What is the BATT ETF ?

Discover the world of ETFs and unravel the mysteries of BATT ETF with this insightful article. Gain a comprehensive understanding of the BATT ETF and its potential impact on the market.

The issuer of the BATT ETF, which seeks to track the investment results of an index comprised of equity securities issued by large-capitalization companies meeting specific environmental, social, and governance (ESG) criteria, is committed to responsible investing. This issuer aligns with MSCI, the index provider, to ensure adherence to rigorous ESG standards when selecting and weighting index components. By excluding companies involved in controversial businesses and prioritizing ESG performance, the BATT ETF issuer caters to investors looking for sustainable investment options.

While the focus of the BATT ETF (Environmental, Social, and Governance ETF) may primarily be on ESG criteria, it also offers a dividend distribution to its investors. These dividends are influenced by the performance and dividend policies of the large-cap companies included in its underlying index, the MSCI USA Index. Typically, dividend distributions occur on a quarterly basis, providing investors with both ESG-aligned investment options and potential income through dividends.

The BATT ETF, managed by Logan Capital Management, Inc., tracks an innovative investment strategy focused on companies utilizing cutting-edge technologies and ideas to gain a competitive edge in the market. This exchange-traded fund primarily invests in large-cap U.S. equity securities traded on U.S. exchanges, with a strong emphasis on the information technology sector. The fund's investment process combines macroeconomic analysis, fundamental research, and technical analysis to identify companies with outstanding earnings growth potential. BATT aims to deliver long-term growth by holding positions in companies that exhibit pricing power, market dominance, and significant barriers to entry, aligning with Logan Capital's commitment to innovation and durable earnings growth.

The correlation profile of the BATT ETF, managed by Principal Investment Strategies, is an important factor to consider for investors. This actively managed exchange-traded fund utilizes an interest income strategy, primarily investing in U.S. Treasury securities and fixed income ETFs. Additionally, it employs an income-generating option strategy on equity and fixed income ETFs. While the correlation of BATT with traditional equity markets may vary due to its unique strategy, investors can explore its correlations with specific asset classes and sectors using tools like ETF Insider's web app. This tool provides deep insights and visualizations, highlighting any overlaps and helping investors make informed decisions about their portfolios.

The Global X Lithium & Battery Tech ETF (BATT) primarily focuses on companies operating within the lithium and battery technology sector. This sector encompasses businesses involved in the production of lithium, the development of battery technologies, and the manufacturing of energy storage solutions. Given the increasing demand for clean energy and electric vehicles, the lithium and battery tech sector has gained significant attention from investors seeking exposure to the future of energy storage and transportation.

The Amplify Advanced Battery Metals and Materials ETF (BATT) is designed to provide investors with exposure to the booming electric vehicle (EV) and advanced battery industry. BATT primarily invests in companies involved in the production and supply chain of advanced battery materials, such as lithium, cobalt, nickel, and graphite. This strategic focus allows investors to participate in the growing demand for EVs and renewable energy solutions, making BATT a compelling choice for those seeking exposure to this rapidly evolving sector.

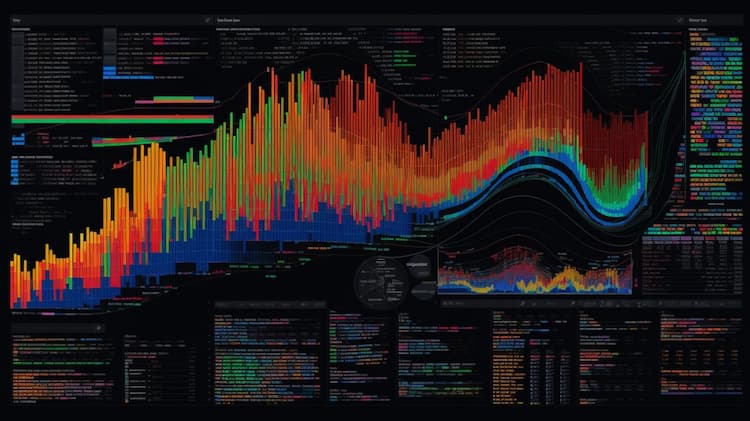

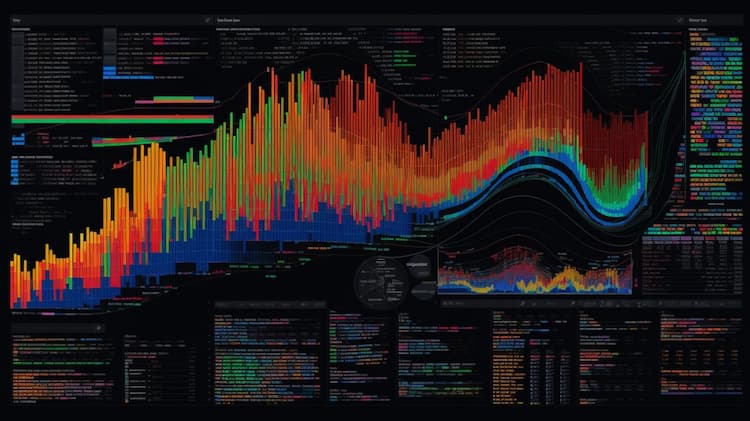

ETF Insider is a data-driven portfolio analytics and optimization platform that introduces a more efficient and practical way to visualize, analyze and optimize portfolios.

Rather than focusing on the surface-level attributes of ETFs and Mutual Funds, ETF Insider goes deeper by examining the underlying holdings of exchange traded products.

By organizing and structuring that data, investors can easily navigate within their overlapping layers.

This innovative perspective combined with modern data visualization and modeling tools, provides an entirely new approach to portfolio optimization that can quickly expose both portfolio inefficiencies and opportunities.

Discover the world of ETFs and unravel the mysteries of BATT ETF with this insightful article. Gain a comprehensive understanding of the BATT ETF and its potential impact on the market.

Compare the MOMO and IMTM ETFs with our thorough analysis. Dive into the performance metrics, underlying assets, and investment strategies.

The XHYH ETF is a specialized investment fund that focuses on a specific sector. This exchange-traded fund offers investors exposure to a range of companies in this sector.

ETF Insider is a novel portfolio optimization tool that uses the power of data visualization to gain insight into portfolio compositions, concentration risks, portfolio efficiency and more. Complex financial data can be transformed into visually appealing and easily digestible graphs and charts, allowing investors to quickly identify trends and make well-informed investment decisions. Not only does this save time, but it also increases the accuracy and effectiveness of portfolio management.