider goes deeper by examining the underlying holdings of exchange traded products.

By organizing and structuring that data, investors can easily navigate within their overlapping layers.

This innovative perspective combined with modern data visualization and modeling tools, provides an entirely new approach to portfolio optimization that can quickly expose both portfolio inefficiencies and opportunities.

Let's take a closer look at perhaps one of the crucial metrics successful investors (including Warren Buffet!) and analysts utilize to assess stocks and investment funds.

The ETF with PepsiCo Inc. exposure provides investors with an opportunity to diversify their portfolio while gaining insight into the performance and potential of PepsiCo Inc.. This ETF offers a comprehensive view of the company's standing in the market, its historical performance, and future prospects.

The ETF with Tesla, Inc. and PepsiCo Inc. Exposure (Nasdaq) exposure provides investors with an opportunity to diversify their portfolio while gaining insight into the performance and potential of Tesla, Inc. and PepsiCo Inc. Exposure (Nasdaq). This ETF offers a comprehensive view of the company's standing in the market, its historical performance, and future prospects.

ETF Insider is a novel portfolio optimization tool that uses the power of data visualization to gain insight into portfolio compositions, concentration risks, portfolio efficiency and more. Complex financial data can be transformed into visually appealing and easily digestible graphs and charts, allowing investors to quickly identify trends and make well-informed investment decisions. Not only does this save time, but it also increases the accuracy and effectiveness of portfolio management.